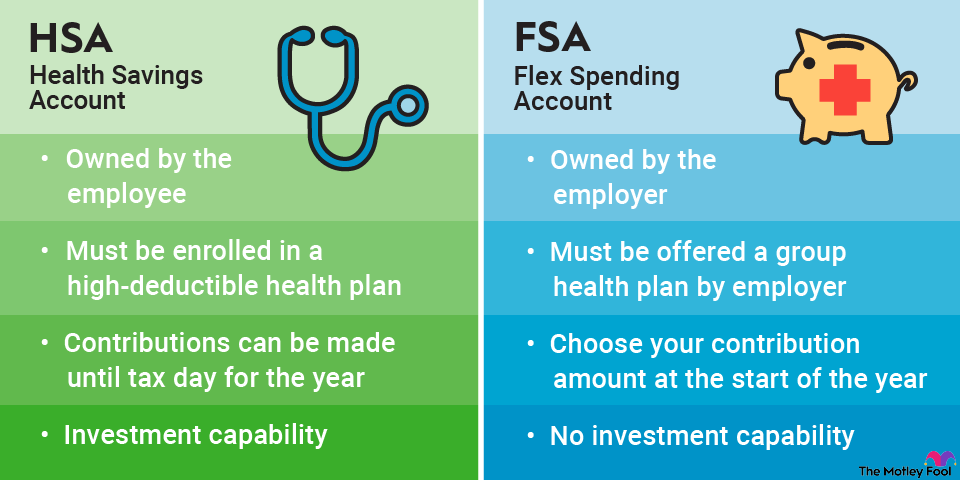

- Carryover rules: Money in an FSA must be spent in the year it is contributed or it is forfeited. In some cases, you can carry over $640 in 2024 ($660 in 2025) from your current year's FSA into the next year (without affecting contribution limits) or use your funds during a grace period after the end of the year. However, not all FSA plans allow these options. HSA funds, on the other hand, don't have to be withdrawn at any specific time and can remain invested and grow for as long as you'd like.

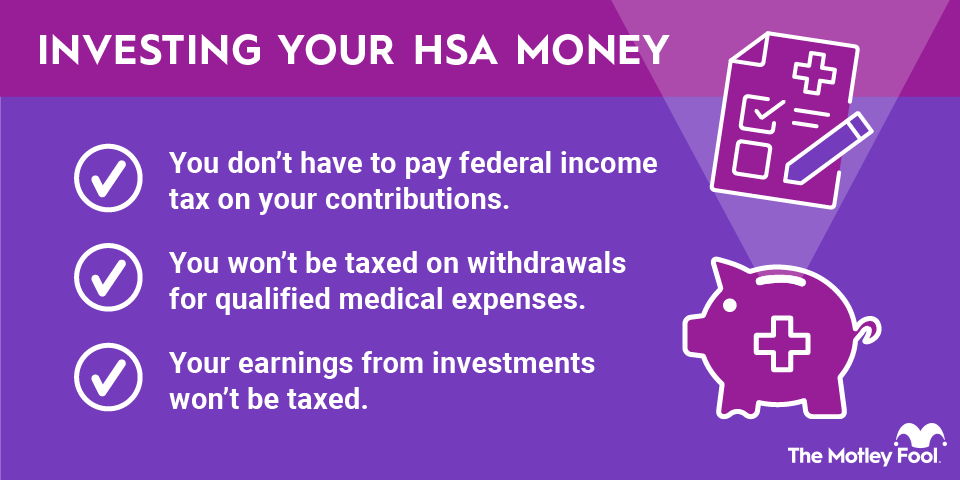

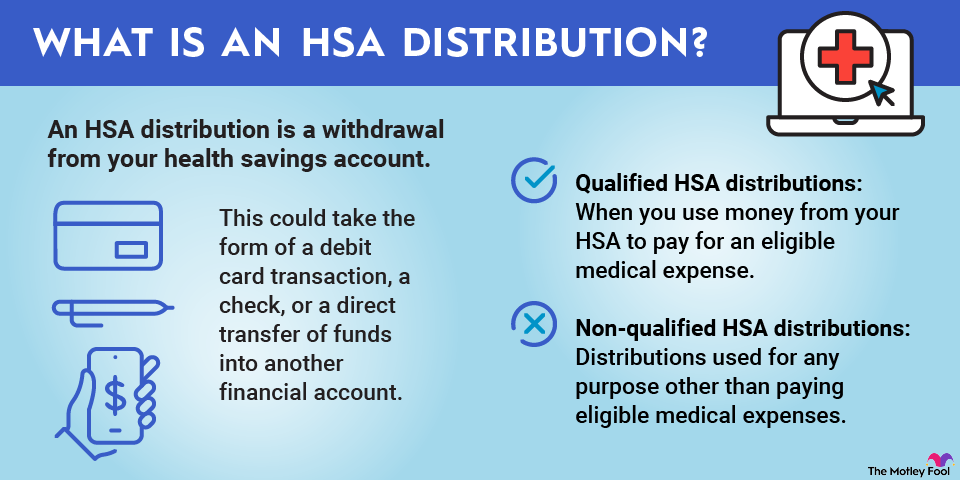

- Withdrawal rules: FSA money can only be used to cover eligible medical expenses. HSA funds can be withdrawn for other purposes, but withdrawals before age 65 are subject to a 20% penalty plus income taxes if the money isn't used to cover medical care. After age 65, you can take money out of an HSA for anything you'd like and will simply pay taxes at your ordinary income tax rate.

