A lot of people who retire as millionaires don't necessarily earn six-figure salaries throughout their careers. Rather, they work hard, save wisely, and make smart choices about how they want to live once their careers come to a close. If you're set on retiring a millionaire, here are a few key steps to take sooner rather than later.

1. Figure out how much you actually need to save

Maurie Backman: Do you actually need $1 million to live on for retirement? Maybe you don't.

It could be that based on your lifestyle choices, you'll do just fine with a $500,000 nest egg. A lot of people get their minds set on that coveted $1 million target, but before you sacrifice a ton to get there, make sure that's actually what you need and want. If you intend to settle down in a modest town where the cost of living is cheap, spend time with family, and keep busy volunteering, then you may not need as robust a nest egg. The same holds true if you have every intention to work in some capacity during retirement, whether by picking up a local job or starting a business of your own that functions as both an income source and a hobby.

Image source: Getty Images.

On the other hand, it could be that you'll need several million dollars to live the retirement you want. Maybe you're planning to spend your senior years traveling the globe, or you want to live in a bustling city and take advantage of fine dining and nightlife. In that case, you may find that $2 million -- or more -- is a better goal to work toward.

To figure out how much savings you should aim to retire with, do some research and set up an actual retirement budget. Of course, if you're years away from leaving the workforce, that budget may not be as accurate as it would be for someone retiring next year. You could, for example, research the cost of a home in a major city today only to see prices shift in a decade from now. But a budget will, at the very least, give you an estimate of what savings goal to set, and from there, you can take steps to sock away whatever amount of money you'll ultimately need to enjoy retirement to the fullest.

2. Set a monthly savings goal

Christy Bieber: Whether your big goal is to save $1 million or some smaller amount it's almost assuredly going to take you a long time to reach it. And it can be daunting to figure out how to get there from where you are now, especially if you're starting from $0 or don't have much saved.

The best way to achieve your objective and retire with that seven-figure nest egg is to break things down. Specifically, you'll want to decide how much you need to save each month in order to hit your target. That way, you can work the amount into your budget and can monitor your progress to make sure you're on track.

Of course, the specific amount you'll need to save is going to vary depending on a number of factors, including your age at the time you start saving, when you want to achieve millionaire status, and the returns that your investments are likely to earn. The longer your timeline before you need your million and the higher the returns you earn, the less you need to invest each month.

There are a number of online calculators you can use to estimate your necessary monthly savings, including this one from Investor.gov. When you use them, it's helpful to be a little pessimistic in your assumptions. In other words, estimate you'll earn around a 7% average annual return even though it's reasonable to expect an 8% to 10% annual return if you invest in a good mix of stocks and bonds. And assume you'll need your money by your early 60s even if you plan to retire late. That way, if things don't go quite as planned, you'll still achieve your objective.

Once you've determined the amount you need to save each month, it's helpful to automate your investing process. If your magic number is $500 per month, set up an automatic 401(k) contribution to have that amount directly invested before you get your paychecks. Or set up a transfer to your IRA through your bank or brokerage firm. That way, you won't ever miss a month and get behind.

3. Invest your money

Katie Brockman: For your money to reach its full potential, it's not enough to simply save -- you'll need to invest.

Investing in the stock market can be riskier than stashing your money in a savings account, but it's one of the most effective ways to see substantial growth. If you don't invest, you'll need to save significantly more each month to reach millionaire status.

For example, say you have 30 years before you retire, and you want to save $1 million in that time period. If you're keeping your money in a savings account earning 1% annual interest, you'd need to save a whopping $2,500 per month. But if you were to invest that money instead, earning a modest 8% annual rate of return, you'd have to save around $750 per month to reach your goal.

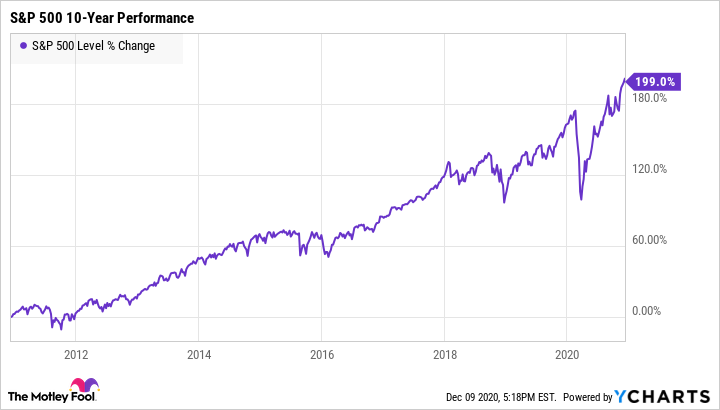

It can be daunting to invest, especially when the stock market is volatile. But it's not as risky as it may seem. Despite its short-term ups and downs, the S&P 500 has experienced an average rate of return of around 10% per year since its inception.

When you invest for the long term, it doesn't necessarily matter what the market is doing right now. Over time, the stock market tends to see positive returns. Just be sure you're investing in quality stocks and funds that can stand the test of time. Index funds and mutual funds are a good choice for many investors, or if you're willing to do some research, investing in individual stocks can provide a more personalized portfolio.

Wherever you choose to invest, be sure to focus on the long term and leave your money alone for as long as possible. You won't be able to escape volatility entirely, but if you're putting your money in the right places, your investments should be able to ride out the storms.