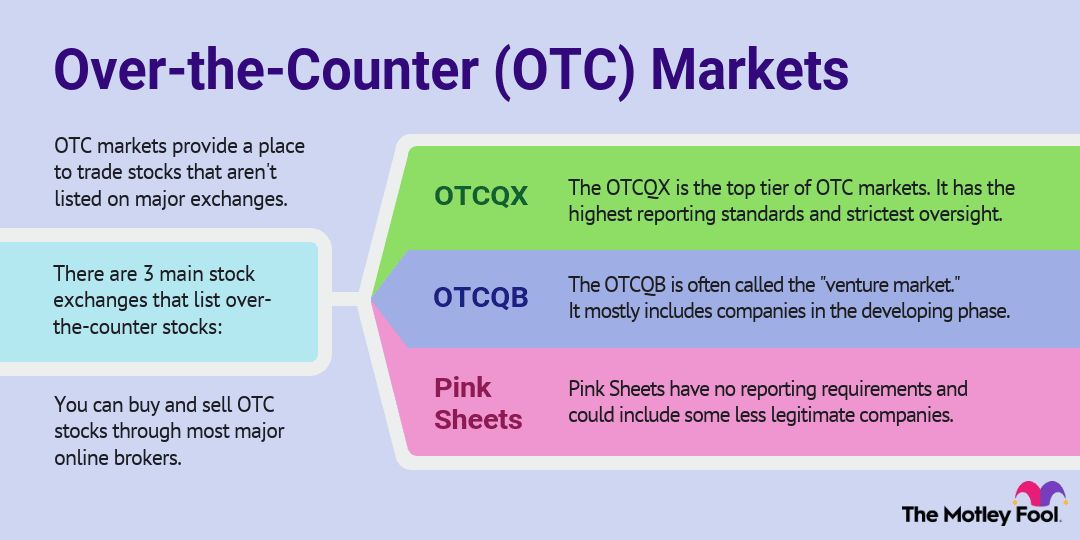

Most stocks trade on a major stock exchange, like the Nasdaq or the New York Stock Exchange. But some securities trade on decentralized marketplaces known as over-the-counter (OTC) markets. There are a number of reasons a stock may trade on OTC markets, but often it’s because the company can’t meet the stringent requirements of a major exchange. Learn how OTC trading works and what you should know before investing in OTC securities.

What is OTC?

OTC stands for over-the-counter. Over-the-counter trading is the buying and selling of securities that aren’t listed on a major stock exchange. OTC trading takes place through decentralized exchanges consisting of broker-dealers that facilitate transactions. Some types of securities that often trade OTC include:

- Penny stocks, generally defined as those priced at less than $5 per share

- International stocks and American depository receipts (ADR), which are certificates that represent a specific number of shares of a foreign company

- Stocks that have been delisted because the company is in bankruptcy or no longer meets the requirements of a major exchange

- Bonds

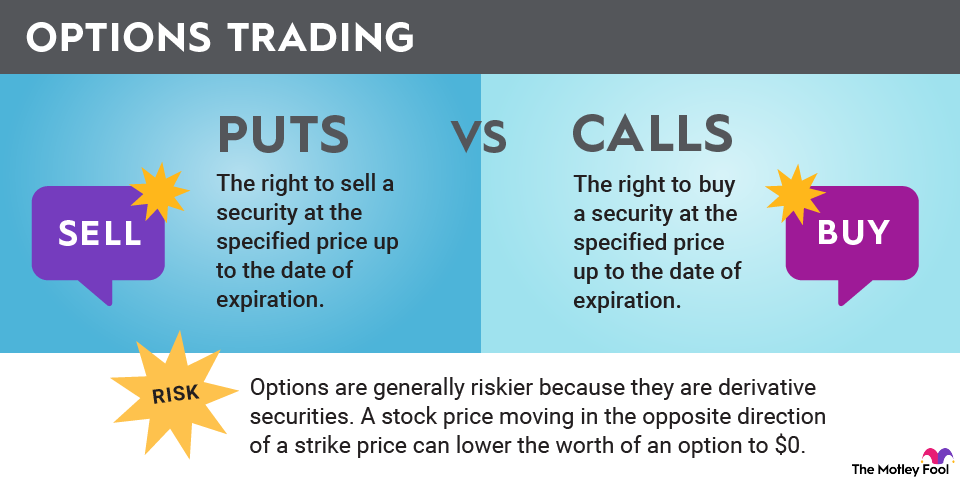

- Financial derivatives, like forwards and swaps

In practice, buying and selling OTC securities may not feel much different than buying and selling securities that trade on a major exchange due to electronic trading. Also, you can trade many OTC securities using most mainstream brokerage accounts. But OTC networks lack the rigorous financial reporting and transparency standards of major stock exchanges, so extra caution and due diligence is required from investors./

Brokerage Account

Risks and rewards of OTC trading

Not all OTC securities are bad investments. For example, many hugely profitable global companies that are listed on foreign exchanges trade OTC in the U.S. to avoid the additional regulatory requirements of trading on a major U.S. stock exchange. Buying stocks through OTC markets can also provide the opportunity to invest in a promising early-stage company. Some companies may want to avoid the expense of listing through the NYSE or Nasdaq.

One of the big risks, though, is that OTC securities tend to be thinly traded. As a result, they often lack liquidity, which means you may not be able to find a willing buyer if you want to sell your shares. Low trading volume can create enormous price volatility. Because supply and demand may be out of sync, you’ll often find wide bid/ask spreads for OTC securities.

Because the disclosure requirements are lax and the financial standards are sometimes non-existent, you may find companies with no proven track record or that have been delisted from major exchanges due to bankruptcy or other financial trouble. The lack of transparency can leave OTC investors vulnerable to fraud. In a pump-and-dump scheme, for example, fraudsters spread false hype about a company to pump up its share prices, then offload them on unsuspecting investors.