More and more employers are adding Roth options to their 401(k) plans. In 2023, 93% of 401(k) plans gave employees the option of a Roth 401(k) versus a traditional 401(k), according to a survey by The Plan Sponsor Council of America.

Only 21% of participants made Roth contributions when given the opportunity, though. If you have the choice between a Roth 401(k) and a traditional 401(k), it's smart to examine the advantages and disadvantages of each one before you decide.

Traditional 401(k) vs. Roth 401(k) tax benefits

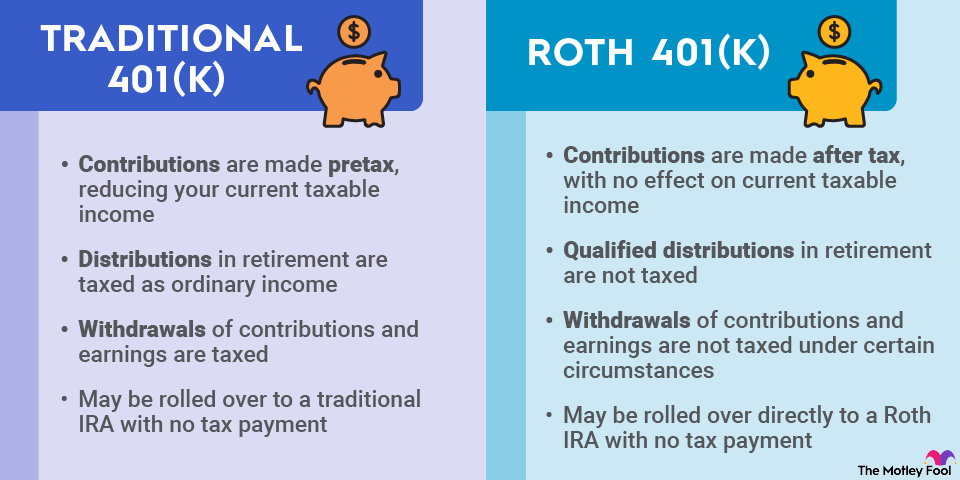

Both a traditional 401(k) and a Roth 401(k) are tax-advantaged accounts. That means there are tax savings from using a 401(k) account instead of a taxable brokerage account. However, each type of 401(k) offers different tax benefits:

- A traditional 401(k) allows you to make pretax contributions. Your contributions don't count toward your taxable income, saving you money in the current tax year. Withdrawals in retirement are taxed as ordinary income.

- A Roth 401(k) allows you to make tax-free withdrawals in retirement. Your distributions don't count toward your taxable income, saving you money when you're retired. You make after-tax contributions, meaning you don't get a tax break in the current tax year.

You also save on investment taxes for assets held in your 401(k). With a traditional 401(k), earnings on investments are tax-deferred, as you only pay taxes when you make withdrawals. With a Roth 401(k), earnings on investments are tax-free if you follow the withdrawal rules.

Withdrawal rules

Traditional 401(k)s and Roth 401(k)s both have a 10% early withdrawal penalty for withdrawals made before age 59 1/2. You also pay income taxes on the withdrawal. While they have that in common, there are key differences in 401(k) withdrawal rules.

When you have a Roth 401(k), you can withdraw your own contributions without an early withdrawal penalty. Let's say you've contributed $25,000 of your own money to a Roth 401(k), and your investments have gained $10,000, for a total balance of $35,000. You could withdraw your $25,000 in contributions penalty-free, but not the $10,000 in earnings. However, you can't take any withdrawals from a Roth 401(k) in the first five years without paying a penalty and taxes.

With a traditional 401(k), the early withdrawal penalty applies whether you withdraw contributions, earnings, or both.

There are limited exceptions to the 401(k) early withdrawal penalty for both traditional and Roth plans. One of the most important is the Rule of 55. If you turn 55 or older in the calendar year when you lose your job, you can withdraw from your 401(k) without an early withdrawal penalty. You'll still need to pay taxes on your withdrawals if you have a traditional 401(k).

Required minimum distributions

Traditional 401(k) accounts have required minimum distributions (RMDs) starting the year after you turn 73 (previously 72). If you don't take the minimum distribution, which is based on the account value and average life expectancy, you'll be penalized. The penalty is 25%, though it may be reduced to 10% if you take swift corrective action.

The Secure Act 2.0 eliminated RMDs from Roth-designated accounts beginning in the 2024 tax year.

Comparison of traditional and Roth 401(k)s

The table below provides a quick rundown of the differences between traditional and Roth 401(k) plans.

Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

When you're typically taxed | Upon withdrawal | Upon contribution |

Tax on early withdrawals | Full amount | Earnings |

Minimum holding timeframe to avoid penalty | 0 years | 5 years |

Required minimum distributions | Starting at age 73 | No |

Related retirement topics

Which is best for you?

The most important factor when choosing between a traditional 401(k) and a Roth 401(k) is which will save you more in taxes. Consider your tax rate today and whether you expect to pay a lower or higher rate when you start taking withdrawals in retirement.

If you think you're paying a higher tax rate today than you will in the future, a traditional 401(k) will likely save you more. If you're in a low tax bracket now and expect to be in a higher one in retirement, then a Roth 401(k) probably makes more sense.

You may also want to go with a Roth 401(k) if you'd prefer more withdrawal flexibility, since you can access contributions at any time. Ultimately, both types of 401(k)s are effective ways to save for retirement -- it's just a matter of picking the one that best fits your financial needs.