One of the more important decisions you have to make as you approach retirement is when to claim Social Security, because it will permanently affect how much you receive in monthly benefits.

Claiming Social Security before your full retirement age (FRA) -- which is when you're eligible to receive your base monthly benefit (called the primary insurance amount) -- will result in a decreased monthly benefit. However, delaying benefits past your FRA will increase the monthly benefit.

By delaying benefits until 70, you can potentially increase your monthly benefit by 24% (2/3 of 1% monthly increase; 8% annual increase). And although the thought of higher monthly benefits may seem enticing, it isn't always the best option. Personally, I plan to claim Social Security before 70 for the following three reasons.

Image source: Getty Images.

1. I would rather receive benefits for a longer time span

On a basic level, the question of whether to claim Social Security benefits at 70 or an earlier age comes down to whether or not you want smaller benefits for a longer time or larger benefits for a shorter period of time.

To put the difference into perspective, I like to consider the break-even age, which is the point at which the total lifetime benefits received from claiming at one age equal those from claiming at another age.

Let's assume your monthly benefit at your primary insurance amount is $2,000, and you're debating between claiming benefits at 62 or 70. Claiming at 62 means your monthly benefit will be reduced by 30% to $1,400 (if your FRA is 67). Claiming at 70 means it will be increased by 24% to $2,480. Here are your cumulative benefits received at various ages:

| Monthly Benefit | Total by Age 75 | Total by Age 80 | Total by Age 81 |

|---|---|---|---|

| $1,400 (claiming at 62) | $218,400 | $302,400 | $319,200 |

| $2,480 (claiming at 70) | $148,800 | $297,600 | $327,360 |

Table by author.

In this case, the break-even age by claiming at 62 versus 70 is just after age 80. Personally, I would prefer smaller benefits for longer because the break-even age is fairly late, lowering the chances of maximizing total lifetime benefits.

Image source: The Motley Fool.

2. The future of Social Security benefits has question marks

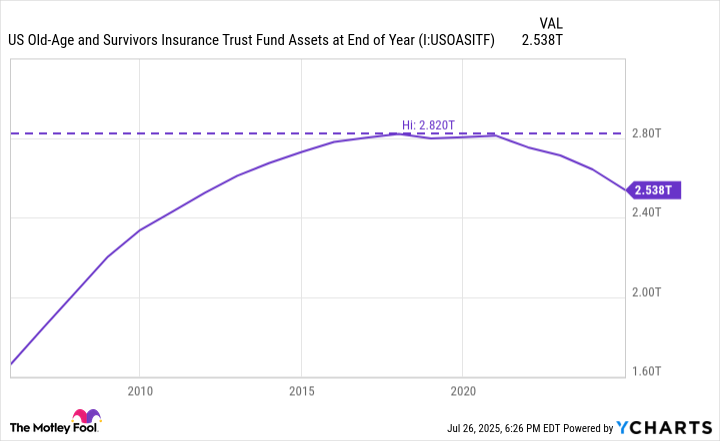

The Social Security Administration's 2025 Trustees Report noted that the program cost $1.485 trillion in 2024 -- $67 billion less than it brought in. It also noted that, at the current deficit rate, the Old-Age and Survivors Insurance (OASI) Trust Fund could be depleted by 2033, resulting in Social Security being able to pay only 77% of its expected benefits.

With bipartisan government action, the shortfall could be resolved, but this is far from guaranteed based on past inaction and the current political landscape. I don't anticipate the Social Security program being eliminated in my lifetime, but I would much rather take my payments sooner rather than later, while the program has adequate funding and is working as currently intended.

US Old-Age and Survivors Insurance Trust Fund Assets at End of Year; data by YCharts.

3. Claiming early lets you put the money to work for you

Ideally, Social Security serves as supplemental retirement income alongside other means, such as retirement accounts like 401(k)s and IRAs and other investments. This isn't feasible for many people, but that should be the goal as you're saving and preparing for retirement.

Assuming you have other retirement income, claiming Social Security early allows you to start putting your benefits to work by either investing, paying down debt, or reducing how much you need to withdraw from other assets.

Investing would ideally grow your benefit amount, paying down debt would save you money in interest, and reducing how much you need to withdraw from other sources could reduce your potential tax bill. All three of these are smart uses of your benefits that could compound over time, which wouldn't happen if you delayed your benefits until 70.