The future is digital, and digital assets are a popular asset class for investors who want to capitalize on the trend. Although digital assets can be volatile, they also provide a chance to get in early on technology that will likely be used more and more. In this guide, we'll cover what digital assets are and how to start investing in them.

What are digital assets?

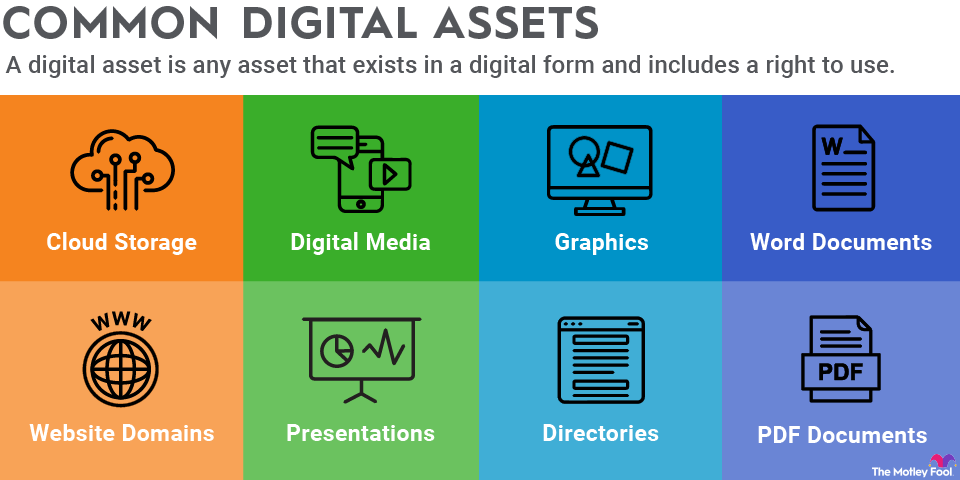

A digital asset is any asset that exists in a digital form and includes a right to use. Some of the most popular examples are digital assets related to cryptocurrency and blockchain technology. These include cryptocurrencies, non-fungible tokens (NFTs), and virtual real estate in the metaverse.

Digital assets have an extremely broad definition that covers a wide range of items, including photos, videos, and documents, to name a few. For example, a photo you take and store on your phone or computer would qualify as your digital asset. It's stored in a digital format, and you have usage rights as the photographer, so you can publish it on your website or sell it.

Digital assets explained

The overall concept of digital assets is understandable enough, but there are many different categories of assets that qualify, and the ones that are considered investments tend to be more complex. To better explain digital assets, we'll look at two of the biggest types: cryptocurrencies and NFTs.

A cryptocurrency is a digital currency that uses cryptography and runs on a decentralized network. A network of devices validates and records transactions. The network doesn't have a single entity managing it, allowing cryptocurrencies to be decentralized.

An NFT denotes ownership of a digital asset. Going back to the example of a photo you take, you could mint an NFT of that photo, which would be a digital record showing that you're the owner of the photo. If you later sold the NFT to someone else, it would transfer to them and list them as the new owner. Creators can also charge royalties on their NFTs, meaning you could get a cut of every sale of an asset you created.

NFTs are a particularly interesting innovation in the world of digital assets. They work with any type of digital asset, and they provide verifiable ownership records as these assets are bought and sold. If there's a dispute regarding who has the right to use a digital asset, an NFT could settle the issue.

How digital assets work

Decentralized digital assets such as cryptocurrencies and NFTs use blockchain technology to operate without a central authority. A blockchain is a public ledger that records transactions for a cryptocurrency. Transactions are sorted into blocks, with each block containing a group of transactions. Any device that runs the blockchain's software helps validate blocks of transactions and adds them to the chain.

Blockchain technology can do more than just record transactions, and one of its most versatile capabilities is smart contracts. A smart contract is a program that runs on a blockchain and self-executes when certain conditions are met. While smart contracts have all kinds of applications, the relevant one in this case is NFTs.

Smart contracts are how blockchain technology is used to mint, buy, and sell NFTs. To mint an NFT, the creator sets up a smart contract for it on their blockchain of choice, with Ethereum (ETH -0.80%) being the most popular. The smart contract's code assigns ownership of the NFT and manages transferability.

Pros and cons of digital assets

There are quite a few benefits of digital assets, but they also have their fair share of drawbacks. Here are some of the biggest advantages of digital assets – specifically, decentralized digital assets:

- Cryptocurrencies provide a way to store and transfer funds without relying on financial institutions or governments.

- Many cryptocurrencies are a highly efficient digital currency option, able to process transactions in seconds for a fraction of a cent.

- NFTs are a record of ownership that work with any digital asset.

- NFTs also give content creators a way to make money from their work by selling it.

- Both these digital assets have the potential to be profitable investments, although they also carry substantial risks.

Here are the most notable downsides:

- They can be extremely volatile. Cryptocurrencies and NFTs are considered high-risk investments for this reason.

- The digital asset market is full of scams. For example, people frequently launch cryptocurrency pump-and-dump schemes and mint plagiarized NFTs with assets that aren't theirs.

- There are often allegations of insider trading related to cryptocurrencies and NFTs.

If you decide to invest in cryptocurrency or NFTs, doing plenty of research is a must. There are quality projects out there, but you'll also run into lots of scams and cryptos that have no real utility.

Digital asset examples

We've looked at what digital assets are and the different categories, so now let’s check out some specific examples of well-known digital assets:

- Bitcoin (BTC -1.18%) was the first cryptocurrency. An anonymous founder created it in 2009 as a decentralized electronic payments system.

- Ethereum was the first blockchain network to have smart contract capabilities. This helped it become the second-largest cryptocurrency in the world.

- USD Coin (USDC +0.01%) is a stablecoin designed to maintain a value of $1. It's used by those who want to keep savings in cryptocurrency while avoiding volatility. However, it's worth mentioning that stablecoins don't have the same protections as the U.S. dollar, and some have failed.

- CryptoPunks was one of the earliest successful NFT collections. Created by a two-person studio in 2017, the CryptoPunks collection has 10,000 unique digital avatars.

- Decentraland (MANA -2.48%) is an early example of the metaverse, which is a virtual world built on the Ethereum blockchain where players can participate in activities and buy virtual land.

Related investing topics

How to manage digital assets

Decentralized digital assets are managed using wallets. These wallets provide private keys to assets stored on the blockchain, so if you have cryptocurrency funds or an NFT, you use your wallet to access them.

With cryptocurrencies, there's a bit more flexibility regarding how you manage them. Most crypto apps and exchanges let you keep cryptocurrency on the platform after buying it, so you don't need to move it to a wallet. However, many crypto enthusiasts recommend transferring your funds to your own blockchain wallet to ensure that you're in full control of your cryptocurrency.

NFTs, on the other hand, need to be stored in NFT wallets. When you buy or mint an NFT on an NFT marketplace, it's stored in the wallet you provide.

Although this all might seem complicated, many of the best NFT wallets are also blockchain wallets that can store cryptocurrency. So, although you can have separate wallets if you want, you can also store any crypto and NFTs you buy in the same place.

Digital assets are exciting, and, during bull markets, investors have poured money into them. As previously mentioned, these are very high-risk investments, so it's best to take a cautious approach. Consider making digital assets a small part of your portfolio, but don't bet the farm on them.