Decisions about your health and your money are ones only you can make. When you combine the two, it becomes an even more personal decision.

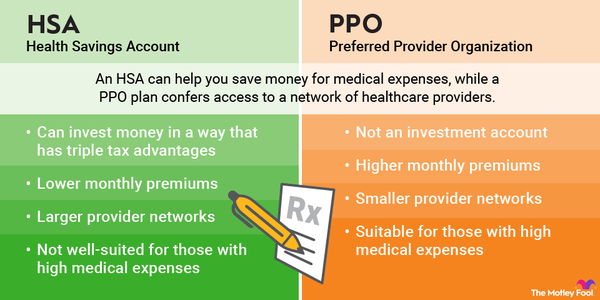

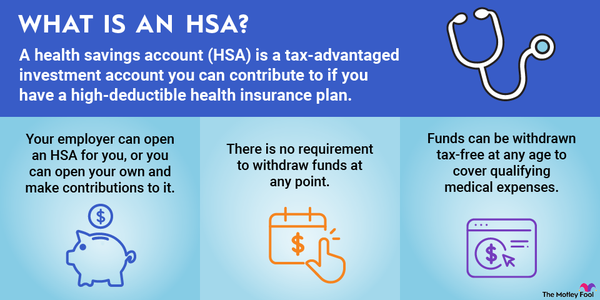

One important choice most U.S. residents have related to their health and their money is whether to set up a health savings account (HSA). These accounts don't just provide a way to cover your health expenses; they can also be attractive investment vehicles.

But investing in HSA funds isn't for everyone. Here's what you need to know about the ins and outs of investing HSA money to be able to make the best decision for your personal situation.

Can you invest your HSA money?

The answer to this question is maybe. Many HSA administrators require a minimum balance in your account before allowing you to invest. Check with your HSA administrator to find out if there's a minimum balance required for your HSA before you can invest. Keep in mind, though, that just because you can invest your HSA money doesn't mean that you necessarily should.

Why should you invest your HSA money?

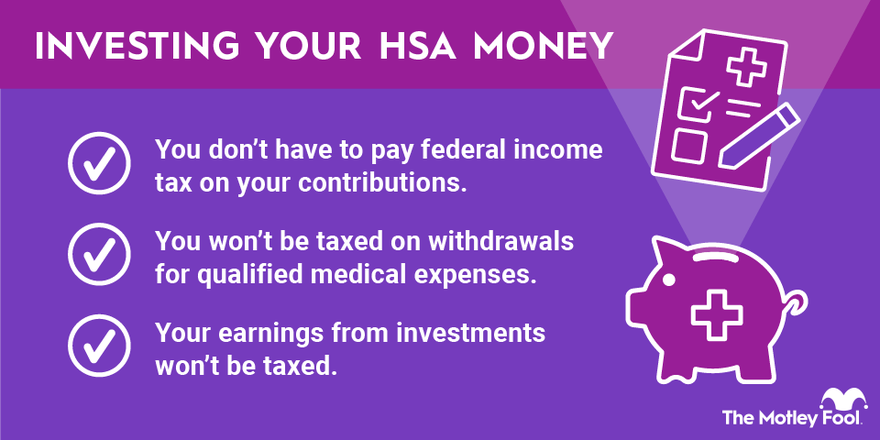

HSAs were established primarily for individuals to use for their health expenses. But they can also serve as excellent retirement savings accounts with important benefits. Arguably, the biggest upside for HSAs is that they offer a triple tax advantage:

- You don't have to pay federal income tax on your contributions.

- You won't be taxed on withdrawals for qualified medical expenses.

- Your earnings from investments won't be taxed.

You benefit from the first two tax advantages even if you don't invest your HSA money. However, if you do invest your HSA money, the third advantage helps you as well.

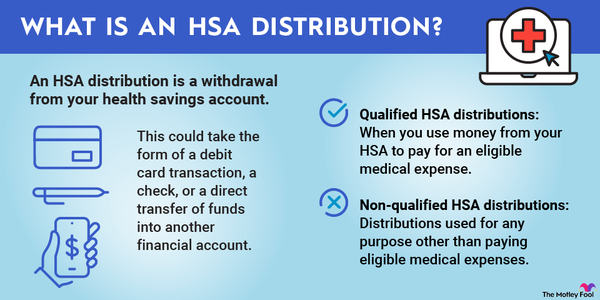

There is a caveat to this advantage, though. If you withdraw HSA money before you turn 65 for reasons other than qualifying medical expenses, you'll be taxed at your ordinary income tax rate. You could also incur an additional 20% tax penalty on HSA distributions for nonqualified reasons.

