One of the biggest financial challenges people face is covering the high costs of healthcare. Especially as you get older, your healthcare costs tend to rise much faster than inflation. Having a nest egg set aside to cover out-of-pocket health expenses is crucial.

Health savings accounts (HSAs) encourage individuals to save for future healthcare expenses. Congress created health savings accounts in 2003 to provide tax advantages to individuals who set aside money for their healthcare expenses.

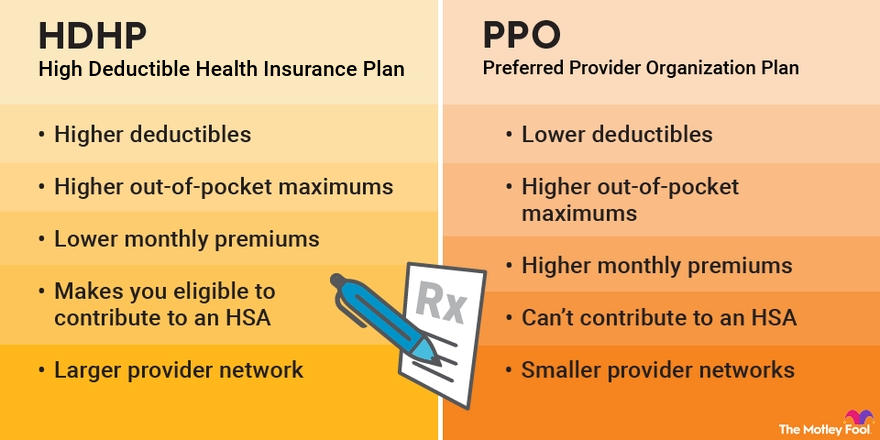

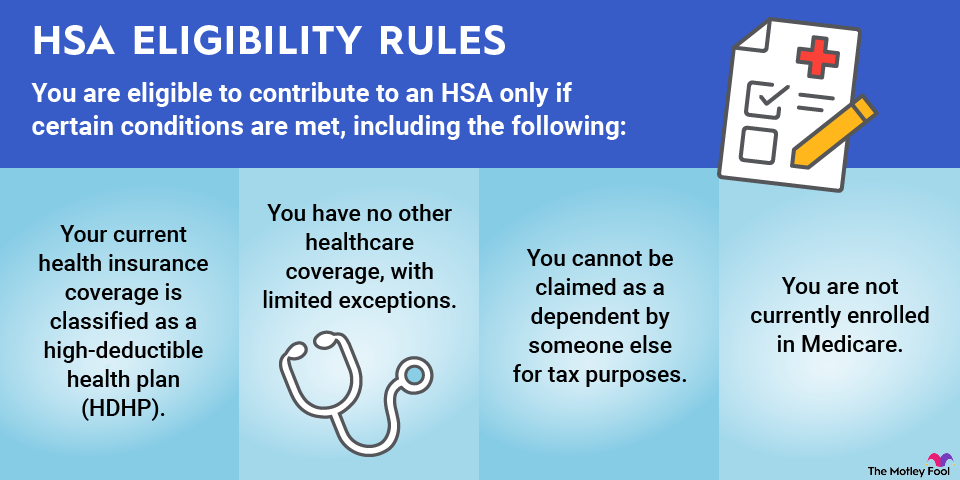

To contribute to an HSA, you need to have a high-deductible health plan (HDHP). That's because HSAs are for those whose health insurance doesn't cover any costs until the insured has already paid a substantial amount. Another HSA rule pertains to maximum annual contribution limits, which are set annually by the Internal Revenue Service (IRS).

Keep reading to find out exactly what types of expenses are covered by HSAs.

What is an HSA-eligible expense?

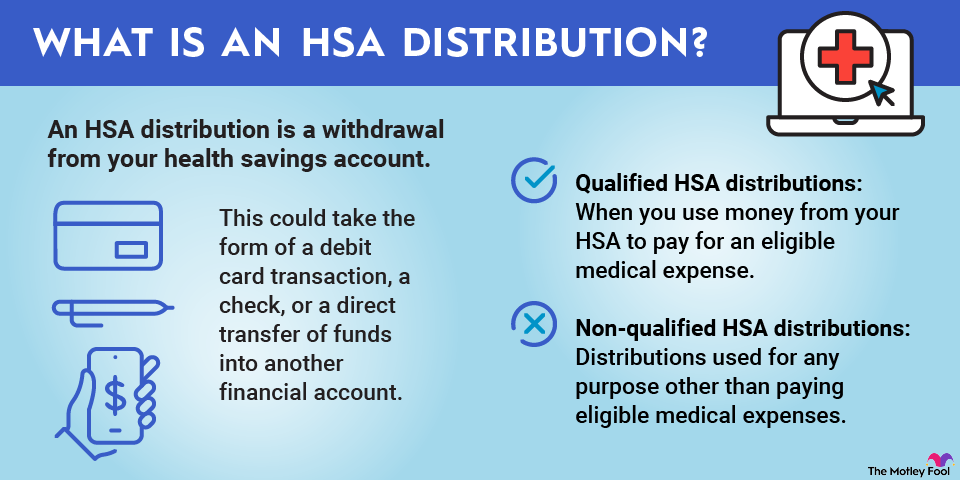

The IRS has a broad list of expenses related to medical, dental, and vision care that it considers qualified expenses for HSAs. As long as you spend your HSA funds on any of these IRS-approved expenses, it won't tax the distribution.

