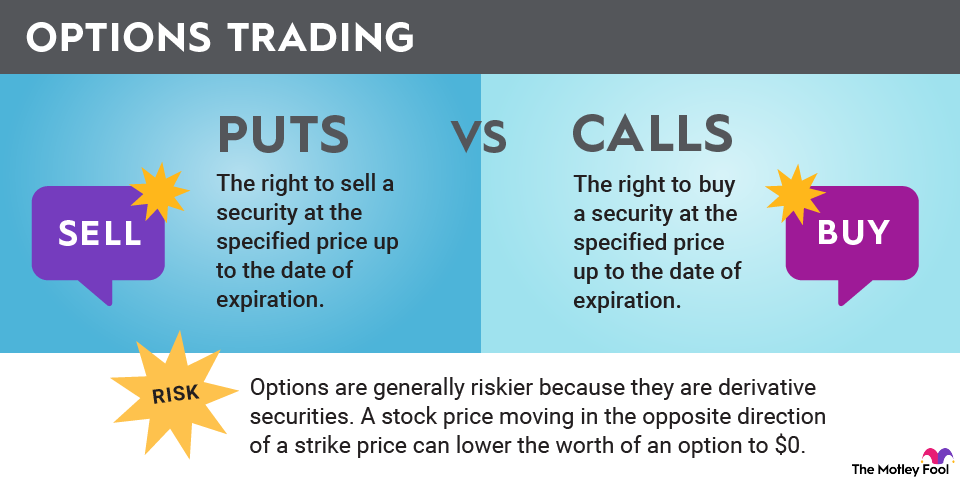

What are the benefits of trading options?

Investors can use options to enhance the performance of their portfolios and gain exposure to individual securities with minimal cash. Buying options is also a way to lower the overall investment risk of a portfolio.

If an investor buys a call option and the stock's price increases to above the strike price before the option's expiration date, then the investor can exercise their option to buy the stock at the strike price and resell it at the higher market price for a profit.

Similarly, if an investor buys a put option and the stock's price decreases to below the strike price before the put option's expiration date, then the investor can exercise their option to sell the stock at the strike price and repurchase it at the lower market price.

Investors can also enhance the performance of their portfolios by selling options. If an investor sells an option and the stock's price does not reach the strike price before the option's expiration date, then the investor's profit equals the premium paid for the options contract.

Using options, you can gain increased exposure to a stock without using a lot of cash. Instead of buying the shares directly, you can buy a call option for a much lower price. As the stock increases in value, the value of the call option also increases, and you have the option of selling that option before its expiration date.

If you already own a stock, then you can use options to decrease the volatility of your investment. Buying a put option can protect you against a crash in a stock's price since you can earn the strike price specified by the contract.