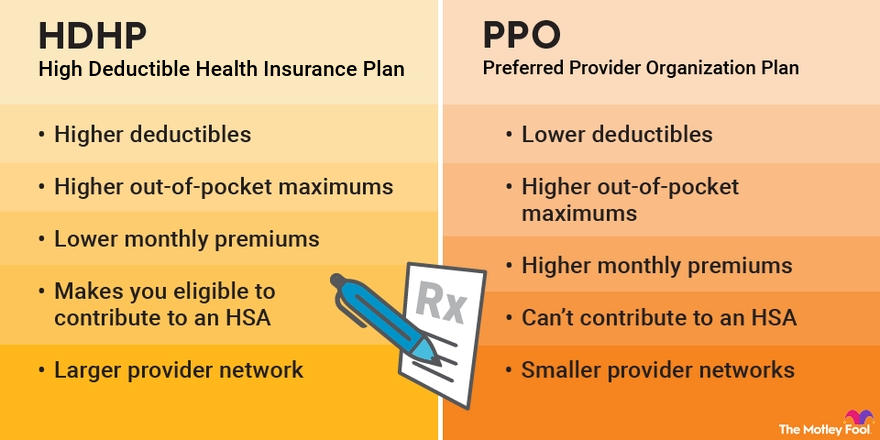

These plans also tend to have higher out-of-pocket maximums than PPOs do. In 2026, individual plans can carry out-of-pocket maximums of up to $8,500 ($8,300 in 2025). If you're on a family plan, you could pay up to $17,000 in 2026 ($16,600 in 2025) before your insurance coverage begins paying for 100% of your outstanding bills.

Because of these high deductibles, HDHPs typically aren't a great choice if you visit the doctor frequently. But they're great if you rarely need medical care and want to reduce your monthly payments.

Pros

Cons

- Higher deductibles -- often thousands of dollars

- Higher out-of-pocket maximums

What is a PPO?

PPO stands for "preferred provider organization plan." With a PPO, you get access to a wide network of providers, but you can go out of network for an additional cost. You also don't need a referral from a primary care provider to visit a specialist.

Note that PPO refers to the provider network, while HDHP refers to the deductible and whether the plan makes you eligible to fund an HSA for the year. An HDHP can also be a PPO, HMO (health maintenance organization), or exclusive provider organization (EPO). HMOs and EPOs have more restrictive networks than PPOs.

A traditional PPO offers lower deductibles than most HDHPs do. That makes them a good fit if you visit the doctor frequently and don't want to pay thousands of dollars out of pocket before your insurer will pay for care.

The downsides to these plans include higher premiums and smaller provider networks. The latter issue could pose a challenge if you travel often. If you become ill or injured and can't find an in-network provider near you, you could pay a lot more to see an out-of-network doctor.

Pros

- Lower deductibles

- Lower out-of-pocket maximums

Cons

- Higher premiums

- Traditional PPOs aren't compatible with a health savings account