Defined contribution plan vs. defined benefit plan

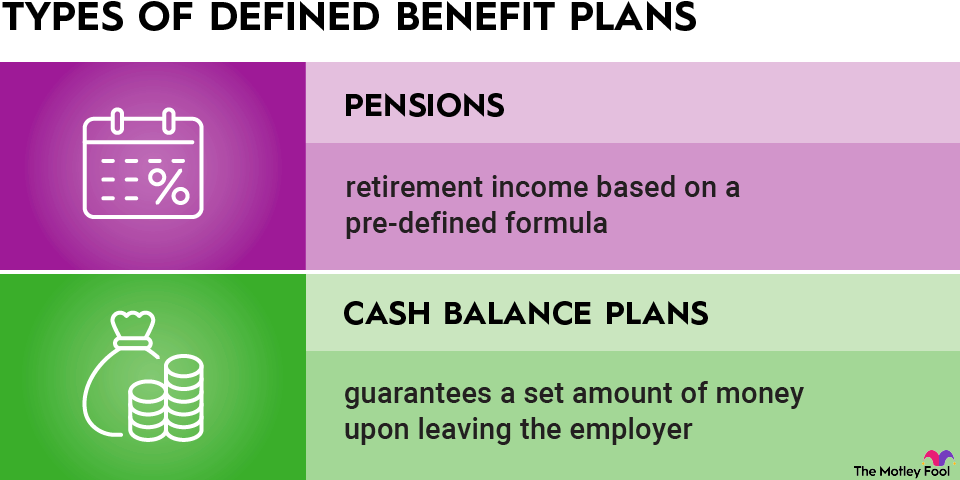

Defined benefit plans are plans that provide a guaranteed payout in retirement. The most common type of defined benefit plan is a pension, but these are becoming less common because they're more expensive and complicated for employers.

Essentially, there's a formula that dictates how much you'll receive from your pension in retirement based on how long you've worked for the company or your average income as an employee. The employer is responsible for funding that one way or another, even if that means making an additional cash contribution if its investments don't perform as expected.

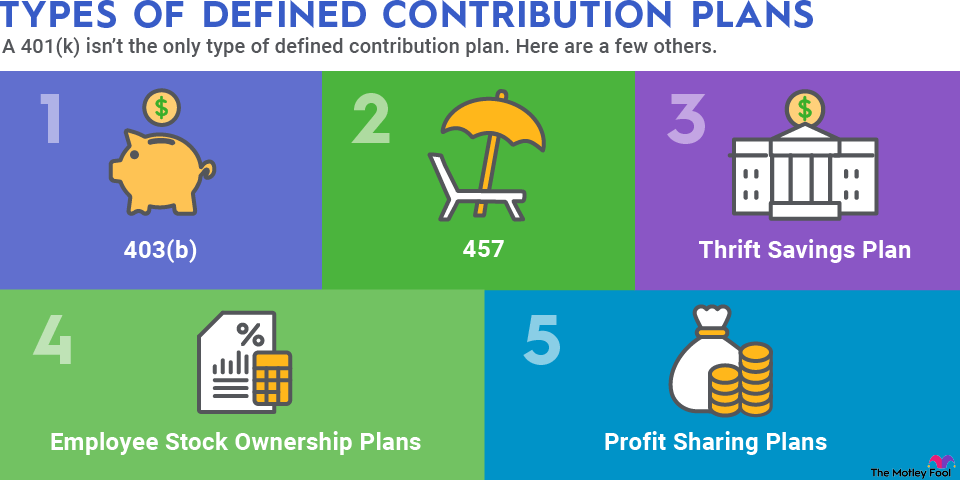

Defined contribution plans shift most of the savings burden from the employer to the employee. That's not as desirable for you as a worker, but it might suit you better if you don't plan to stay with your employer long. You can take your defined contribution plan with you and change how you invest your funds, but a defined benefit plan will always be tied to your old employer.

You're much more likely to have a defined contribution plan than a defined benefit plan these days, but it helps to have an understanding of both types and how they work. Whichever type of qualified retirement plan you end up with, make sure you understand any rules associated with contributions or withdrawals, and talk to your company's HR department if you have any questions.