Real estate investment trusts, or REITs, are excellent candidates for retirement account investments. The tax-advantaged nature of retirement accounts can magnify the already tax-advantaged nature of REITs, which can result in some powerful long-term return potential.

Here's a rundown of what investors should know before deciding whether buying REITs in a Roth IRA is the best move for them.

How a Roth IRA works: The quick version

First, here's a quick explanation of how a Roth IRA works. There are two main varieties of individual retirement accounts (IRAs): traditional and Roth.

On the one hand, a traditional IRA is a tax-deferred retirement account. Qualified taxpayers can take a current-year tax deduction for money they contribute to a traditional IRA, and investments in a traditional IRA are not subject to capital gains or dividend taxes on an annual basis. However, when money is eventually withdrawn from a traditional IRA, it will be considered taxable income.

On the other hand, a Roth IRA is a type of after-tax retirement account. If you contribute money to a Roth IRA, you'll get no immediate tax deduction.

However, your investments in a Roth IRA get the same tax-deferred treatment as in a traditional IRA, meaning you won't have to worry about capital gains or dividend taxes each year. And because you didn't get a tax break when you made your contributions, qualified withdrawals from a Roth IRA are 100% tax-free.

Moreover, Roth IRAs can be smart choices for investors who don't necessarily want their money tied up until they reach retirement age. Because you've already paid tax on your Roth contributions, you are allowed to take your contributions (but not any investment gains) out of a Roth IRA at any time and for any reason.

Of course, this is a simplified overview of how Roth IRAs work. There's a lot more you should know about these retirement accounts. So, be sure to check out this thorough Roth IRA overview.

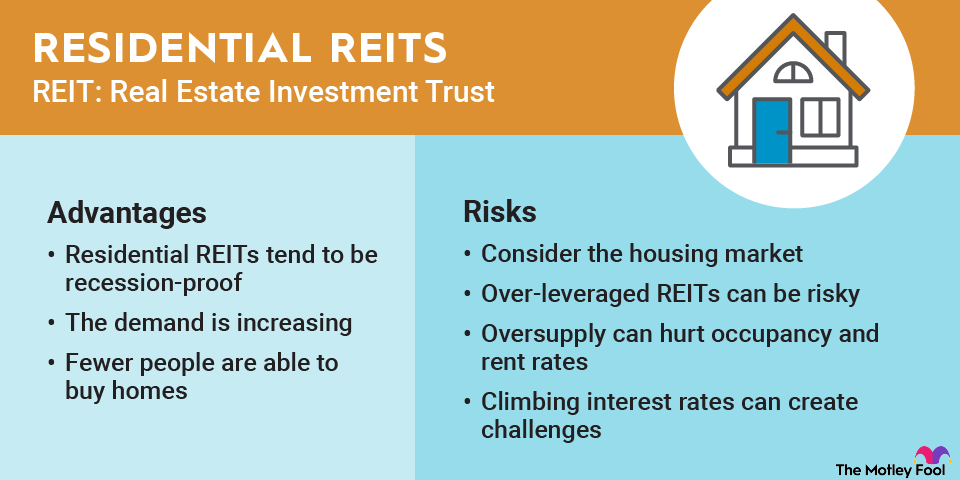

Reasons to hold REITs in a Roth IRA

Holding your REIT investments in a Roth IRA has two main benefits: dividend compounding and tax-free profits.

In any tax-advantaged retirement account, investments are allowed to grow on a tax-deferred basis, meaning you won't pay capital gains tax if you sell any investments at a profit, and you won't have to include dividends with your taxable income. The only potential tax implications occur when you withdraw money from the account.

In the case of REIT dividends, this is a big advantage. Recall that REIT profits aren't taxable on the corporate level -- this is one of the main benefits of being a REIT. Well, in a Roth IRA, you won't be taxed on your dividends at the individual level, either. REIT dividends can also be quite complex when it comes to tax classification, and holding them in a Roth IRA allows you to avoid this complication.

Because qualified Roth IRA withdrawals are completely tax-free, you won't ever have to pay taxes on your REIT's dividends or the profits you make when you sell them. Over time, this can make a huge difference.

Related investing topics

Is a Roth or traditional IRA the best choice?

To be clear, retirement accounts are ideal places to hold REIT investments, as the benefits of tax-deferred investing can magnify the already tax-advantaged nature of these companies. However, which should you choose: a Roth IRA or a traditional IRA? Unfortunately, there's no perfect answer. It depends on when you want your tax break, now or later.

If you're in a relatively low tax bracket right now, which is generally either the 10% or 12% marginal tax bracket under current tax law, a Roth IRA is a no-brainer since you're likely to benefit more from tax-free withdrawals in the future. However, if you're in one of the higher tax brackets and qualify for the traditional IRA tax deduction, that could be the smarter way to go.