Stack Overflow operates a popular question-and-answer website for software developers and other professionals. The site receives millions of visitors each month and claims to have hosted 83 million questions and answers to date.

Like many companies, Stack Overflow is seeking to tap into the enormous potential of artificial intelligence (AI). In 2023, it launched Overflow AI to integrate generative AI into its public platform, Stack Overflow for Microsoft's (MSFT -2.40%) Teams, and other new products.

IPO

Tencent

Tencent (TCEHY +1.29%) is a Chinese technology company. It's one of the world's top video game publishers and a leading social media platform with more than 1 billion monthly active users. Naspers is also one of Tencent's top investors. Like Prosus, Tencent owns and invests in many other companies, which gives it a diversified technology portfolio.

How to buy stocks similar to Stack Overflow

People who want to buy one of these technology company alternatives to Stack Overflow can purchase shares in most brokerage accounts. Here's a step-by-step guide on how to invest in stocks.

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should I invest in Stack Overflow?

You can't invest directly in Stack Overflow because it's not a publicly traded company. However, you can buy shares of its owner, Prosus. Here are some reasons you might want to invest in Prosus or a similar company:

- You're an avid user of Stack Overflow's site and want to invest in the company that owns it.

- It would diversify your portfolio by adding an international stock.

- You think Stack Overflow will continue to grow its user base and revenue at high rates in the future.

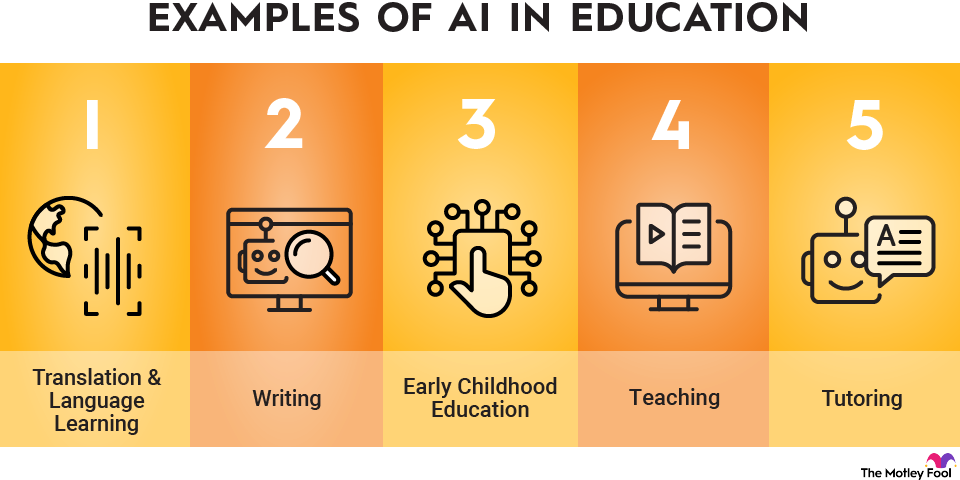

- You like that Stack Overflow is embracing AI and believe it could become an important growth driver for the company.

- You see lots of growth potential in the edtech sector.

On the other hand, here are some reasons you might not want to invest in Stack Overflow's owner or a similar company:

- You don't understand what the company does or how it makes money.

- You don't want to invest in a company listed on a foreign exchange.

- You're concerned about Stack Overflow's losses and its impact on Prosus's bottom line.

- You're concerned that AI will affect Stack Overflow's usefulness.

ETFs with exposure to Stack Overflow

Since Stack Overflow is a subsidiary of a larger company, you can't get passive exposure to its stock through exchange-traded funds (ETF). However, you can use ETFs to invest in Prosus and similar companies. Here are a couple of notable ETFs to gain some exposure to the European internet and technology company:

- iShares MSCI Netherlands ETF (EWN -0.18%): This ETF focuses on stocks listed in the Netherlands. It held 58 companies in late 2025, including Prosus (second-largest at 9.6%), and had a 0.5% ETF expense ratio.

- iShares Europe ETF (IEV +0.28%): This fund focuses on European-listed companies. It held 376 stocks in late, including Prosus (0.73% of its net assets), and had a 0.60% expense ratio.

Related investing topics

The bottom line on Stack Overflow

While you can't invest directly in Stack Overflow, you can buy shares of its parent, Prosus. You could also consider investing in related companies (like Udemy or Tencent) or an ETF to gain exposure to the same trends driving its growth. With lots of growth ahead for edtech, AI, and other technologies, these investments could pay off in the coming years.