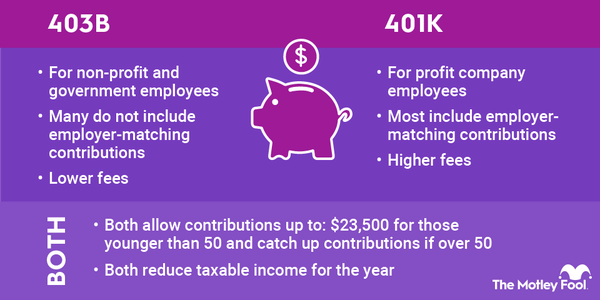

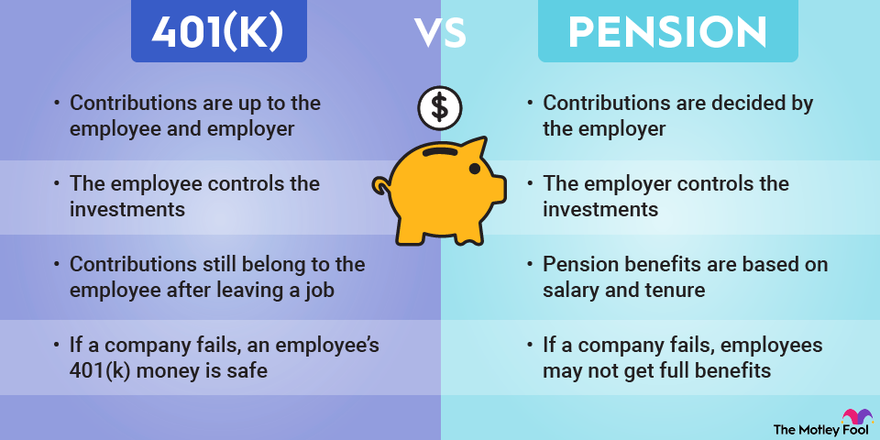

Workplace retirement plans serve as the cornerstone of most Americans' retirement savings efforts, but there are many different types of workplace plans. Two of the most common are pensions and 401(k)s, but there are major differences between the two offerings.

Of course, many workers don't have a choice of workplace plan since traditional pensions are a disappearing perk. In fact, while 56% of private sector workers participated in a workplace retirement plan in 2023, just 11% had a pension.

If you're one of the millions of employees with only a 401(k), here are four key reasons why they are better than pensions.

1. 401(k)s allow you to set the contribution schedule.

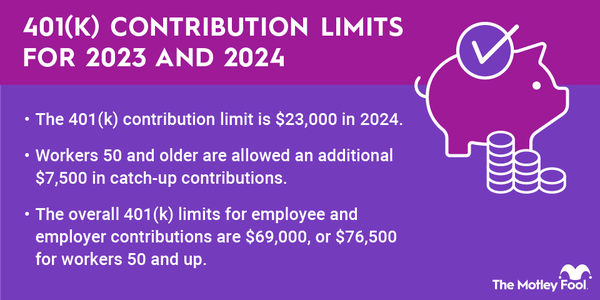

With a 401(k), you can contribute as much of your paycheck as you'd like as long as you don't exceed the annual contribution limits. Contributions are withdrawn directly from your paycheck, and you can change your contributions by filling out some paperwork with your employer.

With a pension, your employer decides how much to contribute. Unfortunately, this can sometimes result in underfunding. Underfunded pensions are at risk of not being able to pay out promised benefits, whereas 401(k)s are funded by employees and are not susceptible to this risk.

2. Pensions don't allow you to make investment choices.

Chronic underfunding gets worse when paired with bad investment decisions, and history shows you can't assume the person managing your pension will invest wisely. Unfortunately, the Center for Retirement Research reports the return on investment earned by public sector pension plans has fallen far short of actuarial estimates throughout the 2000s.

One reason for this is that many plan managers overinvested in alternative investments, particularly hedge funds -- 31% of pension plans have at least 30% of their assets in alternative investments. These investments have been hugely underperforming the stock market since 2010, in part because hedge funds charge relatively high fees that reduce returns.

