Image source: Flickr user Eric Chan.

Tens of millions of people rely on income from Social Security when they retire. Yet there are huge concerns about the viability of Social Security's long-term finances, as the trust fund that helps pay retirement benefits is projected to run out of money within the next 20 years. In part because of this fear of a Social Security default, the most popular age to start receiving benefits is 62 -- the earliest possible. Almost half of women and more than two out of five men claim at that early age.

Unfortunately, there's a lot of confusion about the impact of a Social Security Trust Fund default. Many mistakenly believe they'll receive nothing once the Trust Fund runs out of money. Even in a worst-case scenario, Social Security would still pay reduced benefits. With that in mind, the question is whether the threat of getting reduced benefits later justifies taking full benefits earlier. As it turns out, a future Trust Fund default would mitigate the benefits of delaying benefits -- but not by as much as you might expect.

What happens when the Trust Fund runs out of money?

Currently, Social Security brings in less money from payroll taxes and other revenue sources than it pays in benefits. As a result, the program is drawing from the Trust Fund to cover the shortfall. The latest projection from the Social Security and Medicare Boards of Trustees predicted that at current rates, the Trust Fund will run out of money in 2033.

When that happens, Social Security will only be able to pay out as much as it brings in through tax revenue. Currently, the Social Security Administration believes it will be able to pay 77% of current benefits in the event of a Social Security default.

Because of that 23% haircut, many retirees think taking benefits early is smarter than ever. What's surprising, though, is just how small an impact it has on the cost-benefit analysis of when to take Social Security.

Breakeven dates and Social Security default

Currently, Americans who claim Social Security at age 62 will get a 25% lower benefit than they would get by claiming at the full retirement age of 66. Meanwhile, taking benefits at age 70 will get you a 32% larger benefit than claiming at age 66. In short, if you claim early, you'll get more checks, but if you delay benefits, you'll get bigger checks. After a certain time period, those who delay benefits reach a "breakeven point," at which they will have received the same amount in total benefits that they would have received by claiming earlier. Beyond the breakeven point, they will come out ahead in terms of lifetime benefits -- and that's when delaying benefits really starts to pay off.

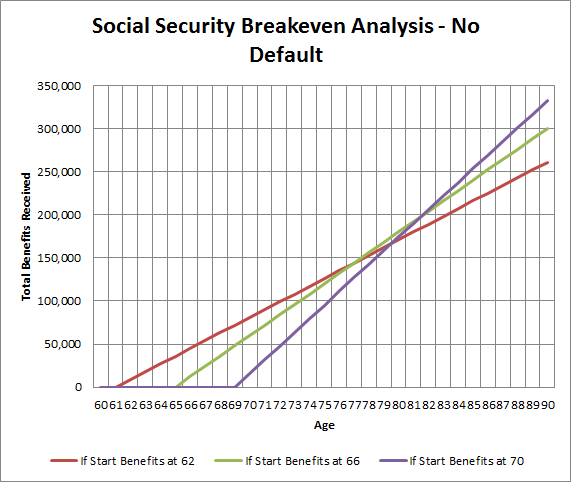

If you assume that Social Security will pay all of its promised benefits, then you can run a simple analysis that shows how long you must live in order to reach the breakeven point. As you can see below, if you live to be 78 years old, then you'll get more in total benefits by waiting until 66 than by taking early benefits at age 62. The breakeven age for waiting until age 70 is 80 years.

Image: Author based on SSA data.

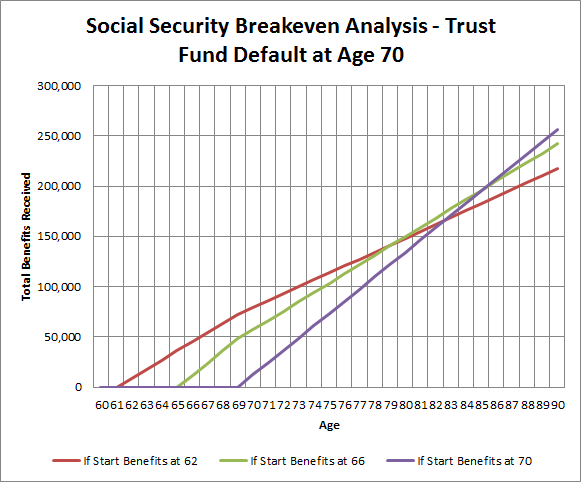

The worst possible outcome for someone is that the 23% cut in Social Security benefits happens just as they reach age 70. By waiting, they would miss out on eight years' worth of early benefits and get reduced benefits for the rest of their lives. Yet when you run the numbers, the impact isn't as severe as you might think.

Image: Author based on SSA data.

Under this scenario, you have to reach age 80 for claiming at full retirement age to catch up with claiming early, and you have to be 83 years old before claiming late at age 70 pays more in lifetime benefits. In other words, a Social Security default would only push back the breakeven point by two or three years.

Making the right Social Security decision

Of course, choosing the best Social Security strategy is about more than a simple breakeven analysis. Married retirees have to take into account the impact of spousal and survivors benefits, which can tip the balance toward waiting longer to claim Social Security. Those who have no employment options and those who are forced into retirement may take early benefits out of need, regardless of the math involved.

Still, one thing is clear: The fear of a Social Security default is overblown. Whether you want to take Social Security early to get your money sooner rather than later, or prefer to get the added protection of larger payments throughout the later years of your retirement, even a default-induced reduction in benefits is unlikely to push you over the fence one way or the other.

Figuring out when to take Social Security is a deeply personal decision that many people struggle with. Don't let fear of a Social Security default lead you to make a decision you wouldn't otherwise make, as it might well turn out to be the wrong move for you.