Many HSA-eligible expenses are those not ordinarily covered by regular insurance. You can use your HSA to fund copayments and to pay for eligible expenses for yourself and also for your spouse and your dependents. Expenses incurred by adult dependents are eligible, provided the recipient is covered by an HDHP and not otherwise insured.

Your HSA must be formally "established" before any expenses can be eligible. State law determines when your HSA is officially established. In most states, if you become eligible for an HSA on Jan. 1, but your first contribution (deducted from your paycheck) doesn't reach your HSA administrator until Jan. 10, then your HSA isn't considered established until Jan. 10.

List of HSA-eligible expenses

Here are some common IRS-approved HSA-eligible expenses. Please note that this list is not exhaustive. Always check with your plan provider if you have questions about whether an expense is covered.

- Abortion

- Acne laser treatment

- Acupuncture

- Ambulance fees and emergency care

- Artificial limbs

- Birth control pills, injections, and devices, such as IUDs

- Blood pressure monitors

- Body scans

- Breast pumps and lactation supplies

- Breast reconstruction surgery following cancer

- Canes and walkers

- Childbirth expenses, such as care from a midwife or obstetrician

- Childbirth classes for the expectant mother

- Chiropractic care

- Contact lenses and saline solution

- Crutches

- Dental care, including cleanings, sealants, fluoride treatments, X-rays, fillings, braces, extractions, and dentures

- Diabetes supplies, such as blood sugar test kits and insulin

- Diabetes education, including nutrition counseling

- Eye exams

- Eye surgery, including laser surgery

- Eyeglasses, including prescription and reading glasses, and prescription sunglasses

- Blue-light-blocking glasses

- First-aid kits

- Flu shots

- Guide dogs to assist with disabilities

- Food, grooming, and veterinary care for guide dogs

- Hearing aids and batteries

- Hospital expenses for both inpatient and outpatient services

- Infertility treatment, including in vitro fertilization; egg, sperm, and embryo storage; fertility monitors; and sperm washing

- Egg donor expenses related to infertility treatment

- Inpatient drug and alcohol treatment

- Insulin

- Lab fees

- Long-term-care premiums, up to a qualifying amount based on your age

- Medical alert bracelets

- Medical records fees

- Medicare premiums if you're 65 or older, excluding Medicare supplemental policies

- Night guards to treat teeth grinding

- Nursing care, whether provided in your home or a nursing home

- Occupational therapy

- Oxygen and oxygen equipment

- Physical exams

- Physical therapy

- Prescription medications

- Psychiatrist care

- Psychologist care

- Smoking-cessation programs and drugs, including nicotine patches and gums

- Speech therapy

- Surgery, excluding elective cosmetic surgery

- Thermometers

- Tubal ligation (female sterilization) and tubal ligation reversal

- Ultrasounds

- Vaccines

- Vasectomy (male sterilization) and vasectomy reversal

- Wheelchairs

- X-rays

Under the Coronavirus Aid, Relief, and Economic Security Act (CARES) Act that passed in March 2020, additional expenses became HSA-eligible. Many of these are over-the-counter (OTC) medications and products that previously were HSA-eligible only with a prescription:

- Acid reducers

- Acne treatment

- Allergy and sinus medications

- Anti-allergy medications

- Breathing strips

- Cough, cold, and flu medications

- Eye drops

- Feminine hygiene products, such as pads, tampons, and menstrual cups

- Heartburn medications

- Insect repellent and anti-itch creams

- Laxatives

- Lip treatments for cold and canker sores

- Medicated shampoos and soaps

- Nasal sprays

- Pain relievers

- Skin creams and ointments, including cleansers, toners, and moisturizers

- Sleep aids

- Sunscreen and OTC remedies (like aloe gel) to treat the effects of sun exposure

HSA-eligible expenses with a diagnosis

Under the IRS rules, the following expenses may be HSA-eligible if you have a doctor's note indicating that the product or service is necessary to treat a medical condition. Whenever you have an expense that requires a diagnosis to be HSA-eligible, be sure to obtain the necessary documentation from your medical provider.

