Matt DiLallo

Matt DiLallo is a contributing Motley Fool Stock Market Analyst specializing in covering publicly traded companies that pay dividends, especially those in the energy and REIT sectors. He also covers pre-IPO companies, ETFs, and other investing topics. Prior to The Motley Fool, Matt was Director of Operations for a non-profit business group in Pittsburgh and Business Manager for a religious organization in New York. He holds an MBA and a B.S. in Biblical Studies from Liberty University.

Recent Articles by Matt DiLallo

Jul 3, 2025

by Matt DiLallo

What Is Net Asset Value?

Jul 3, 2025

by Matt DiLallo

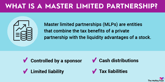

What Is a Master Limited Partnership?

Jul 2, 2025

by Matt DiLallo

What Is Growth at a Reasonable Price (GARP)?

Jul 1, 2025

by Matt DiLallo

$1,000 in VTI Could Turn Into $12,385

Jul 1, 2025

by Matt DiLallo

What Is Convertible Preferred Stock?

Jun 30, 2025

by Matt DiLallo

Investing in Farmland: A Real Estate Investor's Guide

Jun 30, 2025

by Matt DiLallo

How to Invest in Birkenstock

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.