Are you looking to invest in titanium stocks? While high-strength, low-weight titanium alloys are becoming increasingly important in next-generation aerospace parts, titanium companies are more diverse than that specialty market. And no, I'm not talking about titanium miners, either.

|

Company |

Market Cap |

2016 Revenue |

Dividend Yield |

|---|---|---|---|

|

Allegheny Technologies Inc. (ATI -1.58%) |

$1.8 billion |

$3.1 billion |

N/A |

|

Arconic (HWM -0.76%) |

$12.0 billion |

$12.4 billion |

0.9% |

|

Chemours Co. (CC 2.01%) |

$7.4 billion |

$5.4 billion |

0.3% |

|

Huntsman Corporation (HUN 1.77%) |

$5.6 billion |

$9.6 billion |

2.1% |

|

Kronos Worldwide (KRO 1.85%) |

$2.1 billion |

$1.3 billion |

3.3% |

Source: Google Finance.

The best titanium stocks to buy include titanium alloy manufacturers for industrial applications and chemical manufacturers that serve various industrial and consumer markets. On one hand, the end use may be airframes that are hundreds of feet long. On the other, consumer brands are relying on titanium nanomaterials hundreds of times smaller than the width of a human hair. Both approaches represent intriguing long-term opportunities for individual investors looking to gain exposure to the titanium market.

Aerospace parts and 3-D printed metals

Titanium is becoming increasingly important to aerospace applications, and since rockets and double-decker commercial aircraft easily capture our imaginations, this growing application easily grabs most of the headlines for the material. Allegheny Technologies and Arconic are among the leading manufacturers of high-strength titanium alloys for this and other industrial markets.

Image source: Getty Images.

Allegheny Technologies is an under-the-radar stock emerging from a massive restructuring. After shedding low-margin steel manufacturing, it has cozied up to higher margin specialty markets uniquely suited for its technology platform. In 2016, the company generated 62% of its revenue from the high-performance materials and components segment, with 75% coming from aerospace and defense customers.

Management expects the segment to drive 10% sales growth in 2017 and low-double-digit operating margin. The ability to carry forward losses from previous years will be critical to avoiding income taxes this year, as the company puts the finishing touches on its rebirth. That should allow cash flow positive operations to remain a permanent feature in normal market conditions.

One of the biggest growth opportunities for Allegheny Technologies lies in producing metal powders for additive manufacturing. While only a small portion of revenue today, the 3-D printed metal industry is quickly heating up. The company already serves General Electric and Snecma's 3-D printed fuel nozzles for jet engines, and could piggyback on a recent deal between Norsk Titanium and Boeing to 3-D print airframes. It's a major supplier for Boeing's titanium airframes today.

Arconic, which was formed when Alcoa split into two, is beginning to hit its stride despite a rough start to public life. Although aluminum is a key driver of its growth, especially in automotive markets, the company is a major titanium supplier to the aerospace industry. Unfortunately, the industry's move away from aluminum airframes toward titanium alloys may end up cannibalizing some of its business.

The good news is that airframes aren't the only component being swept up by the titanium craze. Arconic figures to offset negative impacts from its airframe business with growth in other components -- specifically, jet engine parts (which saw 9% growth in first-quarter 2017 compared with the year-ago period) and new contracts for landing-gear components. And, not to be undone by competitors, the company is also gearing up to supply metal powders to the 3D-printed metal industry.

Investors may also be surprised to learn that one of the leading titanium alloy manufacturers is none other than Berkshire Hathaway. In 2015, the conglomerate acquired Precision Castparts for $32 billion, making it the largest single acquisition of Warren Buffett's career. While a small part of the overall business empire, Precision Castparts solidified its position in the market by acquiring Titanium Metals years before. However, given the diverse operations of Berkshire Hathaway, it's not among the best titanium stocks to gain direct exposure to the market.

Paints, sunscreen, and cosmetics

Contrary to conventional wisdom, the largest use for titanium is within pigment and additive markets -- and it's not even close. Over 90% of all titanium ore is used to produce titanium dioxide, which is white pigment with various protection characteristics added to paints, toothpaste, and sunscreen. In fact, it happens to be the ingredient in sunscreen that blocks harmful UV rays.

Image source: Getty Images.

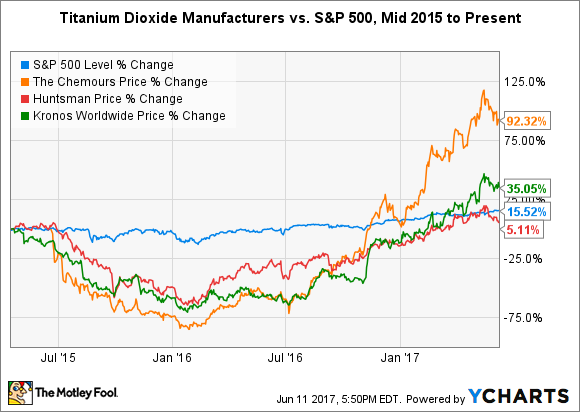

Titanium dioxide is the most-produced man-made nanomaterial on Earth, which means there's no shortage of competition. However, rising prices since early 2016 have lifted the performance of such as Chemours, Huntsman Corporation, and Kronos Worldwide, which are among the world's leading titanium companies.

Chemours, fresh off a settlement involving manufacturing of toxic fluoroproducts, is the world's largest producer of titanium dioxide, with over 1.25 million metric tons of annual manufacturing capacity that serves over 800 customers. That represents 22% of global demand -- and production capacity will increase by at least 200,000 metric tons in the coming years after an expansion project in Mexico comes online in the next several years.

The titanium segment was responsible for 31% of sales and over half of Chemours' adjusted EBITDA in 2016. Those numbers grew in the first quarter of 2017 on the heels of rising prices and the company's high-quality product grades, which easily make this one of the best titanium stocks on the market for the long haul.

Huntsman Corporation owns approximately 782,000 metric tons of annual production capacity for titanium dioxide. It's a bit different from its competitors in that it utilizes both of the dominant manufacturing processes to produce the material, which allows it serve more diverse customer needs. That hasn't amounted to much of an advantage in recent years, however.

The company's pigment and additives segment generated $2.1 billion in revenue and $130 million in adjusted EBITDA last year, accounting for 22% and 11% of the respective totals. That makes it clear that Huntsman Corporation isn't enjoying the same bounce from a strong titanium dioxide market as Chemours. Then again, its bread and butter continues to be polyurethanes, not titanium.

Last but not least, Kronos Worldwide owns approximately 555,000 metric tons of annual production capacity of titanium dioxide -- the company's only product. Sales have slid along with global prices, which peaked in 2012 but should rebound along with selling prices in the coming years. It got off to a hot start in 2017, with first-quarter revenue up 16% from the year-ago period. Better yet, cost of sales decreased.

While it boasts the smallest top line of the titanium stocks listed above, Kronos Worldwide pays the highest dividend. It hasn't looked quite so sustainable in recent years, as operating cash flow has failed to cover the dividend and capital expenditures since 2013, but rising selling prices should once again alleviate those concerns and save a dwindling cash position.

What does it mean for investors?

The top titanium stocks to own don't necessarily operate in the high-flying, media-hogging industries that dominate the conversation. While there are ample growth opportunities within next-generation aerospace and 3-D printing, the top use of the material will continue to be the tiny nanomaterials in the paints, cosmetics, and other consumer products you use in everyday life. Just remember that when thinking about the best titanium companies on the market.