15 Reasons 'Rich' People Go Broke

15 Reasons 'Rich' People Go Broke

It happens all the time

More often than you might think, rich people go broke. Even more often, they simply lose a lot of money. It's worth taking a look at some of the reasons wealthy folks lose money, because many of those reasons apply to nonrich people, too. Avoiding many of these blunders can help you hang on to more of your dollars -- and it might help you get richer, too.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. They aren't really rich

First off, remember that not everyone who you assume is rich is actually rich. Just because someone is driving a Porsche or living in a huge house doesn't mean they're wealthy. They might just look wealthy. In Morgan Housel's illuminating book, The Psychology of Money, he points out that visible signs of someone's apparent wealth are actually the opposite of that -- they're signs of money that has been spent, money that is no longer owned. Real wealth tends to be invisible, evident in a bank or brokerage account.

ALSO READ: You Won't Get Rich Just by Saving Money. You'll Need to Do This, Too

Previous

Next

2. They don't live like "the millionaire next door"

Another insightful book about money and our relationship to it is The Millionaire Next Door: The Surprising Secrets of America's Wealthy by Thomas J. Stanley and William D. Danko. It points out that many millionaires are not those you'd suspect are millionaires: They live in modest homes, drive older cars, and use coupons when they shop. These are all good practices that can help you achieve millionairehood -- and that can help you remain a millionaire. If you stray from them, as many have done, your financial condition can worsen quickly.

Previous

Next

3. They aren't very money savvy

Many rich people have become poor people by making lousy financial decisions. Some, for example, invest in businesses that go under -- perhaps businesses that their friends are starting, or businesses of their own that they aren't savvy enough to run profitably. This is nothing new, either -- even Mark Twain ended up losing a lot of money by investing in speculative ventures, such as a protein powder, reportedly after doing little due diligence.

Previous

Next

4. They overindulge

Many rich people simply overindulge, which ends up consuming much of their wealth. Imagine buying a yacht, for example. You might be able to afford to buy it, but you'll then need to pay for its expenses and repairs, along with paying people to run it. The folks at Denison Yacht Sales have noted that:

"About 5% of the world’s ultra-high-net-worth individuals own a yacht. A 180′ superyacht costs $4.75 million annually to maintain and run. Kitty McGowan of the US Superyacht Association says that among the costs, you need to budget $400,000 for fuel, $350,000 for dockage, $240,000 for vessel insurance, $1 million for maintenance and repairs, and $1.4 million for crew salaries."

Previous

Next

5. They buy more house than they can afford

Simply buying a mansion can erode a rich person's wealth, too -- due to taxes, insurance, upkeep, repairs, staff, security, heating and cooling, and so on. A few years ago, Business Insider reported that "The rapper 50 Cent recently sold a $2.9 million Connecticut mansion that was reportedly costing him $70,000 per month to keep."

Less rich people often buy too much house, too -- leaving little wiggle room in their finances. It's best to buy less house than you can afford, in order to be able to save for your future, maintain an emergency fund, and cover all living expenses.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

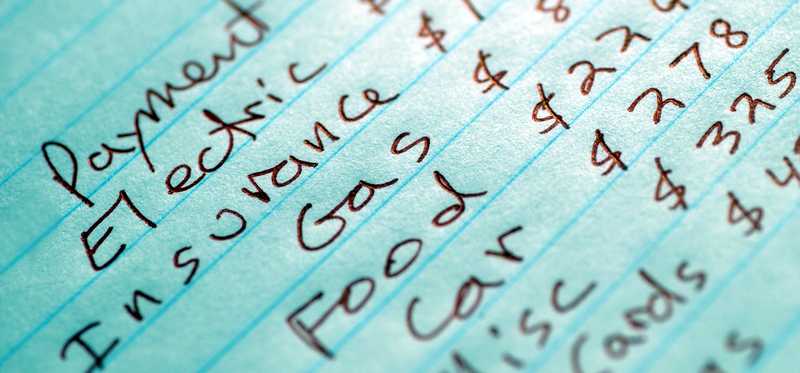

6. They live beyond their means

Clearly, many rich people who lose much or all of their money have not made use of budgets. All of us, rich or poor, would do well to set up a budget. It would account for all incoming funds and would delineate where all that money would go, helping us making sure that priorities, such as savings, and necessities, such as housing and food, are covered before optional expenses (like travel or restaurant meals) are paid for. For maximum financial security, you need to live below your means.