401(k) accounts generally don't offer the option to invest in hedge funds. But even if they do, you have the option to select your own investments so you can steer clear. Most 401(k)s offer multiple investment options for you to pick from, including index funds or target date funds that make it easy to maintain an appropriate asset allocation as you age. Since you have the option to choose your own investments, you can determine how much risk you want to take on and choose investments that are a good fit for you personally, whereas a pension invests for all company employees.

3. Your retirement is portable with a 401(k).

Pension benefits are based on your salary and tenure with the company. Pensions typically use either cliff vesting or graded vesting to determine access to your benefits (vesting refers to when you get ownership). With cliff vesting, after you stay with the company a certain time (typically five years), you earn 100% access to your pension benefits. With graded vesting, after you've been with the company for three years, you start gaining access to pension benefits at a rate of 20% per year. By the end of your seventh year, you'll be 100% vested.

Unfortunately for this system, job-hopping is the norm these days, and people rarely stay with the same employer for more than three years, let alone seven. Worse, even if you stay long enough to fully vest, your pension benefits will be based on your earnings from that employer, so if you stay only a few years, the resulting benefits will be pretty minimal.

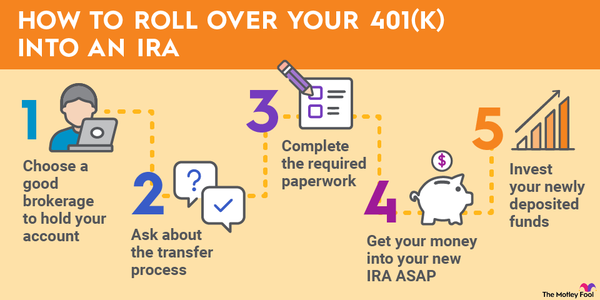

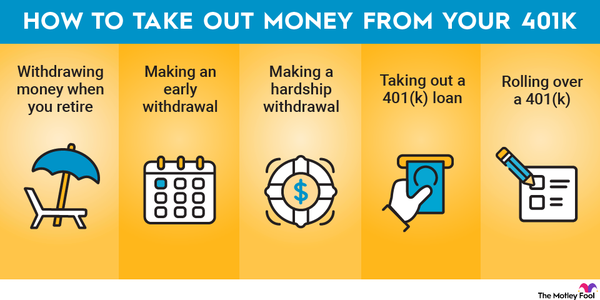

401(k) accounts work differently. Any contributions you make to your plan are always 100% vested, and, when you leave your employer, your contributions still belong to you. You can leave them invested or choose to roll them over into your new employer's 401(k) or into an IRA. While employer matching contributions may be subject to a vesting schedule similar to that of a pension, most of your retirement money comes with you when you switch jobs, even if you've been with your company for only a short time.

Related Retirement Topics

4. If the company fails, your money is safe in a 401(k).

Remember Enron? Its spectacular crash not only wiped out thousands of jobs but also destroyed the company's $2 billion in pension plans. And it wasn't just current employees who lost their retirement benefits; many former employees who'd already retired found themselves suddenly without their major source of income.

Even if your employer is in perfect financial health today, there's no predicting how it will be doing decades down the line. The Pension Benefit Guaranty Corporation insures private pensions and will step in if your pension fails, but the agency has only so much money to hand out. If your pension fails, there's a good chance you won't get your full benefits -- and, in some cases, you may not get a penny.

On the other hand, employers can't touch your 401(k) money. Those funds are in the hands of a 401(k) trustee precisely so they'll be safe if something bad happens. Even if your employer is the next Enron, you may lose your job, but your 401(k) funds will be fine.

In theory, pensions are the ultimate retirement savings tool. In practice, they have many pitfalls -- and, as a result, they present an awful risk to anyone counting on them for retirement income. So instead of bemoaning the fact that your company doesn't offer a pension, be thankful you have a 401(k) instead.