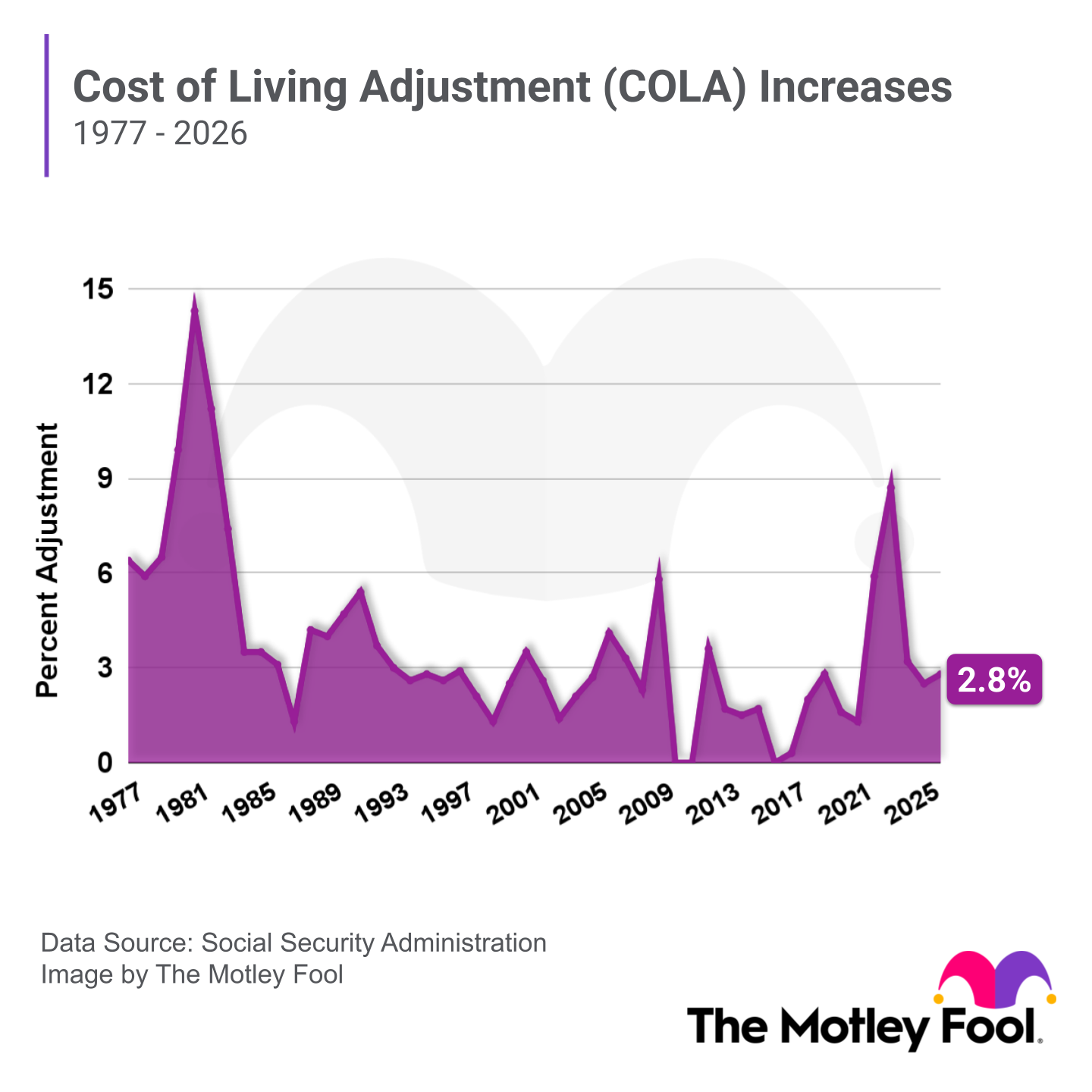

Most people have some idea of what Social Security is, but not as many understand the Social Security COLA history or how it affects benefits. Annual increases are designed to help seniors' checks keep up with inflation, although some argue they don't do nearly enough.

Let’s take a look at how Social Security benefits have increased over time and why this matters to you.

The government applied the first few COLAs to benefits payable for June or later. But since 1982, COLAs have been effective for benefits payable for December, and they're paid out in January of the following year.

For example, the 2025 COLA called for a 2.5% increase to Social Security checks, and beneficiaries began receiving this new, higher amount in January 2025. The COLAs apply to all Social Security beneficiaries, including those receiving spousal benefits. The 2026 COLA is higher at 2.8%, which reflects rising inflation.

COLAs for Supplemental Security Income (SSI) are generally the same as the COLAs for other Social Security benefits. However, they typically go into effect one month later. So the government first applies the COLA to benefits payable for January of the following year, and recipients get these checks in February.

The Social Security Administration announces the next COLA in October after it's had a chance to review the third-quarter inflation data used to calculate the COLA. In years with high inflation, such as 2022, COLAs are generally higher. When inflation is low, COLAs are also low. In rare cases -- only three times since 1975 -- the government may not issue a COLA at all.