Investing HSA money can be an especially attractive option for some. Have you maxed out your other tax-protected retirement savings account contributions? Do you still have additional money to invest for retirement? If so, HSAs provide a great way to boost your overall retirement savings.

Why shouldn't you invest your HSA money?

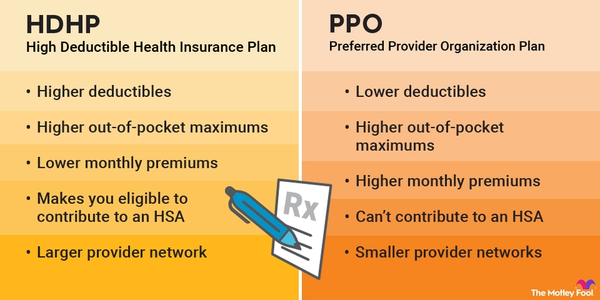

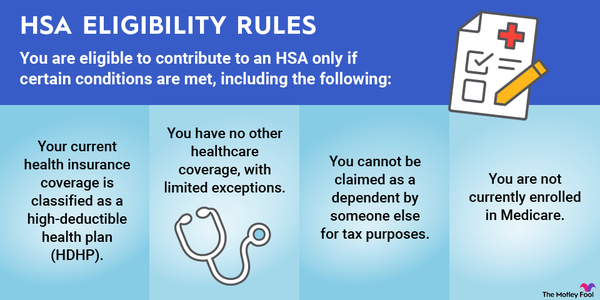

The biggest drawback to HSAs is that they must be tied to a high-deductible health plan. These plans require you to spend relatively high amounts from your own pocket on deductibles before your health insurance will provide any reimbursement. High-deductible health plans aren't ideally suited for those with high medical expenses.

It's possible that your medical expenses weren't very high when you initially opened your HSA, but that those expenses later increased. Do you suspect there's a good chance you will incur significant medical expenses in the near future? If so, you'll want to make sure you have enough money (in cash!) in your HSA to pay those expenses.

Additionally, some HSAs might not offer the investment options you prefer. Others could charge fees that are higher than you'd like.

What are your HSA investment options?

You'll need to check with your HSA administrator to find the specific investment options available in your HSA. However, common HSA investment options include:

- Mutual funds

- Exchange-traded funds (ETFs)

- Stocks

- Bonds

The investment option -- if any -- best suited for you will depend on your goals and risk tolerance. Each common investment option has pros and cons.

| HSA Investment Option | Pros | Cons |

|---|---|---|

| Mutual funds |

Diversification across a basket of stocks. Automatic dividend reinvestment. Little or no investing knowledge required. |

Annual fees. Potential sales commission charges. Many mutual funds underperform the overall market. |

| Exchange-traded funds (ETFs) |

Diversification across a basket of stocks or other investments. Automatic dividend reinvestment. Typically low annual fees. Some HSAs allow ETFs to be purchased with no commissions. |

Some ETFs have higher fees. Index ETFs won't beat the indexes they attempt to track. |

| Stocks |

Opportunity to outperform the overall market. No annual fees. Some HSAs allow stocks to be purchased with no commissions. |

More volatile. Requires more investing expertise and research time. |

| Bonds |

Can be less risky and less volatile than other investment options. Interest rates typically higher than bank savings account rates. |

Typically underperform stocks over the long run. Risk of issuers defaulting on interest and principal repayment. |

How to invest HSA funds strategically

For those who choose to invest their HSA funds, here are a few ways to invest strategically:

- Make sure you take full advantage of any employer matching contributions. This will give you more money to use on qualified medical expenses and potentially free up more funds you can use to invest.

- Contribute the maximum amount allowed to your HSA. For 2024, the maximum contribution limits are $4,150 for an individual and $8,300 for families. In 2025, contribution limits rise to $4,300 for individuals and $8,550 for families. Individuals ages 55 and older can contribute an additional $1,000 in both 2024 and 2025.

- Consider how close you are to retirement as you decide on your HSA investments. If you have decades before you'll retire, you might consider adding more aggressive mutual funds, ETFs, or stocks. If you're only a few years from retiring, you'll probably want to consider investing in less-volatile alternatives, such as bonds and dividend stocks.

- Think of your HSA as a key component of your overall retirement strategy. Try to invest as much of your HSA money as possible while ensuring that you keep enough cash to cover your qualified medical expenses. Consider where your other retirement plans are invested as well to make sure that your HSA investments provide diversification.

- Avoid taking out funds from your HSA as much as possible. The more money you leave in your HSA, the more it will grow over time.

Related Investing Topics

Of course, some individuals might determine that the best strategy for their HSA money is to not invest at all. Whether or not to invest HSA funds and how to invest those funds are decisions that only you can make for yourself and your family.