Over the last five years, both contractionary and expansionary policies have whipsawed households nationwide. The COVID-19 pandemic spurred a massive effort by the U.S. government to expand the economy. As inflation heated up, officials adopted monetary policies to mitigate the worst effects of expansionary fiscal policies. Here, we'll examine the tools and history of expansionary fiscal policies.

What are expansionary fiscal policies?

The economy isn't always a smooth-running machine. There are busts and booms, recessions and recoveries -- sometimes within the space of a few months. Expansionary fiscal policies are used to stimulate the economy during a recession or when there's concern that a recession is on the horizon. Policymakers typically have two extremely blunt tools at their disposal when the economy goes south.

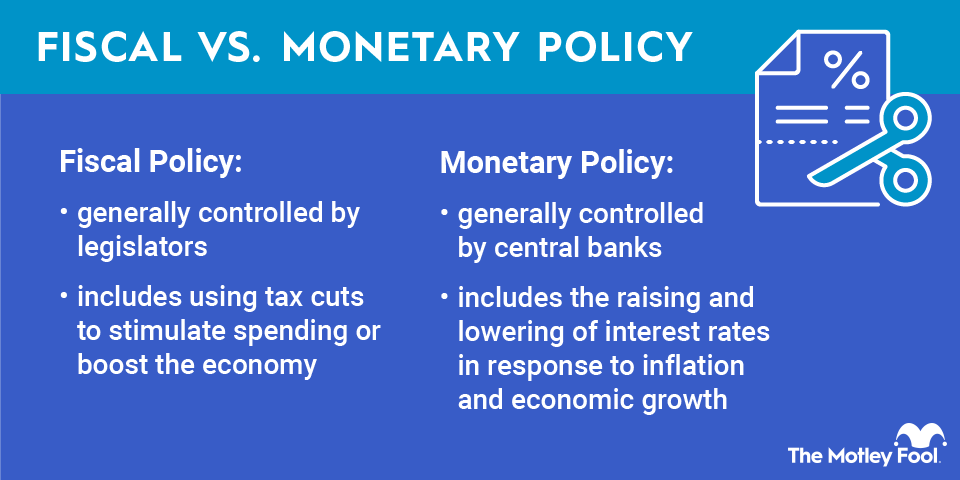

The first tool is monetary policy: The Federal Reserve can cut interest rates, reducing the cost of borrowing, or increase the money supply and stimulate investment by businesses. The second is fiscal policy: Congress can pass legislation to increase federal spending or reduce taxes, encouraging more economic activity by consumers and businesses.

Types of expansionary fiscal policies

There are three major types of expansionary fiscal policies:

1. Increased federal spending

During recessions or when the economy needs to be boosted, Congress can attempt to spur economic activity with new programs that increase spending. The $1.2 trillion Infrastructure Investment and Jobs Act, for example, was passed in November 2021 in an effort to boost employment and return economic activity to normal in the wake of the COVID-19 pandemic.

2. Reduced taxes

Congress can also reduce taxes and levies, leaving more money for households and businesses to spend. Tax cuts have been a popular measure for encouraging increased economic activity since the Economic Recovery Tax Act of 1981 was credited with helping to curb a sharp recession by significantly lowering marginal income tax rates.

3. Transfer payments

Direct payments to individuals are among the most popular and fast methods for increasing economic activity. Most transfer payments are fixed: Social Security payments, unemployment insurance, and benefits for participants in the Supplemental Nutrition Assistance Program (SNAP, also known as food stamps).

But in several instances when the economy has shown signs of major weakness, policymakers have approved direct payments to taxpayers. The economy fell into a deep tailspin during the Great Recession, causing Congress to pass the Economic Stimulus Act of 2008, which authorized payments of as much as $600 per individual taxpayer or $1,200 per household.

Pros and cons of expansionary fiscal policy

Expansionary fiscal policy isn't the only tool used to combat economic downturns. During some economic cycles, the monetary policy set by the Federal Reserve has been more effective. Here are some of the advantages of fiscal policy:

- Influenced by citizens. Unlike monetary policy, which is set via a largely opaque process at the Federal Reserve, expansionary fiscal policy is a response by elected officials and is usually designed to benefit everyone.

- Wide range of tools. Expansionary fiscal policy can range from extremely narrow, targeted efforts -- such as the $52 billion CHIPS Act of 2022, which was passed to boost the nation's lagging semiconductor industry -- to stimulus legislation passed during the COVID-19 pandemic, which made direct payments of as much as $3,200 to individual taxpayers over three rounds of stimulus checks.

- Can increase confidence in government. Faith in elected officials tends to wane during economic downturns. Expansionary fiscal policies can reassure citizens that their problems aren't being ignored.

Related investing topics

Expansionary fiscal policy, however, can have its downsides:

- Inflation. The $1.9 trillion American Rescue Plan, passed about one year into the COVID-19 pandemic, has been blamed for pushing inflation to its highest levels since the 1980s. The massive influx of money into the economy gave people more money to spend, which led to shortages -- and higher prices -- for items ranging from used cars to toilet paper.

- Budget deficits. Because the U.S. is the world's reserve currency, budget deficits are less of a concern than for other countries. Even so, deficit spending means the U.S. Treasury must borrow more money and pay interest on its borrowing. The Congressional Budget Office estimates that interest payments on the national debt, currently $952 billion, will rise to $1.8 trillion by 2035.

- Interest rates. If the government borrows enough money to fund its spending, the higher costs of borrowing can cause a "crowding-out" effect, making private investment more difficult as interest rates rise.