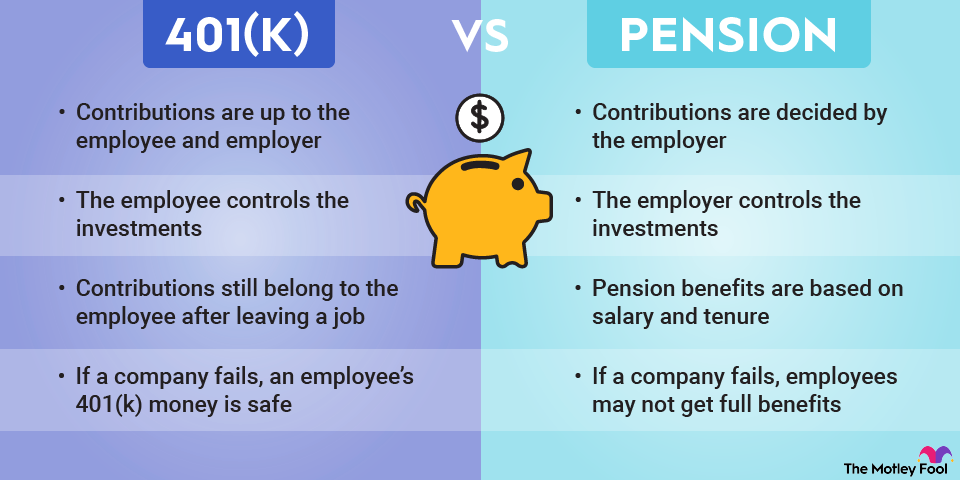

Workplace retirement plans are the cornerstone of most Americans' retirement savings. Two of the most common types of plans are pensions and 401(k)s, and there are significant differences between them.

Many workers don't have a choice since traditional pensions are a disappearing perk. In fact, while 56% of private sector workers participated in a workplace retirement plan in 2023, just 11% had a pension, according to the Pension Rights Center.

If you're one of the millions of employees with only a 401(k), here are four key advantages this type of plan has over a pension.

1. 401(k)s allow you to set the contribution schedule

With a 401(k), you can contribute as much of your paycheck as you'd like as long as you don't exceed the annual contribution limits. Contributions are withdrawn directly from your paycheck, and you can change your contributions by filling out some paperwork with your employer.

With a pension, your employer decides how much to contribute. Unfortunately, this can sometimes result in underfunding. Underfunded pensions are at risk of not being able to pay out promised benefits. You don't have this risk with a 401(k), since you decide how much to contribute.

2. Pensions don't let you choose investments

The plan sponsor -- meaning the employer -- selects investments for a pension. Pensions typically invest in a mix of stocks, bonds, and real estate. Many also diversify further with alternative investments, such as hedge funds.

Poor investment decisions are another way an employer could end up with an underfunded pension. In this situation, you may not receive the pension that was supposed to be guaranteed.

A 401(k) gives you control over how to invest your money. The plan sponsor selects the investment options, so you won't have all the options that you would with an individual retirement account (IRA). But 401(k)s typically offer a range of investments, including target-date funds and asset allocation funds.

3. Your retirement is portable with a 401(k)

Pension benefits are based on your salary and tenure with the company. Pensions typically use either cliff vesting or graded vesting to determine access to your benefits (vesting refers to when you get ownership). Here's how each type of vesting works:

- Cliff vesting: After you stay with the company for a certain time (such as three or five years), you earn 100% access to your pension benefits.

- Graded vesting: You gain gradual access to your company's pension benefits. For example, after an initial service period of one year, you may start gaining access to pension benefits at a rate of 20% per year. By the end of your sixth year, you'll be 100% vested.

Unfortunately for this system, job-hopping is the norm these days. The median number of years that employees had been with their employers was 3.9 years in January 2024, according to data from the Bureau of Labor Statistics. That's the lowest since January 2002.

If you only stay at a job with a pension for a few years, your pension benefits may not fully vest. Even if they do, the payout is based on your earnings from that employer, so the resulting benefits could be minimal.

Contributions you make to a 401(k) are always 100% vested. If you leave your employer, your contributions remain yours. You can keep them there or choose to roll them over into your new employer's 401(k) or an IRA. Employer matching contributions may be subject to a vesting schedule similar to that of a pension, but most of your retirement money comes with you when you switch jobs.

Related Retirement Topics

4. If the company fails, your money is safe in a 401(k)

Remember Enron? Its spectacular crash not only wiped out thousands of jobs but also destroyed the company's $2 billion in pension plans. And it wasn't just current employees who lost their retirement benefits; many former employees who'd already retired found themselves suddenly without one of their primary sources of income.

Even if your employer is in perfect financial health today, there's no predicting how it will be doing decades down the line. The Pension Benefit Guaranty Corporation insures private pensions and will step in if your pension fails, but the agency has only so much money to hand out. If your pension fails, there's a good chance you won't get your full benefits -- and, in some cases, you may not get a penny.

On the other hand, employers can't touch your 401(k) money. Those funds are in the hands of a 401(k) trustee precisely so that they'll be safe if something bad happens. Even if your employer is the next Enron, you may lose your job, but your 401(k) funds will be fine.

In theory, pensions are the ultimate retirement savings tool. In practice, they have many pitfalls -- and as a result, they pose a risk to anyone counting on them for retirement income. While 401(k)s also have their drawbacks in relation to pensions, they ultimately give you more control over your retirement savings.