- Breast implant removal, if the implant is defective or causing medical problems

- Car modification expenses for additional features, such as hand controls or a wheelchair lift, for people with disabilities

- CBD and hemp oil

- Cosmetic procedures, if they're used to correct a deformity or scar stemming from an injury or disease

- Electric toothbrushes, excluding any replacement brushes

- Fluoride toothpaste and rinses

- Home improvements to accommodate a medical condition, such as widening a doorway or adding a ramp to make a home wheelchair-accessible

- Massage therapy and chairs

- Mattresses, mattress boards, and special cushions and pillows

- Meals and lodging, if the costs are incurred during medical treatment

- Premiums paid for special clothing that provides relief from a diagnosed condition, excluding the "standard" cost of clothing

- Special education or tutoring services for people with learning disabilities

- Special home modifications for someone with an intellectual or physical disability

- Vitamins and dietary supplements

- Weight-loss programs, health club dues, and exercise equipment

- Wigs, for diseases that cause hair loss

If you need an item or service that is not listed here, you can determine if it's HSA-eligible by searching the HSA Store online.

Ineligible expenses for HSAs

The IRS typically disallows using funds from an HSA for the following types of expenses:

- Child care for a healthy child

- Cosmetic procedures, unless they correct a deformity or treat an underlying medical condition

- Employment-related physical exams

- Funeral expenses

- Health insurance premiums, unless you have COBRA continuation coverage or receive unemployment benefits

- Imported medications that aren't FDA-approved

- Infant formula, even when the mother can't breastfeed

- Late payment charges and missed appointment fees

- Life insurance premiums

- Long-term disability premiums

- Marijuana, even if a doctor prescribes it

- Maternity clothes

- Toiletries

Eligible expenses for FSAs vs. HSAs

Both an HSA and a flexible spending account (FSA) are tax-advantaged accounts designed to help you save money for medical expenses. The same medical expenses are eligible for coverage with HSAs and health FSAs. Other, less common types of FSAs can be used to cover dependent care or adoption-related expenses, rather than medical costs.

The key difference between an HSA and a health FSA isn't which expenses are covered, but rather who controls the money in the account. An HSA is like a 401(k) plan in the sense that you own the account's funds. You can contribute to an FSA only if your employer offers one, and the employer owns the account. If you leave your job for any reason, you'll usually forfeit the money in an FSA. Funds in an FSA typically cannot be rolled over from one year to the next, and you also typically can't contribute to both an HSA and an FSA at the same time.

Related investing topics

Is funding an HSA a good idea?

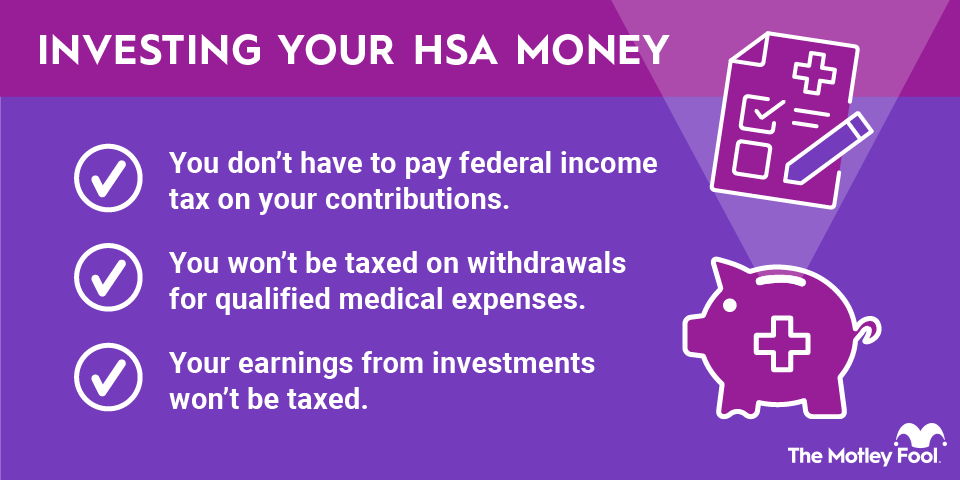

Contributing to an HSA confers tax advantages, and you can also benefit from employer contributions to an HSA on your behalf. If your employer provides health insurance through an HDHP plan but doesn't offer an HSA, you can establish one independently through an HSA provider such as HSA Bank or Fidelity.

If you contribute to an HSA, it's important to pay attention to which of your expenses qualify since the penalties for using HSA funds for non-qualifying expenses are steep. Ineligible distributions are considered as taxable income, and, if you're younger than 65, your HSA is charged a 20% penalty on the ineligible amount withdrawn.

HDHPs can be expensive if you have, or expect to incur, major medical bills. But if you are in good health and have an HDHP, then supplementing it with an HSA can be a great way to save for future medical expenses and supplement your retirement savings.