What happened

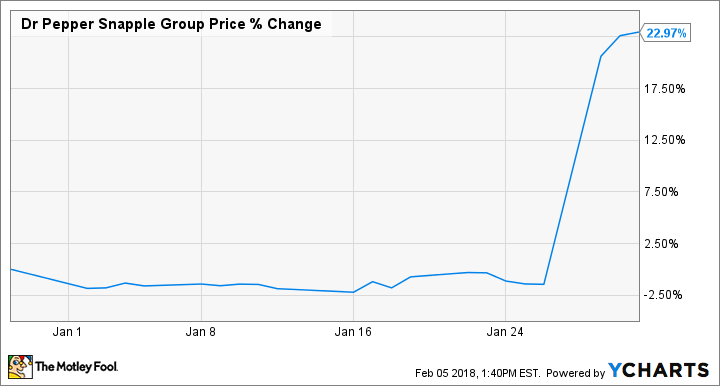

Shares of Dr Pepper Snapple Group, Inc. (DPS +0.00%) jumped last month after the beverage giant announced a surprising merger with Keurig. As a result, the stock finished the month up 23%, according to data from S&P Global Market Intelligence.

As you can see from the chart below, all of the gains came on Jan. 29 when the deal was announced.

So what

According to the agreement, Dr Pepper Snapple shareholders will receive $103.75 a share, and will retain a 13% stake in the new company, which will be called Keurig Dr Pepper and will be publicly traded. That arrangement valued Dr Pepper Snapple at a 25% premium above its closing price on Jan. 26.

Image source: Dr Pepper Snapple.

The deal was a surprise as Keurig parent JAB Holding is known for taking over coffee brands like Krispy Kreme, Caribou Coffee, and Panera Bread, but this is the company's first play at the cold beverage channel. The two companies said the merger would create "a new beverage company of scale with a portfolio of iconic consumer brands and unrivaled distribution capability to reach virtually every point-of-sale in North America." Dr Pepper Snapple's wide portfolio of brands that include Sunkist, A&W, and Mott's, as well as its namesake beverages, also seemed appealing to Keurig.

Now what

The deal looks like a smart move for Dr Pepper Snapple shareholders as sugary drinks have fallen out of favor in the U.S., and the company does not have the same scale or global distribution that Coca-Cola and PepsiCo, making it less able to compete by pivoting to healthier brands through acquisitions.

Keurig Dr Pepper expects to realize $600 million in annual cost-saving synergies by 2021, and the combined distribution chains should help increase sales of both companies' brands.

The deal is expected to close in the second quarter of 2018. Expect Dr Pepper Snapple stock to remain steady until the new company is created.