A standard FIRE strategy

It starts with asking yourself some basic questions and then doing the math to figure out how much you'll need to save -- or if you need to adjust your goals.

- How much income do you need to sustain your lifestyle in early retirement?

- How soon do you want this to happen?

Once you've answered these two questions, you can start working to determine if your goal is feasible. Let's start with the first number, which is how much you expect to spend each year in retirement.

As mentioned earlier, a helpful rule of thumb is the "4% rule," which says your retirement savings will need to be large enough for you to withdraw 4% per year. In other words, your nest egg needs to be 25 times the amount you'll withdraw the first year. In each successive year, your withdrawal amount may be increased by inflation.

In the previous example, we used this concept to show that someone anticipating $50,000 in annual living expenses would need to accumulate $1.25 million. If your expectations for annual expenses in retirement aren't quite so frugal -- the median U.S. household income is now closer to $80,000 per year -- you may need to accumulate even more.

Let's use $1.25 million as a starting point, along with the next question: When do you want to retire?

If someone who's 25 wants to retire at 40 with a $1.25 million nest egg, they'd have to stick $83,000 per year in a savings account at current interest yields. Needless to say, that's out of reach for many people who don't earn a significant income.

However, there are ways to boost how much you save and to maximize how much your savings grow so you're not doing all the hard work on your own. And remember, FIRE is far from an all-or-nothing proposition. Even reaching 50% of your FI goal is a tremendous accomplishment and will earn you a significant amount of financial flexibility.

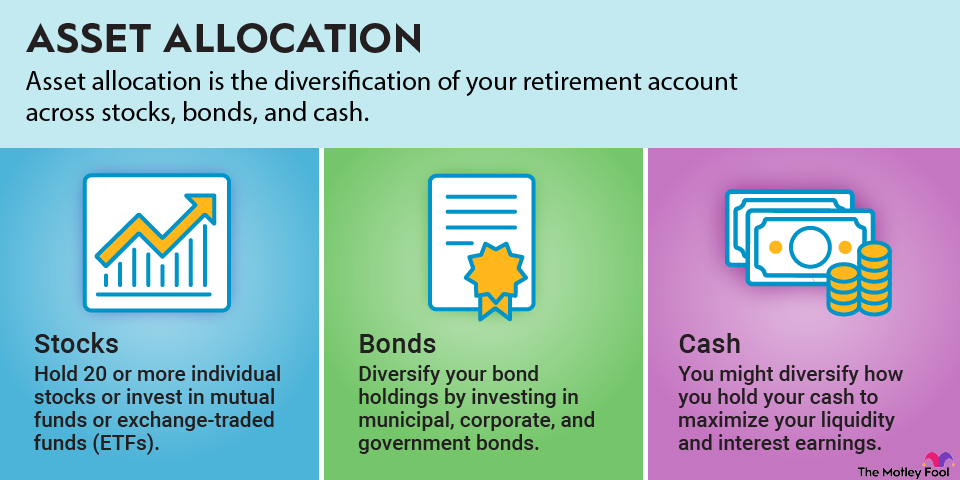

Of course, these are simple numbers to illustrate the point: Saving a lot of money is much harder than growing wealth by investing a portion of that savings over the long term. And, perhaps a more salient point: Investing as much money as you can -- as soon as possible -- will pave the way toward financial freedom.

Related retirement topics