- Account ownership rules: Your HSA belongs to you. If you leave your job, you can take it with you. This is not the case with an FSA, which you forfeit upon leaving your job unless you are eligible for and elect COBRA continuation coverage of your FSA.

HSA vs. FSA eligible expenses

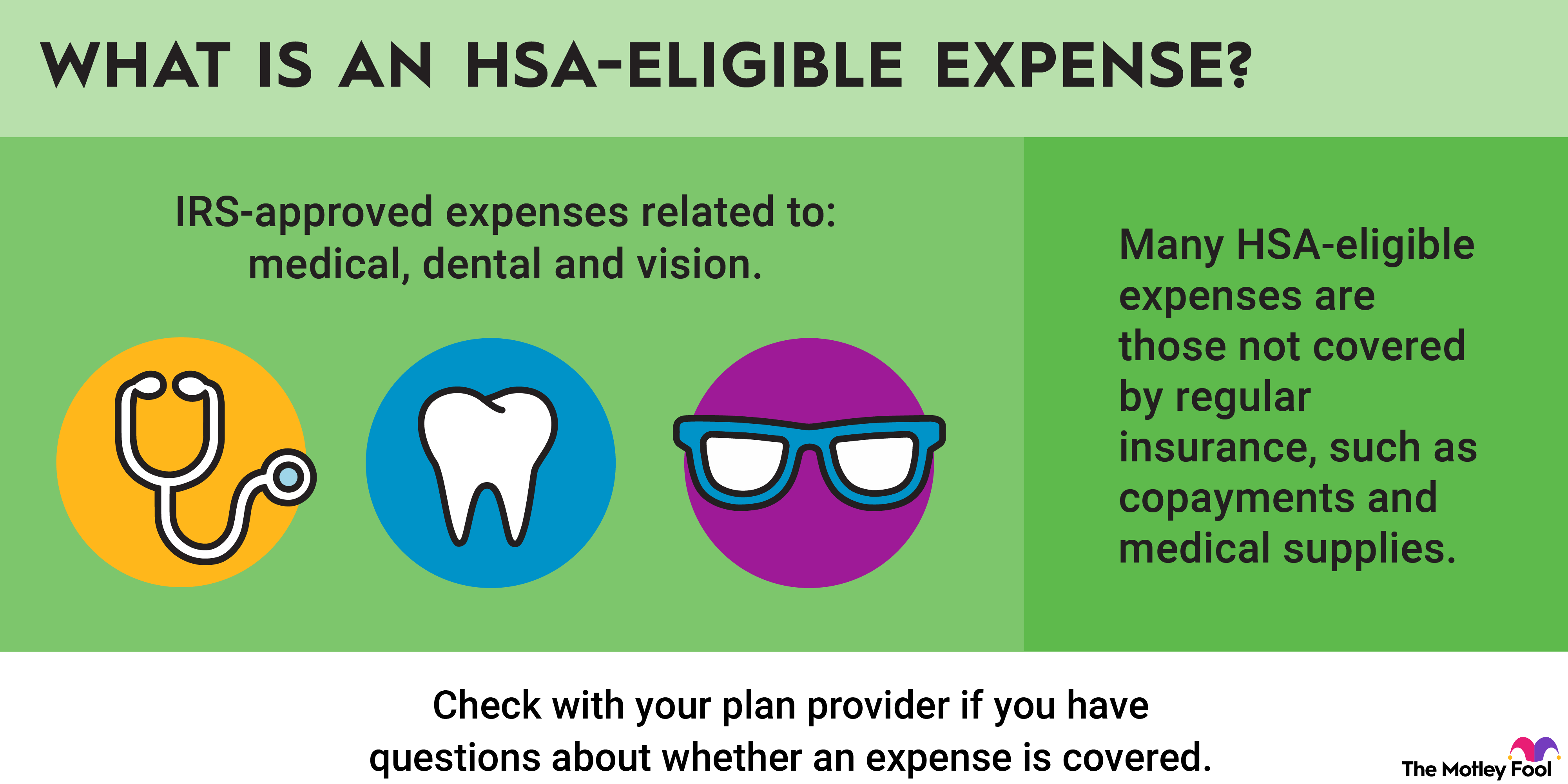

HSAs and FSAs have similar rules regarding which medical expenses you can pay for with your contributed funds. For example, you can pay for prescription medications, eye care, hearing aids, most types of dental care, chiropractic care, and most other medical services.

However, dependent-care FSAs enable you to pay for many things HSAs do not. For example, you can pay for child care costs, including day care, overnight summer camp, housekeeping expenses related to dependent care, and similar expenses incurred while caring for qualifying dependents.

Related Investing Topics