For most retired Americans, Social Security is more than just a monthly check. It represents a financial foundation that helps them make ends meet.

Even though the average monthly retired-worker check only crested $2,000 for the first time in history in May, this relatively modest payout was responsible for pulling an estimated 16.3 million adults aged 65 and over above the federal poverty line in 2023, according to an analysis from the Center on Budget and Policy Priorities.

For aging workers who can no longer provide for themselves, nothing is of more significance than knowing how much they'll receive each month from America's leading retirement program -- and no announcement has more relevance than the annual cost-of-living adjustment (COLA), which will be unveiled on Oct. 15.

Even with Social Security's 2026 COLA currently on pace to do something that hasn't been witnessed this century, retirees are very likely staring down yet another lose-lose scenario.

Image source: Getty Images.

What is Social Security's COLA and how is it calculated?

The best way to view Social Security's cost-of-living adjustment is as the tool used by the Social Security Administration (SSA) to fight back against a loss of buying power due to inflation (rising prices).

For instance, if a basket of goods and services regularly bought by retirees were to increase in cost by 2% from one year to the next, Social Security benefits would need to climb by the same percentage, otherwise retirees wouldn't be able to purchase the same amount of goods and services. Social Security's COLA is the annual "raise" designed to match the inflationary pressures Social Security recipients are contending with.

Beginning in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) became the inflationary measure used to calculate COLAs on an annual basis. Prior to 1975, COLAs were assigned by special sessions of Congress on an arbitrary basis.

The CPI-W has well over 200 price categories, all of which have their own respective percentage weightings. These weightings are what allow the CPI-W to be expressed as a single figure at the end of the month to determine if this basket of goods and services has, collectively, increased (inflation) or decreased (deflation) in cost.

Although the CPI-W is reported monthly by the U.S. Bureau of Labor Statistics (BLS), only readings from July through September (the third quarter) factor into the cost-of-living adjustment calculation. If the average CPI-W reading from the third quarter of 2025 is higher than the comparable reading in 2024, beneficiaries can expect their monthly benefit to climb in 2026.

The year-over-year percentage increase in average third-quarter CPI-W readings, rounded to the nearest tenth of a percent, represents the COLA beneficiaries will receive in the upcoming year. It's that simple.

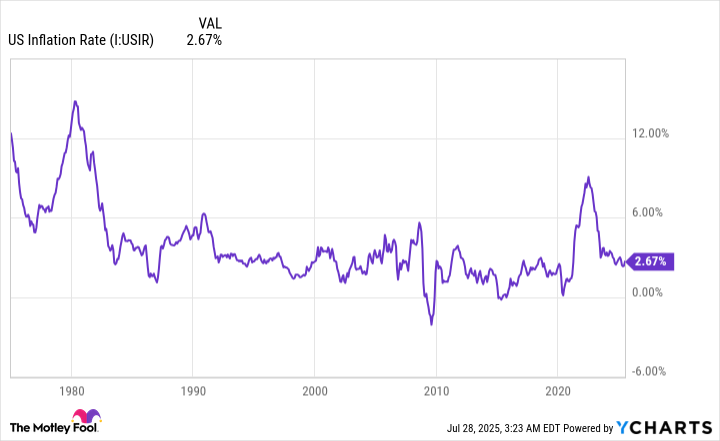

A big uptick in the prevailing rate of inflation sent COLAs considerably higher in recent years. U.S. Inflation Rate data by YCharts.

Social Security's 2026 cost-of-living adjustment is on pace to make history

Though the SSA is still two and a half months away from revealing the 2026 COLA, initial independent estimates point to history being made.

Throughout the 2010s, Social Security beneficiaries had little to look forward to. Deflation led to no COLA being passed along in 2010, 2011, and 2016, while 2017 featured the smallest positive COLA (0.3%) in the program's storied history.

The tables have turned dramatically in recent years thanks to the COVID-19 pandemic and a surge of fiscal stimulus. A rapid increase in U.S. money supply sent the prevailing rate of inflation notably higher, which in turn produced respective COLAs of 5.9% in 2022, 8.7% in 2023, 3.2% in 2024, and 2.5% in 2025. All four of these cost-of-living adjustments are above the 2.3% average annual "raise" since 2010.

Following the release of the June inflation report from the BLS, nonpartisan senior advocacy group The Senior Citizens League (TSCL) is forecasting a 2.6% bump in monthly payouts for the upcoming year. Meanwhile, independent Social Security and Medicare policy analyst Mary Johnson is looking for Social Security's COLA to come in at 2.7% in 2026.

If (big "if") either TSCL or Johnson proves accurate with their respective forecasts, it would mark the first time this century that five consecutive COLAs reached at least 2.5%. The last time Social Security's cost-of-living adjustment was at least 2.5% for five straight years was 1987 through 1996.

Keeping in mind that numerous variables can alter these forecasts, including President Donald Trump's tariff and trade policy, retired-worker beneficiaries could be looking at a monthly payout boost ranging from $52 to $54 in 2026.

In comparison, the average worker with disabilities is on track for a monthly increase of $41 to $43, while the average survivor beneficiary can see their check climb by $41 to $42 per month in the upcoming year, based on estimates.

Image source: Getty Images.

The dreaded lose-lose scenario awaits retirees, yet again, in 2026

Unfortunately, even history-making moments for Social Security aren't enough to protect aging workers from getting the short end of the stick.

On a nominal basis, a 2.6% or 2.7% COLA would be higher than the average payout increase of 2.3% since 2010. But it would almost certainly result in retirees losing buying power, which has been an ongoing theme of this century.

While the CPI-W is a vast improvement over the arbitrary cost-of-living adjustments assigned by special sessions of Congress, it's still rife with flaws. Specifically, it's an index that caters to "urban wage earners and clerical workers." These are typically working-age Americans who aren't currently receiving a monthly check from Social Security. More importantly, urban wage earners and clerical workers are going to spend their money differently than seniors.

For retirees, shelter and medical care services account for a larger percentage of their monthly expenditures than the typical worker. However, the CPI-W provides no added weighting for these two categories, even though 87% of Social Security's nearly 70 million beneficiaries (including disabled workers, survivors, retired workers, and all applicable spouses and children) are aged 62 and above.

Based on data from the Consumer Price Index for All Urban Consumers (CPI-U), which is a similar inflationary measure to the CPI-W, shelter and medical care services inflation respectively hit 3.8% and 3.4% on a trailing-12-month basis, ended June 2025. As long as the prevailing rate of inflation for these two critical spending categories remains higher than the COLA beneficiaries receive, the purchasing power of a Social Security dollar seems destined to decline.

But this is just one of two ways retirees appear set to lose in 2026.

In addition to key expense categories rising at a brisk pace, the Medicare Part B premium is projected to soar next year. Part B is the segment of Medicare that deals with outpatient services, and it's usually automatically deducted from the Social Security benefit of enrollees each month.

Following back-to-back years of a 5.9% increase in Part B premiums, the Medicare Trustees Report is estimating a whopping 11.5% jump to $206.20 per month in 2026. Even if Social Security's COLA comes in modestly higher than current estimates, there's an extremely high likelihood that Part B premiums will eat up a significant chunk of next year's cost-of-living adjustment for most beneficiaries.

Yet again, Social Security's retirees are facing a lose-lose scenario.