If you're choosing a health insurance plan, you may be weighing a health savings account (HSA) versus a preferred provider organization (PPO) plan. An HSA can help you save money for medical expenses, while a PPO plan gives you access to a network of healthcare providers.

HSAs and PPO plans serve distinct purposes. Here is a summary of their respective benefits and drawbacks:

Plan Type | Advantages | Disadvantages |

|---|---|---|

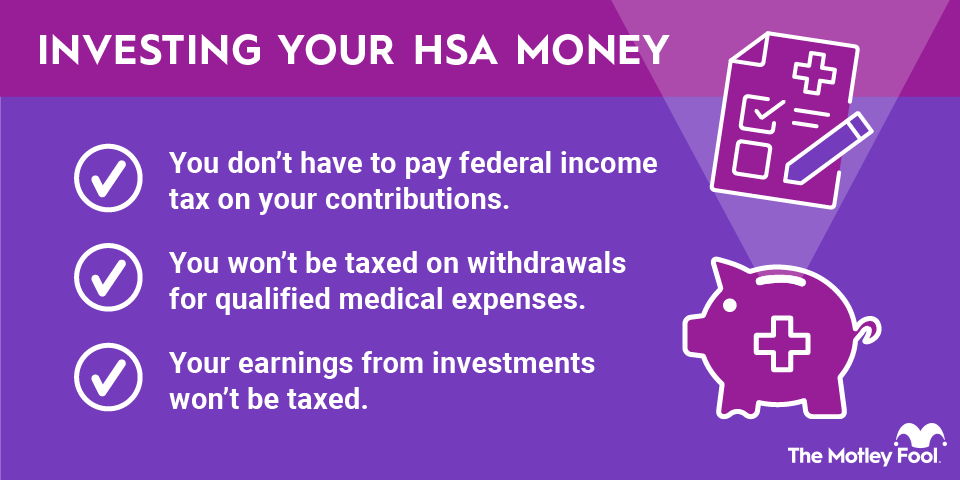

HSA | Can invest money in a way that has triple tax advantages.

Low premiums.

Greater flexibility for how money can be spent.

Can be rolled over. | Higher out-of-pocket healthcare costs.

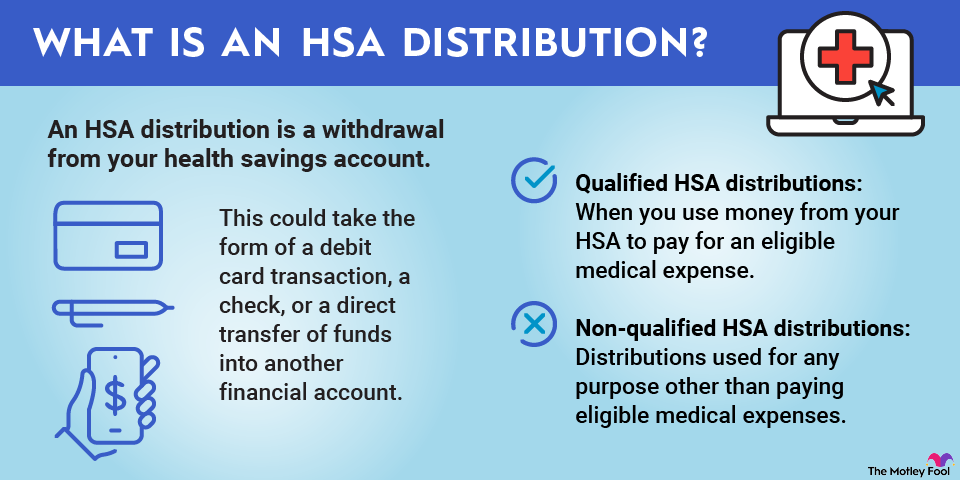

20% early withdrawal penalty for non-medical expenses.

Typically not well suited for those with high medical expenses. |

PPO | Lower out-of-pocket costs for medical expenses.

Easier access to medical specialists.

Suitable for those with high healthcare costs. | Higher premiums.

Expenses such as dental and vision care are usually not covered.

Not an investment account. |

What is an HSA?

