As of the third week of October, Social Security's more than 70 million traditional beneficiaries would normally know whether or not they're receiving a cost-of-living adjustment (COLA) in the upcoming year. But this year has been unique, in more ways than one.

Due to the federal government shutdown, the release of most economic data has been delayed indefinitely. This includes the September inflation report, which is the last puzzle piece needed to calculate Social Security's 2026 COLA. Though some furloughed workers for the U.S. Bureau of Labor Statistics are headed back to work to release the September inflation report on Oct. 24. Social Security's biggest announcement of the year will, ultimately, be nine days late.

The other factor that makes this year's cost-of-living adjustment one-of-a-kind is that it'll be directly influenced by President Donald Trump's tariff and trade policy. That's right, folks -- Social Security is due for a "Trump bump."

President Trump speaking with reporters. Image source: Official White House Photo.

Let's take a closer look at how Trump's tariffs are affecting Social Security's 2026 COLA, as well as dive deeper into how much of a raise beneficiaries can expect in the new year.

President Trump's tariffs are directly impacting Social Security's 2026 COLA -- here's how

For the last half-century, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has served as Social Security's inflationary tether.

The CPI-W has more than 200 spending categories, each of which has its own individual percentage weightings. These unique weightings allow the CPI-W to be whittled down to a single figure at the end of the month, which can then be compared to the prior-year period to determine if prices have, in aggregate, risen (inflation) or declined (deflation). When inflation occurs, Social Security benefit checks rise.

Ideally, Social Security's near-annual COLAs should match the prevailing inflation rate that retired workers, workers with disabilities, and survivor beneficiaries are contending with. But when President Trump introduced his tariff and trade policy on April 2, he brought a new pricing variable into the mix.

When initially unveiled six months ago, Trump's tariff and trade policy set a base global tariff rate of 10%, as well as introduced higher "reciprocal tariffs" on dozens of countries that were deemed to have adverse trade balances with America.

In a perfect world, Trump's tariffs would be solely applied to finished products being imported into the U.S. This would allow U.S.-made goods to be more price-competitive with those being brought in from overseas.

But as four New York Federal Reserve economists writing for Liberty Street Economics pointed out in a December 2024 study (Do Import Tariffs Protect U.S. Firms?), Trump's tariff policy with China in 2018-2019 commonly leaned on input tariffs. This is a duty placed on goods used to complete the manufacture of a product in the U.S. For instance, tariffs on copper, steel, tech components, and so on, are examples of input tariffs.

Input tariffs can make it costlier for U.S. companies to manufacture their products domestically, which often means higher prices passed along to consumers. It's these input tariffs that are having a direct impact on the prevailing rate of inflation, and in turn are providing a modest boost to Social Security's 2026 COLA.

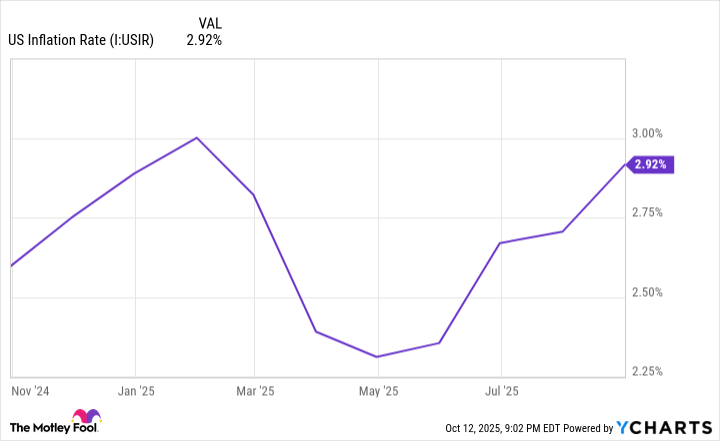

Donald Trump's tariff and trade policy has had a notable impact on the prevailing rate of inflation in recent months. US Inflation Rate data by YCharts.

How much of a Trump bump can you expect in 2026?

With a better understanding of how Donald Trump's tariffs are affecting the inflation rate, let's dive into what program beneficiaries really care about: their monthly income and how it's going to be impacted.

Compared to the 2010s, Social Security COLAs have picked up in a big way over the last four years. Thanks to a significant uptick in U.S. money supply during the height of the COVID-19 pandemic, the prevailing inflation rate, along with Social Security COLAs, soared. From 2022 through 2025, beneficiaries saw their checks climb by 5.9%, 8.7%, 3.2%, and 2.5%, respectively. For additional context, the average raise since 2010 is 2.3%.

Based on two independent estimates, 2026 will mark the fifth consecutive year with an above-average COLA (since 2010), as well as the first time this century that five straight raises have met or surpassed 2.5%.

Nonpartisan senior advocacy group The Senior Citizens League (TSCL) is forecasting a 2.7% increase in benefits next year. As for independent Social Security and Medicare policy analyst Mary Johnson, she's looking for a slightly higher 2.8% bump in payouts.

However, these independent estimates have risen about 50 basis points (0.5%) each due to the projected and actual effects (as seen in monthly inflation reports) of Trump's tariffs.

TSCL's and Johnson's COLA forecasts imply a $54 to $56 monthly benefit hike in 2026 for the average retired worker, and $43 to $44 extra each month for the average worker with disabilities and survivor beneficiary. Trump's tariffs should account for about a $10-per-month boost to the average retired-worker payout, and around $8 per month for the typical worker with disabilities and survivor beneficiary.

Image source: Getty Images.

Social Security raises continue to come up short for retirees

While this much-anticipated announcement is now less than a week away, the fact remains that Social Security raises have consistently come up short for retired workers since this century began. Two separate analyses from TSCL found a 36% loss of purchasing power for Social Security income from 2000 to 2023, and a 20% loss of buying power from 2010 to 2024.

The primary issue for retirees is that the CPI-W doesn't do a very good job of tracking the expenses that matter most. Rather, it's an inflationary index tasked with tracking cost pressures for "urban wage earners and clerical workers." These are typically working-age Americans who spend their money differently than the 87% of Social Security beneficiaries who are age 62 and above, as of December 2024.

Seniors spend far more on shelter and medical care services than the typical working-age American. Not only does the CPI-W not account for the added importance of these two spending categories, but the trailing-12-month inflation rate for shelter and medical care services is commonly higher than the COLAs retirees are receiving. It's a clear recipe for a persistent loss of purchasing power.

To make matters worse, the 2025 Medicare Trustees Report forecast an 11.5% increase to the Part B premium in 2026 to $206.20 per month. Part B is the portion of Medicare responsible for outpatient services, and its premium is usually deducted from the monthly benefit of dually enrolled retirees (persons receiving Social Security benefits who are enrolled in traditional Medicare).

The (projected) eighth double-digit year-over-year percentage increase in the Part B premium over the last 25 years will partially or fully offset the 2026 COLA and further pressure the buying power of Social Security income.