Over the past several years, I've become more interested in dividend stocks -- more specifically, stocks that both pay a strong yield and have solid prospects for increasing their payouts. High-yield dividend growth stocks, if you will.

Over that time, I've bought shares of beaten-up telecom giant Centurylink Inc (CTL +0.51%), integrated oil and gas giant Royal Dutch Shell plc (ADR) (NYSE: RDS-B), energy midstream leader ONEOK, Inc. (OKE 0.29%), and utility-scale solar farm owner 8Point3 Energy Partners LP (CAFD +0.00%). All of these companies still pay dividends yielding over 5% at recent prices.

Image source: Getty Images.

Keep reading to learn why I invested in each of these companies, and what I expect from them going forward.

The one that could backfire

When I first bought shares of Centurylink in April of this year -- and added to this position in May -- my expectation was that the company would be able to ride out the lean times and come through its merger with Level 3 Communications (LVLT +0.00%) strong enough to maintain the dividend and still invest in growing the business.

Image source: Getty Images.

But since I bought shares, the market hasn't been so optimistic. Shares are down more than 20% since I first bought, as the market has become more concerned over the risk of a dividend cut. Centurylink's cash flow is far short of supporting its dividend, and there are very real concerns that the cost savings and cash-flow boosting Level 3 merger won't be enough to make up the difference.

Why am I holding? Frankly, it's because the thesis hasn't really changed; mister market has just gotten the jitters. I invested in the prospects of a very fat yield but always acknowledged the risk of a dividend cut if the merger doesn't deliver as promised. If it doesn't work out, I'm prepared to see the stock price fall even more -- and take my lumps (and losses) if it does.

Big oil, bigger yield

Royal Dutch Shell is another company I opened a position in just this year, having acquired shares in March. But while my Centurylink investment has lost 20% of its value, Shell's share price is up almost 12%. This is because the company's efforts to refocus its business on natural gas -- the segment of the oil and gas sector it sees as having the best long-term prospects -- are starting to pay off.

In early 2016, Shell acquired BG Group, significantly adding to its natural gas exposure, including LNG production and export assets. Over the past two years, management has offloaded much of the company's non-core assets while investing in its new focus. It's still early, but we're already seeing the positive results of those investments:

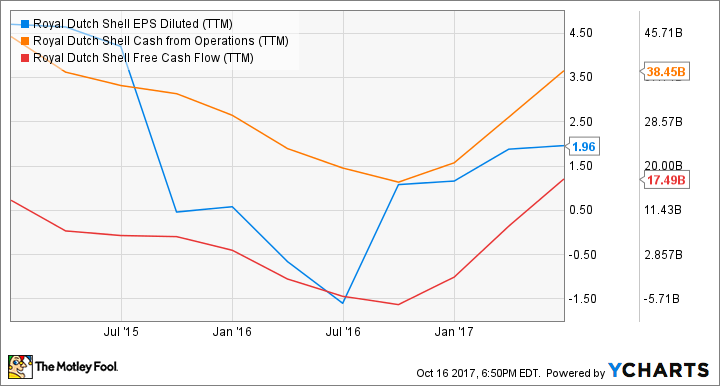

RDS.B EPS Diluted (TTM) data by YCharts.

Earnings and cash flow have started to bounce back in a very big way, as the company concentrates its investments in growing its newly refocused business. The balance sheet is also starting to improve, with cash up to $23 billion and the debt balance down slightly.

This bodes well for Shell's dividend being maintained. It may be some time before a meaningful increase, since paying down the debt with excess cash should probably be a bigger priority for now. With a yield above 6%, I'm happy to get paid to wait.

When being the middleman pays off

ONEOK is one of my favorite investments in the oil and gas industry, and it's the one company of this group that I've owned the longest (since 2015, with additional buys in 2016). The company serves a critically important role, connecting primarily natural gas and natural gas liquids (things like butane, propane, and others) producers to the grid so they can get their products to market.

Image source: Getty Images.

ONEOK not only fits a major need for producers in the markets it serves, but it has also built a business that insulates it from the worst of the ups and downs of commodity prices, with a business model that's based on a "take or pay" fee for access to its pipelines and gathering systems. This move may limit the upside if natural gas or NGL prices go higher, but it has also helped the company avoid taking a bath when prices fall off a cliff.

Through a combination of being connected to some of the best growth plays in North America and some major benefits from acquiring its master limited partnership ONEOK Partners earlier this year, ONEOK's dividend is not only secure -- it's also set to grow significantly.

The future of energy

As much as I'm counting on ONEOK and Shell to help generate income and growth, over the long term, I expect investments in stocks like 8Point3 Energy Partners to play a much bigger role in my portfolio. That's why I first bought shares in March and April of this year.

Image source: Getty Images.

There is a growing body of evidence that renewables like solar and wind, when connected to energy storage, are on track to become far cheaper than oil and gas. This could happen far sooner than most people -- both inside and outside the energy industry -- expect. 8Point3 is an excellent income growth investment, as the partnership owns large-scale solar projects and sells the energy produced by them on long-term contracts to utilities, companies, and even individual consumers.

This makes for a low-risk investment that generates incredibly predictable cash flow, offers significant resistance to recession, and even has built-in price escalations to deal with inflation. With a yield of almost 7% at recent prices and an average contract approaching 20 years in length, 8Point3 Energy Partners is worth a close look for most investors, whether you believe in a future that's dominated by renewables or not.

If solar's role in powering the U.S. and the world does indeed accelerate over the next decade, providers like 8Point3 will almost certainly play a big role. I intend to be invested in that potential.