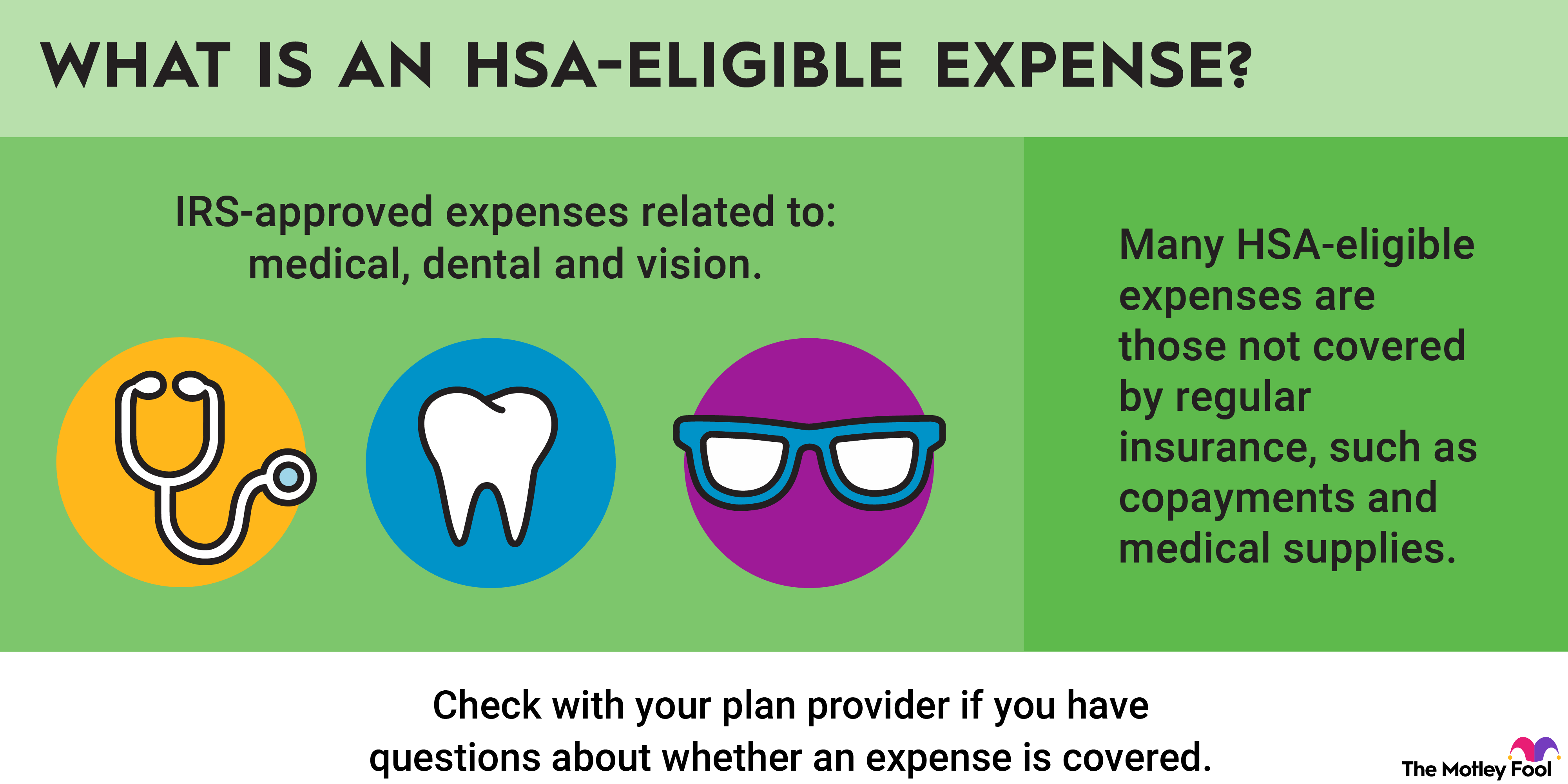

A health savings account is a tax-advantaged investment account designed to help you pay for medical expenses. HSAs are similar to 401(k) plans except they are used for healthcare, including medications, dental care, and vision care.

In 2026, you can contribute up to $4,400 if you have individual coverage (up from $4,300 in 2025), or $8,750 if you have family coverage (up from $8,550 in 2025).

