A 401(a) plan is an employer-sponsored retirement account that allows workers to save and invest for retirement. It’s similar to a 401(k), but 401(a) plans are typically sponsored by state or local government agencies, not-for-profit organizations, and educational institutions. Keep reading to learn the basics of 401(a) plans and how you can use these accounts to build your nest egg.

What is a 401(a) and how is it different from a 401(k)?

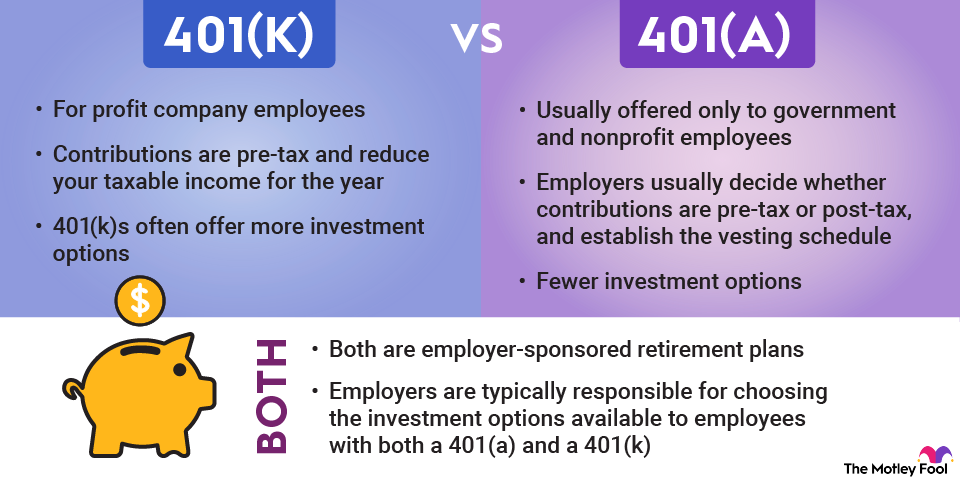

A 401(a) plan is very similar to a 401(k) plan. They’re both qualified tax-advantaged retirement plans offered by employers. Both are defined-contribution plans, which means the employer determines how much it will contribute. But unlike a pension, a defined-contribution plan doesn’t promise you a set benefit or account balance when you retire. The amount you’ll have in retirement depends on how your investments perform. There are a few key differences between 401(a)s vs. 401(k)s, though:

- A 401(a) is most common if you work for the government, a nonprofit, or an educational institution, while a 401(k) is typically offered by for-profit employers.

- Employer contributions are mandatory with a 401(a), but not for a 401(k).

- A 401(a) plan can mandate that workers make contributions, while 401(k) contributions are voluntary.

- Voluntary employee contributions are typically capped at 25% of annual pay for a 401(a) plan, while 401(k) participants can contribute as much as $22,500 in 2023 or 100% of their salary — whichever is less.

- Investment options in a 401(a) plan tend to be more conservative, with fewer options compared to a 401(k) plan.

- A 401(a) plan can limit participation to those with two years of service, while a 401(k) plan can only require one year for eligible employees who are at least 21.

401(a) rules

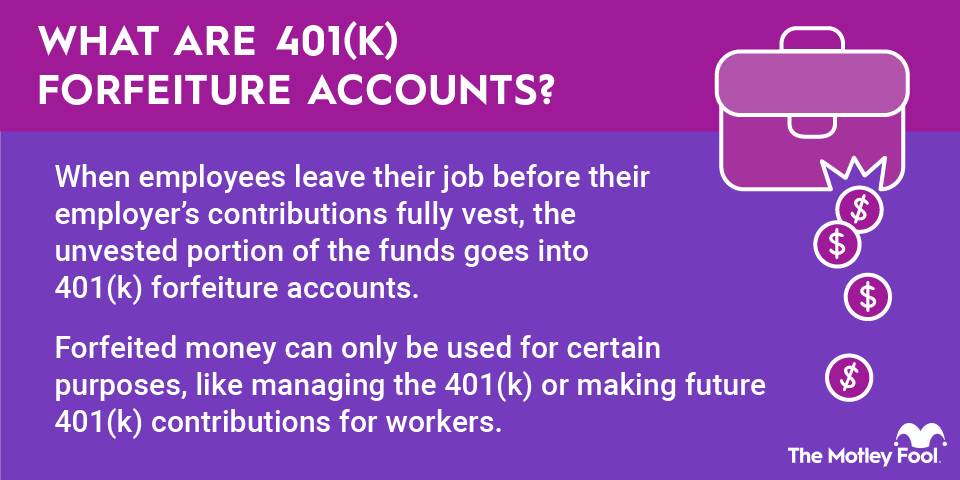

An employer can choose to limit 401(a) participation to certain categories of employees. Many 401(a) plans have a vesting schedule that requires a minimum amount of service before employees fully own the money their employer contributes.

In 2023, total 401(a) plan contributions from both the employer and employee are limited to $66,000, up from $61,000 in 2022. Contributions can be made on a pre-tax or post-tax basis, depending on how the employer structures the plan. Unlike with a 401(k), participants in a 401(a) plan aren’t eligible to make additional catch-up contributions once they turn 50.

Any mandatory contributions are made on a pre-tax basis, while voluntary contributions are made with after-tax money. Voluntary employee contributions are capped at 25% of the worker’s income. In 2023, only the first $330,000 of income can be considered for the purposes of calculating contributions, up from $305,000 in 2022.

When you leave an employer that offers a 401(a) plan, you’re allowed to roll over your money into an individual retirement account (IRA) or another qualified retirement plan, such as a 401(k), 403(b), or a different employer’s 401(a).

But if you withdraw your money before age 59 ½, expect to pay a 10% penalty on top of income taxes. Your employer is required to withhold 20% of an early withdrawal for tax purposes, so if you took a $20,000 distribution, you’d only receive $16,000. Depending on your plan’s rules, a 401(a) loan may be allowed.

If the account is funded with pre-tax dollars, you’ll owe income taxes on distributions when you retire. You’ll also be required to take required minimum distributions (RMDs) at age 73. However, under the Secure Act 2.0, RMD age will increase to 75 by 2033.

Related investing topics

401(a) plan example

For an example of how a 401(a) plan works, let’s look at the University of Colorado’s plan. The university requires that some employees participate in its 401(a) plan. Employees are required to contribute 5% of their salary, and the university contributes 10%.

Contributions are made on a pre-tax basis, but Social Security and Medicare taxes still apply. When the employee withdraws money in retirement, the contributions are taxed as ordinary income.