Elon Musk has a plan.

Actually, the CEO of SpaceX has several plans: He wants to continue supplying the International Space Station with food and other consumables as far out as 2030, resume flights by American astronauts aboard American-built spacecraft, build a global satellite broadband network, and eventually put humans on Mars.

All of these plans, however, will cost money to develop the technologies to implement and continue driving down the cost of doing business in space. To get that money, SpaceX has been working diligently to raise debt and equity financing for its business. Fortunately for mankind's space ambitions, it looks like SpaceX is succeeding at this -- and fortunately for investors, every time SpaceX approaches its financiers for more money, it reveals a little bit more about its business, its finances, and its valuation.

X marks the spot where we discover how much SpaceX's treasure is worth. Image source: Getty Images.

A little bit of debt ...

Case in point: In November, SpaceX secured a $250 million loan from "a select group of investors," money it intends to use to continue development of its "Super Heavy" launch vehicle and "Starship" interplanetary rocketship. That was a nice chunk of change -- there was just one problem.

SpaceX had apparently sought to raise three times as much cash -- $750 million. At the time, it wasn't entirely clear why SpaceX settled for the lower sum. (Wall Street banks were reportedly more than willing to ante up the entire $750 million Musk sought). But the reason for SpaceX's decision to take on less debt soon became clear.

... and a whole bunch of equity

SpaceX would raise the rest of its sought-after $750 million with a stock offering. As The Wall Street Journal reported last month, SpaceX is in the final stages of selling $500 million worth of stock to its "existing [private] shareholders," plus a new (also private) investor, Scottish money management firm Baillie Gifford & Co.

What we've learned about how much is SpaceX worth

So mission accomplished for SpaceX. But as good as this news is for SpaceX, it's arguably even more important for investors who want to know how the market is valuing SpaceX today, on the off chance the company eventually files for an IPO. SpaceX revealed details on its business during the course of negotiations with its debt and equity counterparties.

As the Journal reports, SpaceX is selling $500 million worth of new shares to its private investors at "$186 a share." For this math to work, SpaceX must be selling about 2.7 million shares. We also learn that this latest funding round is being conducted "at a $30.5 billion valuation." From this fact, we can deduce that those 2.7 million shares represent a 1.6% interest in SpaceX. A little more elementary math and we can further determine that SpaceX will have roughly 165 million shares outstanding after completion of this equity issuance.

It never rains, but it pours

To the best of my knowledge, this is the first time SpaceX has ever revealed enough information about its capital structure to be able to pin an accurate share count, share price, and market capitalization on SpaceX stock -- and the deluge of new data doesn't end there.

From The Wall Street Journal's reporting, we also learned that in the 12 months ended Sept. 2018, SpaceX generated $2.5 billion in revenue and earned interest, taxes, depreciation and amortization (EBITDA) of roughly $270 million. That works out to a 10.8% EBITDA margin that SpaceX is earning on its revenue.

This number, by the way, is remarkably close to the 13% EBITDA margin earned by Boeing, and the 13.5% margin earned by Lockheed Martin -- SpaceX's two biggest rivals in spaceflight -- despite the fact that SpaceX charges much, much less for its rocket launches than its rivals. This suggests that SpaceX has the capability to turn GAAP-profitable essentially anytime it wants, simply by raising its prices a bit or, conversely, by lowering its costs -- for example by launching reusable rockets more frequently.

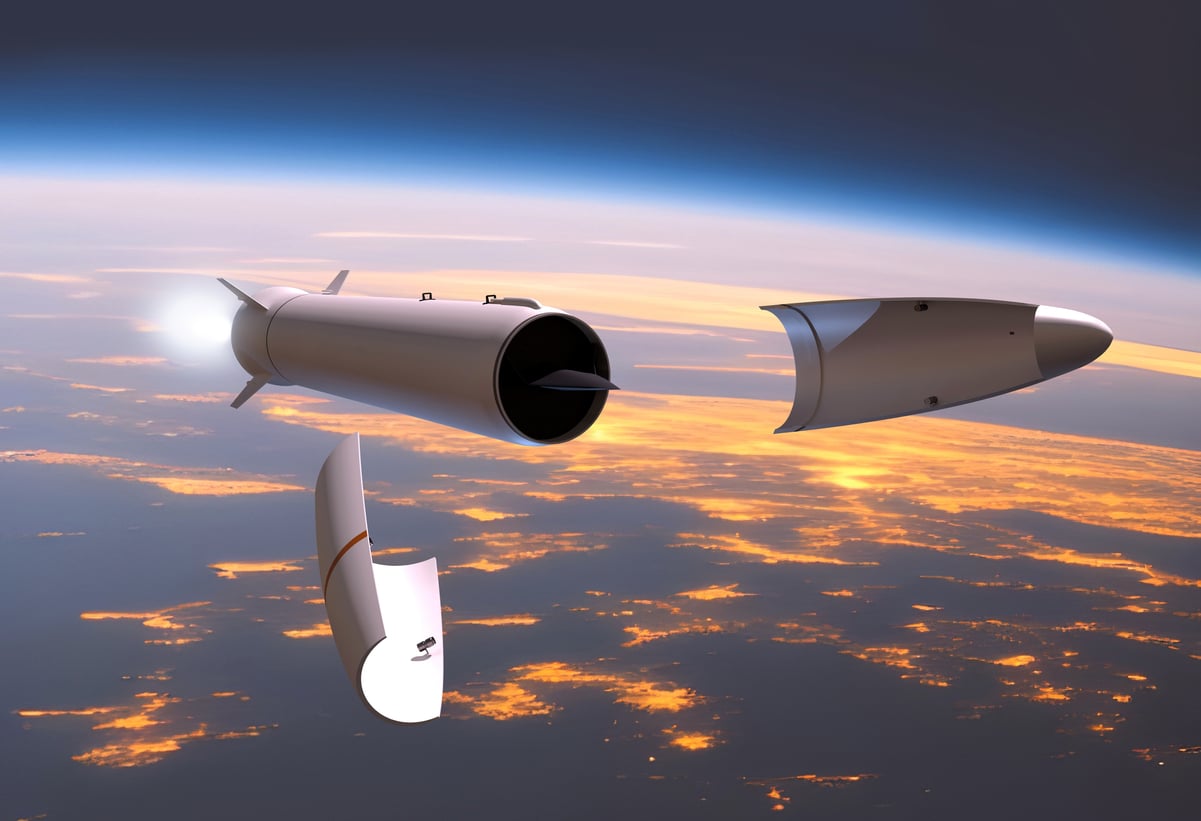

In that regard, it's worth pointing out that through mid-January 2019, SpaceX has launched 40 rockets in a row successfully, and has relanded and recovered for reuse 33 of those rockets' first stages. To date, only a handful of these rockets have actually been reused -- but the more of them that are, the more SpaceX's profits should improve, and the more SpaceX stock should be worth.

Check out all our earnings call transcripts.