It's expected if you're talking about Smith & Wesson Holding (SWHC 0.68%) that you're going to focus on its firearms. After all, they make up more than 90% of the company's total net sales and represent some 40% of its gross profits. It's also an iconic gunsmith with a storied history.

But these days, you also might want to take a closer at its accessories business, because though it only represents about 10% of sales right now, it sports gross margins of nearly 50%, and Smith & Wesson is determined to make it an even more integral part of its operations in the future.

Image source: Getty Images.

Batten down the hatches

The gunmaker bought Battenfeld Technologies for $130 million in 2014, bringing with it a portfolio of brands like Hooyman, Wheeler Engineering, and Tipton. And this year, it further expanded its accessories line by purchasing knife maker Taylor Brands and laser sight manufacturer Crimson Trace, two tuck-in acquisitions that are leading brands in their respective fields.

Smith & Wesson had virtually no presence in the long gun market prior to purchasing Thompson/Center Arms in 2007, but they now account for 18% of its total net sales. Its accessories line was subsequently transitioned in the gunmakers new outdoors accessories segment.

Taylor and Crimson Trace, though, were already two suppliers of the gunmaker, with the former being a licensee of Smith & Wesson and M&P-branded knives, as well as also owning top brands like Schrade, Uncle Henry, and Old Timer. The latter also had an extensive history as a key supplier of laser sighting systems, with Smith & Wesson accounting for 25% of its sales over the past year.

Diversifying away volatility

The idea behind the acquisitions, of course, has been to smooth out the volatility of the firearms market. While gun sales have been white-hot for the past few years, and demand shows no time of abating any time soon, the industry goes through boom and bust cycles, and the current explosion of gun-buying will eventually die down. The sporting goods accessories business is a $60 billion industry that will let it diversify its revenue streams without straying too far from the beaten path.

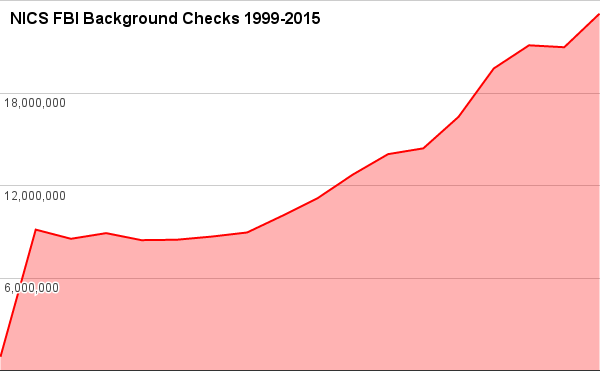

Data source: Federal Bureau of Investigation. Chart by author.

For example, the Crimson Trace purchase, for which Smith & Wesson paid $95 million, will help it upsell to gun buyers at the time of purchase. During its fiscal 2017 first-quarter earnings conference call with analysts, CEO James Debney said the laser-maker generated 10-year compounded revenues growth rates in excess of 10% annually, with trailing revenues hitting almost $45 million.

Going off target

That's a nice growth opportunity for the gunmaker, but it does come with some risks. First, it's likely Smith & Wesson was itself financing much of Crimson Trace's growth, since, as noted, it accounted for a quarter of the laser sight maker's revenues, and that will be eliminated going forward. Of course, there are savings that accrue from it now being in-house.

Second, as polymer grips come to be virtually standard-issue equipment on more handguns, Crimson Trace's grip-based laser systems are less relevant since they're not swappable with the stock grip. Still, as American Rifleman magazine has pointed out, while the grips themselves might not be adaptive, Crimson Trace is. It developed a trigger guard-mounted model that can be used with polymer-framed pistols, and it has also come out with green lasers that are easier to see in daylight to complement sales of its traditional red ones.

Still, Smith & Wesson also wants the business to take a more expansive view of the opportunity. Instead of just focusing on lasers, it's created and folded Crimson Trace into what it calls an electro-optics division that will include products such as sights, aiming and ranging devices, magnifiers, and scopes.

While the laser sight maker has been innovative, it still needs to overcome gun-buyer resistance. Only around 15% of guns sold include laser sights, and while Crimson Trace has set its sights on seeing that grow to 50%, the gun-buying boom could make that difficult. With people crowding in to purchase a firearm, retailers are often more concerned with moving the line along to get the next easy sale rather than spending time trying to convince a gun buyer he needs an accessory that can cost as much or more than the gun itself.

Image source: Flickr via kyle post.

Unchecked demand

The FBI just reported that its NICS gun-buyers background check system notched its 18th consecutive month of record investigations performed, meaning that nearly as many checks were conducted through October as were performed during all of last year. Depending on who wins the presidential election next week, it could mean the gun boom will continue, and accessories sales might be difficult.

Over the long run, Smith & Wesson's accessories strategy is probably a smart one, but the Crimson Trace purchase may not start paying dividends quite as readily as originally envisioned.