Like other earnings and realized gains on investments, dividend income is taxable. The tax rate on dividends, however, is dependent on a number of factors, including your taxable income, the type of dividend, and the kind of account that holds the investment. This means that the amount of the tax you owe on dividends can vary.

Maybe you're asking, "How are dividends taxed?" Let's take a closer look at the various factors that can affect how much tax you owe on the dividends you earned in 2025 or may earn in 2026.

Are dividends taxed?

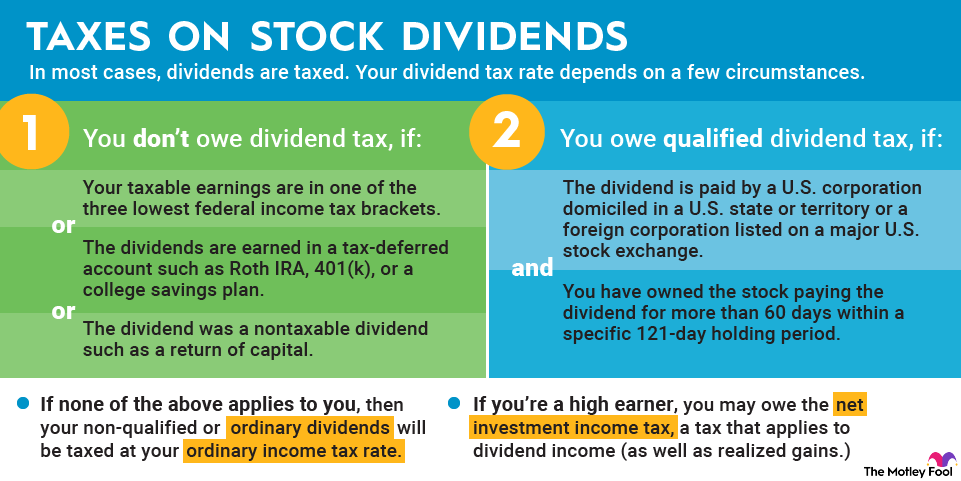

Yes, the IRS taxes dividend income, but not always. It depends on a few circumstances. Let's look at some exceptions.

A common exception is dividends paid on stocks held in a retirement account such as a:

These dividends are not taxed since most income or realized capital gains earned by these types of accounts is tax-deferred or tax-free.

Taxable Income

Another exception is dividends earned by anyone whose taxable income falls into the three lowest U.S. federal income tax brackets. For single filers, if your 2025 taxable income is $48,350 or less, or $96,700 or less for married couples filing jointly, then you won't owe any income tax on dividends earned. The numbers increase to $49,450 and $98,900, respectively, for 2026.

There are also some types of events that pay a dividend-like income that is not taxable. The most common event is a return of capital. In this case, the company is sending you money much like a dividend, but it's classified as a return on some of the capital that you invested. While not taxable today, receiving this type of dividend could increase your future taxes since your capital gain on the stock is increased by the amount of the dividend that you received.

Here's a specific example: If you pay $20 for a single share and the company sends you a $0.50 dividend payment classified as a return of capital, then your cost basis decreases to $19.50. If you sell the share in the future for a profit, then that's an extra $0.50 per share that's subject to capital gains taxes.

How to determine the owed tax on stock dividends

Whether you owe taxes on a dividend depends on three factors:

- Type of investment account: You may owe tax on dividends earned by stock held in a taxable brokerage account. You would not owe tax on dividends from stocks held in a retirement account, such as a Roth IRA or 401(k), or a college savings plan, such as a 529 plan or Coverdell ESA. There are exceptions to this tax immunity, though. Certain pass-through entities, such as master limited partnerships and publicly traded partnerships, can create tax obligations even for retirement accounts in some situations.

- Type of dividend: The tax rate, if any, depends in part on the type of dividend. A qualified dividend is eligible for a lower tax rate. An ordinary or nonqualified dividend gets taxed at the investor's ordinary (sometimes called marginal) income tax rate. Finally, a nontaxable distribution, such as a return of capital, isn't taxable but can have future tax implications, as described in the prior section.

- Your taxable income: Your tax bracket partly determines the tax rate applied to any dividends you earn, whether qualified or ordinary.

Here's a summary of when you won't pay tax on dividends:

- If your taxable earnings are in one of the three lowest federal income tax brackets and you receive qualified dividends.

- If the dividends are earned in a tax-deferred account such as one of those described above, even if your tax bracket is not one of the three lowest.

- If the dividend was a nontaxable event, such as a return of capital.

How much tax do you owe on dividends?

