When you take out a loan or carry a balance on a credit card, the interest accrues constantly. However, if you make regular payments, this interest isn't compounded. For this reason, calculating the unpaid interest that has accrued on a loan is pretty straightforward to do.

Calculating accrued interest payable

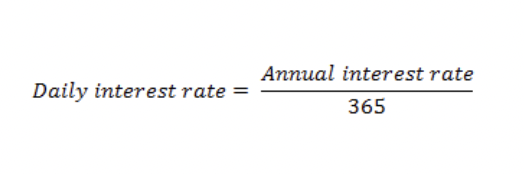

First, take your interest rate and convert it into a decimal. For example, 7% would become 0.07. Next, figure out your daily interest rate (also known as the periodic rate) by dividing this by 365 days in a year.

Daily interest rate = Annual interest rate / 365

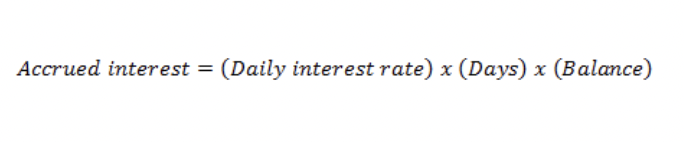

Next, multiply this rate by the number of days for which you want to calculate the accrued interest. Finally, multiply by the account balance in order to determine the accrued interest.

Accrued interest = (Daily interest rate) × (Days) × (Balance)

It's also worth noting that not all accounts use 365 days to determine the daily interest rate. For example, many bonds use 360 days in a year. So, for the most precise calculation possible, confirm with your creditor or lender before calculating. For loan products like credit cards, you should be able to find this information in your cardholder agreement or any document with your loan's terms.

An example

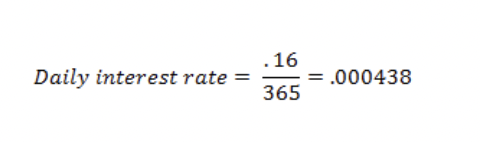

Let's say you carry a $3,000 credit card balance at an APR of 16%, and you want to know how much interest you can expect to pay on your March bill. First, you can determine the daily interest rate by dividing 0.16 by 365 days in a year.

Daily interest rate = 0.16 / 365 = 0.000438

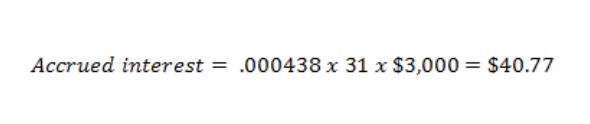

Since March has 31 days, we can use the accrued interest formula to calculate your interest payable for the month.

Accrued interest = 0.000438 × 31 × $3,000 = $40.77

Average daily balance

This is a simplified example, as it assumes your credit card balance stays the same throughout the billing period. In practice, however, credit card balances change as you make purchases, which complicates the calculation.

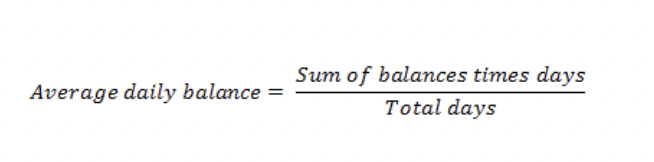

To calculate accrued interest for a changing balance, you can use the above formulas along with your average daily balance, which can be found using the following method.

Average daily balance = (Sum of balances × days) / Total days

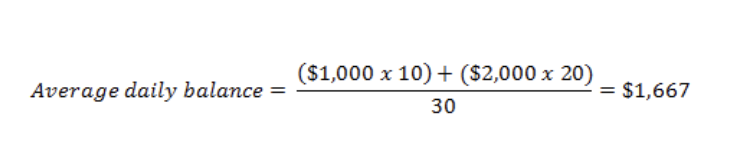

For example, let's say that in a 30-day month, you carried a balance of $1,000 for 10 days and then made some purchases that brought your balance to $2,000 for the other 20 days. In this case, you can compute your average daily balance as:

Average daily balance = [($1,000 × 10) + ($2,000 × 20)] / 30 = $1,667

So, when calculating the accrued interest for a certain time period, be sure to use the average daily balance for an accurate calculation.

And if you're an investor, you know all about doing calculations. Need help? Just getting started? We can help. Just head on over to our Broker Center.