How is the Social Security COLA calculated?

As mentioned, the COLA computation relies on changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). Like other measures for inflation, the CPI-W is calculated monthly by the Bureau of Labor Statistics.

Each year, the SSA averages the CPI-W value for the third-quarter months of July, August, and September. The average is then compared to the same value for the prior year. If the current year's average is higher, the percentage increase is the COLA.

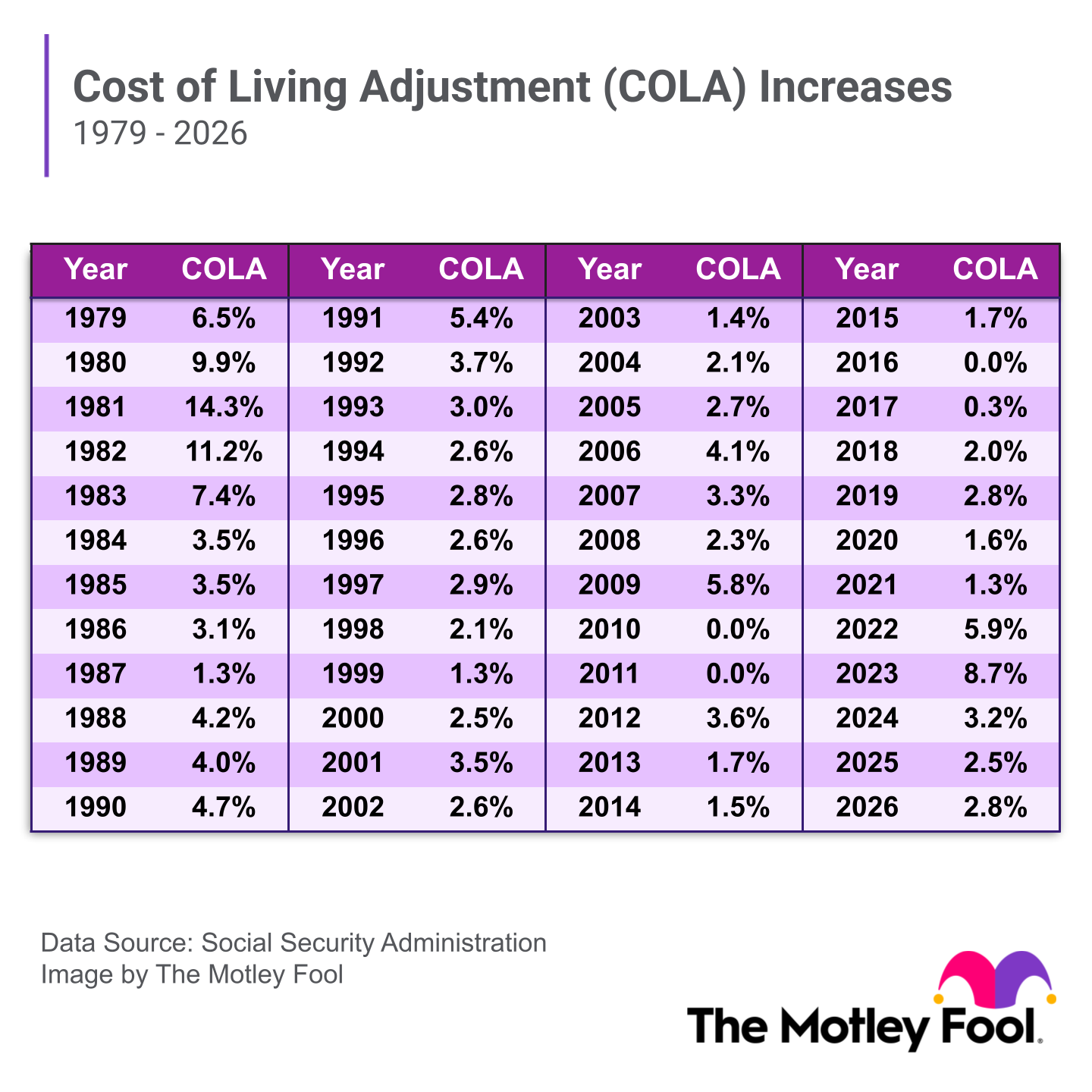

For example, the third-quarter CPI-W for 2024 was 308.729. In 2025, the average was 317.265. The percentage difference here is 2.8%, which became the 2026 COLA. Social Security and SSI recipients will see their benefits increase by that percentage in January 2026.

Related retirement topics