Previous

Next

7. They carry a lot of debt

Carrying a lot in debt is an excellent way to have your net worth shrink instead of grow. That's true whether you've overindulged and have mortgages on several costly homes or whether you've simply racked up $30,000 in credit card debt. It's hard to get ahead in life and become financially healthier if much of your income or assets are being used to make debt payments. Consider, for example, that when Michael Jackson died, he reportedly owed several hundred million dollars. Don't fall deep into debt -- or if you're already there, dig yourself out of debt. It can be done.

ALSO READ: This Growing Pot Stock Could Make You Rich in 5 Years

Previous

Next

8. They don't understand what they're investing in

Rich people who don't know what they're doing when it comes to investing -- even in stocks -- can lose a lot of money. (So can the rest of us.) Uninformed investors might plow lots of dollars into penny stocks that are likely to fall in value, might invest "on margin" (i.e., with borrowed money), might day trade, or might simply follow hot stock tips from friends or strangers, ending up in unsuccessful companies.

Previous

Next

9. They're impatient with their stocks

Even when rich people (and less rich people) are invested in good stocks, they can still lose money (or miss out on a lot of money) if they get impatient and sell too soon. Consider Sherwin-Williams (NYSE: SHW), the paint company, for example: It may not seem like the most exciting stock, but it has grown in value roughly 40-fold over the past 20 years. Anyone who sold after doubling or tripling their money would have missed out on a lot of future gains. Meanwhile, if you invested in Netflix (NASDAQ: NFLX) in mid-2018 when it was trading for around $400 per share and then sold at the end of the year, when it had fallen near $250, you'd have lost quite a chunk of your money. (If you'd hung on, though, you'd be pleased, as the shares were recently trading near $500.)

Previous

Next

10. They don't pay attention to fees

Not paying attention to fees is another problem for the rich and poor alike. Rich people have an extra fee problem if they're dabbling in hedge funds, because it's common for hedge funds to charge "2 and 20," meaning investors fork over 2% of their invested assets each year, plus they forfeit 20% of any gains achieved in the fund in excess of a certain sum. There are gobs of funds out there, and many are not that terrific. If you're earning low (or no) returns for many years but are paying 2% each year, your account will shrink considerably. Big investors may also make venture capital or private equity investments, which can also charge hefty fees. Small investors can end up paying too much in fees to certain mutual funds, banks, 401(k) plans, and others.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

11. They give away a lot of money

Lots of rich people lose a lot of money simply by giving it away. They may lavish it upon friends and family, for example, perhaps flying around in private jets or floating on yachts. Or they may help out loved ones by paying their bills, buying them homes, and so on. Many times, if others are aware of your wealth, they will come around hoping to partake of it. A classic example of this is lottery jackpot winners, who often end up in a bad way.

ALSO READ: Forget About Dogecoin: These 3 Stocks Will Make You Rich

Previous

Next

12. They get scammed

Many rich people end up poor because they got scammed. If you become wealthy before you become financially savvy, as has happened to many celebrities, you may end up employing financial advisors who are unskilled or unprincipled. This even happened to U.S. President Ulysses S. Grant, who started a financial company with his son and another guy, and the other guy turned out to be an embezzler. Grant went bankrupt.

Previous

Next

13. They ignore Uncle Sam

You can go from rich to poor if you don't pay your taxes. Singer Willie Nelson is a prime example, owing Uncle Sam around $16.7 million at one point due to having had bad financial managers. Some $10 million of that was interest and penalties. It's important to stay on top of taxes. Know your tax obligations and don't underpay Uncle Sam.

Previous

Next

14. They're slapped with steep medical bills

You can also end up broke, even if you start out with a lot of money, if you don't have sufficient health insurance and face some costly medical bills. Medical bills are among the most common reasons that Americans go broke.

Previous

Next

15. They have no plan

Finally, one of the worst things to do financially, no matter how wealthy you are, is to go through life without a plan. We all should have an idea of how much money we need to live on now and how much we need to have in the future to live on. We also need a plan for how we will amass -- and/or not lose -- that money.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

How to stay rich or get rich

Whether you're aiming to hang on to your wealth or you need to amass your wealth in the first place, you can avoid a lot of headache, heartache, and financial loss by getting savvier. Read and learn about money management and investing. Read about taxes, too. The more you know, the more you can take care of your own money -- or at least you'll be better able to monitor how advisors are handling your money.

Selena Maranjian owns shares of Netflix. The Motley Fool owns shares of and recommends Netflix. The Motley Fool recommends Sherwin-Williams. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.