As you'd expect, Joe's sales are very uneven, peaking during the holiday season and nearly nonexistent during the first quarter of the year.

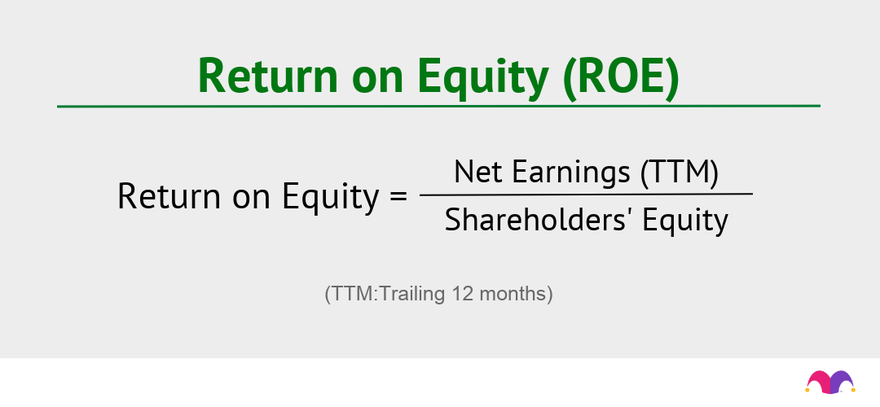

First we'd add up the net earnings for the past four quarters ($250 million + $600 million + $50 million + $100 million = $1 billion). Then we'd take the average shareholders' equity for the period ($8 billion + $9 billion + $12 billion + $11 billion = $40 billion, divided by four quarters = $10 billion). That leaves us with $1 billion divided by $10 billion, for a return on equity of 10% over the past year.

How to use ROE

The higher a company's ROE percentage, the better. A higher percentage indicates a company is more effective at generating profit from its existing assets. Likewise, a company that sees increases in its ROE over time is likely getting more efficient.

A business that creates a lot of shareholder equity is usually a sound stock choice. Investors will be repaid with the proceeds that come from the business's operations, either when the company reinvests them to expand the business or directly through dividends or share buybacks. A business generating a healthy ROE is often self-funding and will require no additional debt or equity investments, either of which could dilute or decrease shareholder value.

In our above example, Joe's Holiday Warehouse, Inc. was able to generate 10% ROE, or $0.10 from every dollar of equity. If one of Joe's competitors had a 20% ROE, however -- churning out $0.20 from every dollar of equity -- it would likely be a better investment than Joe's. If the two companies were reinvesting the majority of their profits back into the business, we'd expect to see growth rates roughly equal to those ROEs.

Related investing topics