Spousal benefits are Social Security benefits that are based on your spouse’s work record instead of your own. In some circumstances, you’re eligible for spousal benefits even if you’ve divorced.

Your Social Security retirement benefit is typically based on your 35 highest-earning years of work. But, if your spouse earned significantly more or your work history is limited, you may get more money from spousal benefits. Read on to learn when you qualify for spousal benefits and how Social Security calculates your payments.

Who qualifies for Social Security spousal benefits?

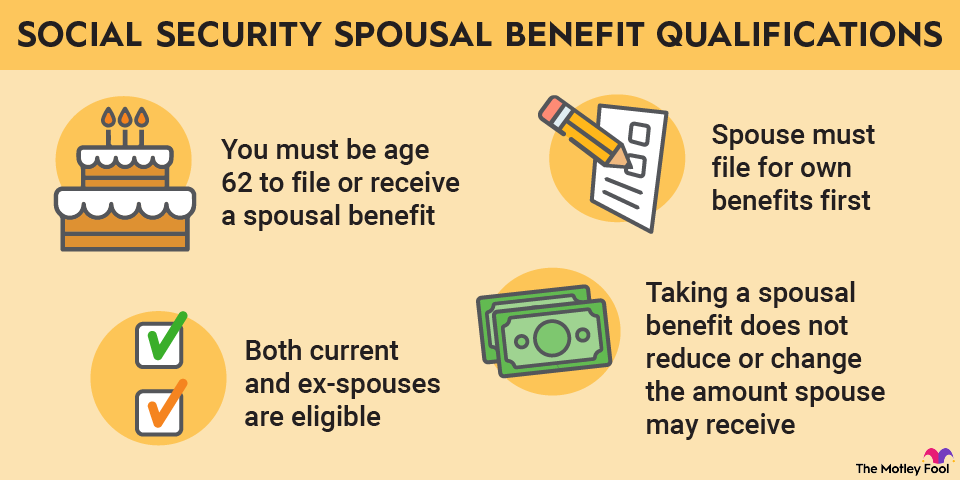

To be eligible for spousal benefits if you’re currently married, all three of the following must apply:

- You’ve been married for at least a year.

- You’re at least 62, or you’re caring for your spouse’s disabled child who is younger than 16.

- Your spouse currently receives retirement benefits.

If you’re at least 62 and your spouse hasn’t started receiving benefits yet, you can take your own retirement benefit and then claim their higher benefit once they file. This is a common Social Security planning strategy for couples.

One key point to know is that Social Security will give you either your own retirement benefit or spousal benefits, but not both.

As with retirement benefits, spousal benefits are taxable if your income exceeds certain thresholds. It’s important to plan for your taxes in retirement, no matter which type of benefit you expect to receive.

Calculating Social Security spousal benefits

Spousal benefits are based on your spouse’s primary insurance amount, which is the amount they’re eligible for at full retirement age (FRA). Depending on how old you are when you start Social Security, you can receive 32.5% to 50% of your spouse’s benefit.

If you wait until your full retirement age – which is 67 if you were born in 1960 or later – you’ll qualify for the 50% maximum. But if you claim as soon as you’re eligible at 62, you’d only receive 32.5% of their full benefit.

Unlike with Social Security retirement benefits, you can’t earn delayed retirement credits when you’re taking spousal benefits. In other words, there is no reason to wait beyond your full retirement age to claim a spousal benefit.

If you take spousal benefits, you won’t affect the benefits your husband or wife receives. Their benefit is based solely on their primary insurance amount and when they claim.

Divorced spouses

If you’re a divorced spouse, you may be eligible for spousal benefits. To qualify as a divorced spouse, the following rules apply:

- Your marriage must have lasted at least 10 years.

- You must have been divorced for at least two years.

- You can’t be currently married.

Benefits for ex-spouses are the same as benefits for current spouses. The maximum divorced spouse benefit is 50% of your former spouse’s primary insurance amount if you wait until full retirement age. If you claim early, you’ll receive as little as 32.5%.

To receive divorced spouse benefits, both you and your ex need to be at least 62. However, unlike with benefits paid to current spouses, divorced spouse benefits don’t require your ex to actually be receiving benefits. As long as they’re at least 62 and meet Social Security’s minimum of 40 work credits, you can take spousal benefits if you meet the other requirements.

If you qualify for retirement benefits based on your own work record, Social Security will use your earnings to determine your benefits. Then your former spouse’s record will be used to qualify you for a bigger benefit if applicable.

Social Security survivor benefits

When your spouse dies, you may be eligible for survivor benefits. This is a different kind of Social Security benefit that has its own set of rules.

Survivor benefits are as much as 100% of the benefit the deceased worker was receiving when they died. If the person died before claiming benefits, the survivor benefit is based on their primary insurance amount.

To qualify for the full benefit, you still have to wait until your full retirement age. However, you can claim benefits as early as age 60 (or 50 if you’re disabled). If you claimed survivor benefits as soon as you’re eligible at age 60, you’d only receive 71.5% of your late spouse’s benefit. Surviving spouses or ex-spouses who are caring for a child younger than 16 or who has a disability can receive 75% of the deceased worker’s benefit.

If you remarry before age 60 (or 50 if you have a disability), you won’t qualify for survivor benefits. However, if you remarry after age 60 (or 50 if you’re disabled), remarrying won’t jeopardize your survivor benefits.

The bottom line on spousal benefits

Spousal benefits can boost your Social Security if your spouse earns significantly more than you. However, if you’re employed for most of your working years, you may still qualify for a bigger benefit on your own. If you’re wondering how much you’d qualify for on your own record or your spouse’s, you can create a my Social Security account to estimate your benefits and kickstart your retirement planning.