The Motley Fool has a disclosure policy.

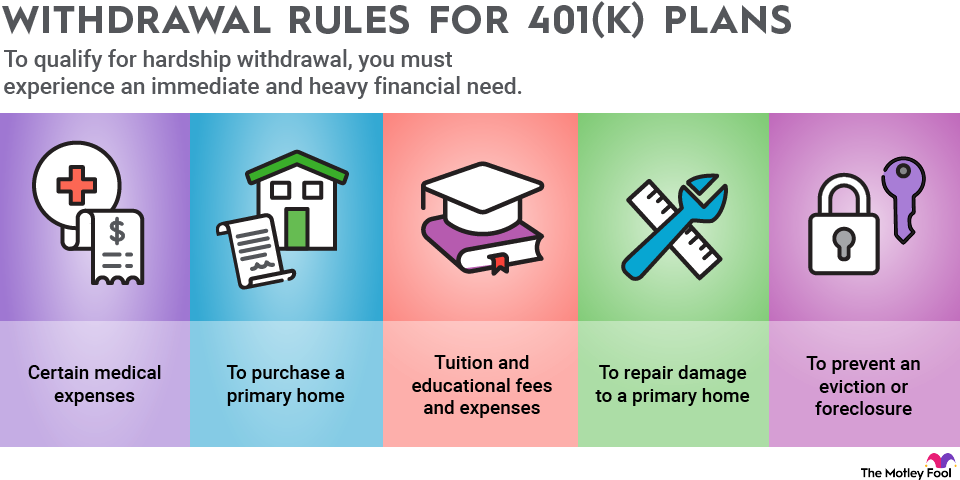

Withdrawal Rules for 401(k) Plans

Don't withdraw money from your 401(k) without reading this.

Key Points

- Withdrawals from a 401(k) before age 59 1/2 can incur a 10% penalty plus income tax.

- Qualified distributions from a 401(k) are tax-advantaged after age 59 1/2 and mandatory starting at age 73.

- Hardship withdrawals may be penalty-free if the money is used to cope with specific financial hardships.