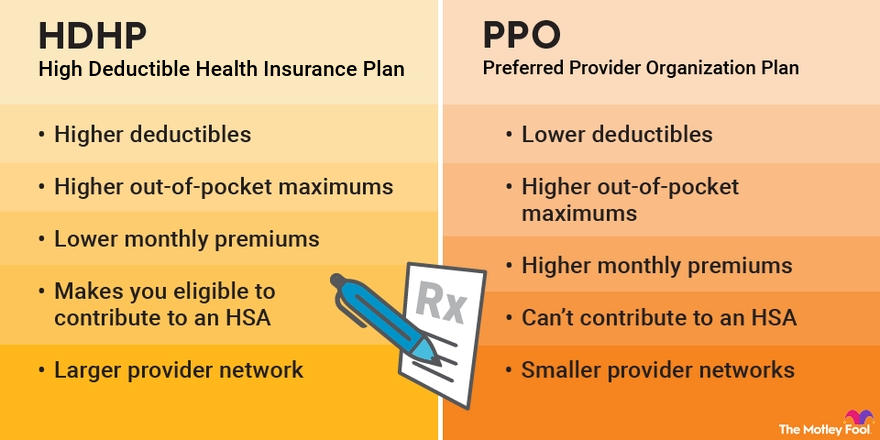

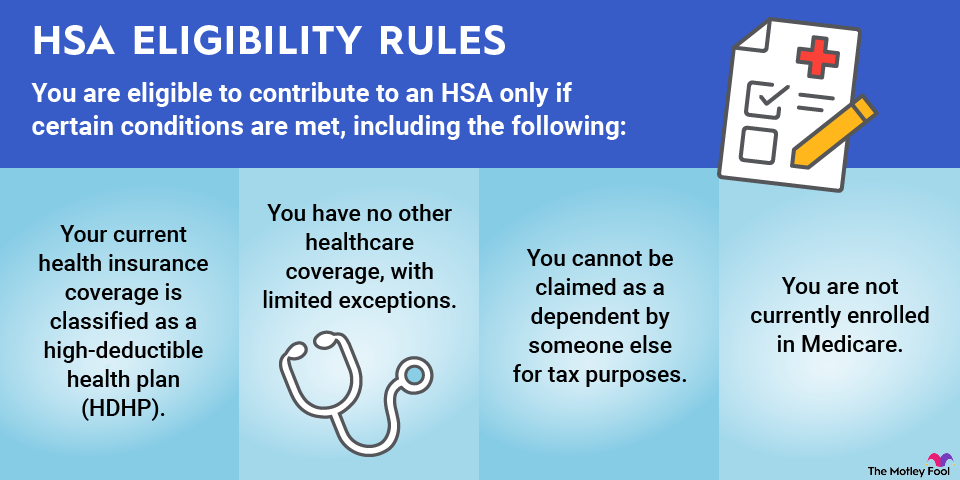

You're allowed to contribute to an HSA only if you have a high-deductible health plan (HDHP). Any type of health insurance plan, including one from a PPO, can be an HDHP. If your annual deductible exceeds the relevant amount below, the health plan only covers preventative care before you hit the plan's deductible for the year.

Insurance Holder Type | 2026 Minimum Deductible |

|---|---|

Individual | $1,700 ($1,600 in 2025) |

Family | $3,400 ($3,300 in 2025) |

Many employers that offer high-deductible health plans also offer HSAs. If your employer doesn't offer an HSA with its high-deductible plan, then you can still open one independently.

What is a PPO?

A PPO plan is a type of health insurance that gives the greatest access to a large network of medical providers or specialists. A PPO typically is not (but can be) an HDHP, which is the necessary condition for establishing an HSA. Most people insured by PPO plans are not eligible to open HSAs.

Although the option of opening an HSA is attractive to many people, choosing a PPO plan may be the best option if you have significant medical expenses. Not facing high deductible payments makes it easier to receive the medical treatment you need, and your healthcare costs are more predictable.

Unlike HSAs, PPO plans are not investment accounts. They also generally do not cover over-the-counter medications, dental, or vision care.

HSA vs. PPO: Which should you choose?

Sometimes an HDHP combined with an HSA is clearly your best option, while for others a PPO plan is the better choice. Here are some general guidelines related to your health and financial situation to help you choose.

Choose an HDHP with an HSA if:

- You're generally healthy and don't need frequent medical care.

- You have enough money in savings to cover a high deductible in case of an emergency.

- You want to save money for your healthcare costs when you retire.

- You're willing to price-shop for medications and services to minimize your expenses.

Choose a PPO plan if:

- You have health problems, visit the doctor frequently, or take many medications.

- You are expecting a major medical expense such as surgery or the birth of a child.

- You're willing to pay higher premiums in exchange for the certainty of lower out-of-pocket costs related to specific medical needs.

If you opt for an HSA in conjunction with a high-deductible insurance plan, you'll also need to decide how to invest the funds in your account. Buying and holding the stocks of quality companies is a sure path to generating enough money to pay for your health expenses in retirement.

Related investing topics

The bottom line

A PPO is a type of health insurance plan, while an HSA is an account you use to save and invest money for healthcare. An HSA can be a smart way to save for health-related costs. The money stays with you and can help you pay for future medical expenses if you don't need the money in a given year. But since it requires a high-deductible health plan, it's not a great option for those with chronic health issues. For those whose medical expenses are high, a PPO is typically the better option because it comes with lower out-of-pocket costs.