Dividends are taxed differently based on whether they are considered qualified or ordinary dividends under U.S. tax law. Qualified dividends get taxed at favorable rates, while nonqualified or ordinary dividends are taxed at your ordinary (marginal) income tax rate. For a dividend to be considered qualified for tax purposes, it must meet two main criteria:

- The dividend is paid by a U.S. corporation domiciled in a U.S. state or territory or a foreign corporation listed on a major U.S. stock exchange. That might sound like it includes most stocks, but keep in mind that the payouts from certain types of investments aren't treated as qualified dividends. Real estate investment trusts (REITs) and certain pass-through entities, including master limited partnerships, pay out distributions that are typically taxed as ordinary income rather than at the preferential rates reserved for qualified dividends.

- You owned the stock that is paying the dividend for more than 60 days within a specific 121-day holding period. The 121-day period begins 60 days before the ex-dividend date of the stock, which is exactly 60 days before the next dividend is distributed. The mandatory holding period prevents traders from earning tax-advantaged income on stocks that they hold for only a few days.

The following tables break down the current tax rates assessed on qualified dividends, depending on your taxable income and filing status in 2025:

2025 Dividend tax rates

2025 Qualified Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Household |

|---|---|---|---|

0% | Up to $48,350 | Up to $96,700 | Up to $64,750 |

15% | $48,350 to $533,400 | $96,700 to $600,050 | $64,750 to $566,700 |

20% | More than $533,400 | More than $600,050 | More than $566,700 |

The next table presents the tax rates assessed on ordinary or nonqualified dividends in 2025, depending on your taxable income and filing status.

2025 Ordinary Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Household |

|---|---|---|---|

10% | Up to $11,925 | Up to $23,850 | Up to $17,000 |

12% | $11,925 to $48,475 | $23,850 to $96,950 | $17,000 to $64,850 |

22% | $48,475 to $103,350 | $96,950 to $206,700 | $64,850 to $103,350 |

24% | $103,350 to $197,300 | $206,700 to $394,600 | $103,350 to $197,300 |

32% | $197,300 to $250,525 | $394,600 to $501,050 | $197,300 to $250,500 |

35% | $250,525 to $626,350 | $501,050 to $751,600 | $250,500 to $626,350 |

37% | Over $626,350 | Over $751,600 | Over $626,350 |

2026 Dividend tax rates

2026 Qualified Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Household |

|---|---|---|---|

0% | Up to $49,450 | Up to $98,900 | Up to $66,200 |

15% | $49,450 to $545,500 | $98,900 to $613,700 | $66,200 to $579,600 |

20% | More than $545,500 | More than $613,700 | More than $579,600 |

The next table presents the tax rates assessed on ordinary or nonqualified dividends in 2026, depending on your taxable income and filing status.

2026 Ordinary Dividend Tax Rate | For Single Taxpayers | For Married Couples Filing Jointly | For Heads of Household |

|---|---|---|---|

10% | $0 to $12,400 | $0 to $24,800 | $0 to $17,700 |

12% | $12,401 to $50,400 | $24,801 to $100,800 | $17,701 to $67,450 |

22% | $50,401 to $105,700 | $100,801 to $211,400 | $67,451 to $105,700 |

24% | $105,701 to $201,775 | $211,401 to $403,550 | $105,701 to $201,775 |

32% | $201,776 to $256,225 | $403,551 to $512,450 | $201,776 to $256,200 |

35% | $256,226 to $640,600 | $512,451 to $768,700 | $256,201 to $640,600 |

37% | $640,601 or more | $768,701 or more | $640,601 or more |

To summarize, here's how dividends are taxed, provided that the underlying dividend stocks are held in a taxable account:

- Qualified dividends are taxed at 0%, 15%, or 20%, depending on your income level and tax filing status.

- Ordinary (nonqualified) dividends and taxable distributions are taxed at your marginal income tax rate, which is determined by your taxable earnings.

High earners may owe the Net Investment Income Tax

In addition to the dividend taxes described above, dividend investors with modified adjusted gross incomes of more than $200,000 (for single taxpayers) or $250,000 (for married couples filing jointly) are also subject to the Net Investment Income Tax. The tax is assessed regardless of whether the dividends received are classified as qualified or ordinary.

Related investing topics

The Net Investment Income Tax is an additional 3.8% tax that applies to dividend income as well as to realized gains. It increases the effective total tax rate on dividends and other investment income.

Yet even with this surcharge, qualified dividends are taxed at significantly preferential rates compared to regular income. The tax break doesn't reduce the risk of investing in the underlying stock, but it does allow you to keep more of your hard-earned gains for yourself.