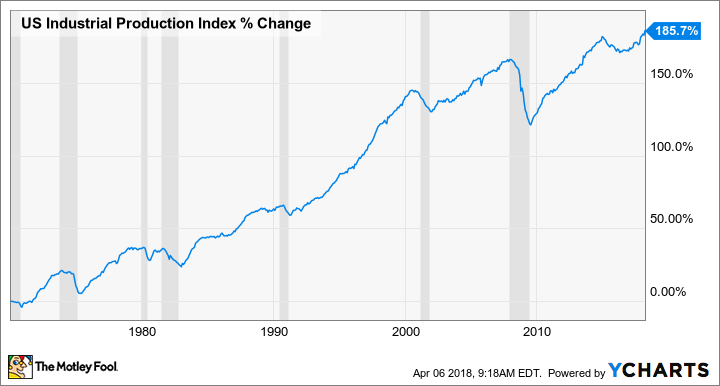

The industrial sector is known for being cyclical, but as every investor knows, not all cycles are equal. Indeed, events have suggested that there's been a sea change in the way investors should think about the sector. Let's take a look at what that means for choosing industrial stocks.

Image source: Getty Images.

All about energy and heavy industries

The drop in U.S. industrial production from mid-2015 to mid-2016 was the first time in close to 50 years that there was a significant decline that wasn't preceded by an economic recession. This marks a change in the way investors should think about the industrial sector.

US Industrial Production Index data by YCharts.

What's going on? Here's a look at industrial production in 2017, by market group. As you can see, there are five major groups:

Data source: Federal Reserve.

As you can see below, the U.S. industrial recession in 2015-2016 was driven by declines in energy materials and business equipment. Defense and space equipment declined significantly, but (see above) it's not a major part of U.S. industrial production. That's interesting because it implies that the growing importance of energy production to the U.S. economy is making the industrial sector positively correlated with energy and mining commodities. In other words, rising energy prices are not necessarily bad news for the U.S. industrial sector as it used to be. On the contrary, many U.S. industrial companies, including the ones discussed here, will welcome rising energy prices.

Data source: Federal Reserve.

What's new in 2018

The good news is that energy and metals prices have been on a general uptrend since the start of 2016; capital spending has started following, as higher prices tend to induce investment. The key conclusion for the industrial sector is that, as long as the trend continues, investors should look for stocks with exposure to energy and mining-related spending. These include process automation company Emerson Electric; construction, mining, and oil equipment machinery company Caterpillar; and welding products and systems company Lincoln Electric Holdings.

All three have strong exposure to precisely the kind of heavy industries that got hit in the industrial slowdown, and will likely have a couple years of robust earnings ahead of them. Here's a look at analyst consensus estimates for all three companies, and current and prospective P/E ratios based on their current stock price:

| Company EPS and P/E |

2017 Actual |

2018 Est. |

2019 Est. |

|---|---|---|---|

|

Caterpillar (CAT 2.54%) | |||

|

--Earnings per Share |

$6.88 |

$9.15 |

$10.59 |

|

--Price-to-Earnings Ratio |

20.8 |

15.6 |

13.5 |

|

Emerson Electric (EMR 2.84%) | |||

|

--Earnings per Share |

$2.64 |

$3.12 | $3.58 |

|

--Price-to-Earnings Ratio |

25.0 |

21.2 |

18.4 |

|

Lincoln Electric Holdings (LECO 4.06%) | |||

|

--Earnings per Share |

$3.79 |

$4.70 |

$5.24 |

|

--Price-to-Earnings Ratio |

23.2 |

18.7 |

16.8 |

Data source: Company presentations. Analyst estimates.

Caterpillar's upside prospects from mining

Buying these stocks right now makes good sense because all three have earnings momentum and therefore are likely to exceed analyst estimates. Caterpillar is probably the best-known of the three -- largely for its iconic construction equipment -- but its mining equipment holds the key to Caterpillar's prospects in 2018.

Caterpillar's construction-based profits remain strong (see the positive trend in construction supplies in the chart above), and the energy and transportation segment has also bounced back. But now its mining equipment sales look set to increase significantly, as major mining companies boost capital spending in response to increases in metal prices.

Emerson Electric is perfectly placed

Emerson Electric's return to sales growth has followed the pickup in energy materials spending discussed above. The company's process automation solutions have led the improvement in its underlying sales growth:

Data source: Emerson Electric presentations. .

Process automation simply involves turning raw materials into finished products (such as chemicals, oil and gas, or power); Emerson's end markets are in exactly the heavy industries that are bouncing back strongly. As such, the company is set for a good 2018, and has already raised near-term earnings estimates while increasing its midterm guidance.

Lincoln Electric

The welding and cutting equipment company generates 40% of its revenue from two subsectors: energy and process industries, and heavy industries such as mining and shipbuilding -- exactly the kind of industries set to bounce back in growth this year. (Around 33% of its revenue comes from general fabrication, and the rest from automotive/transportation and construction/infrastructure.)

The 2017 acquisition of Air Liquide's welding operations helped boost sales growth to 33% in the recent fourth quarter, but even on an organic basis, sales were up 10%.

As you can see below, the slowdown in industrial production hit Lincoln's sales growth in 2015-2016; the company also took hits from foreign currency weakness, and the impact of turmoil in Venezuela in 2013-2014. Otherwise, the company's exposure to heavy industries and infrastructure spending (in emerging markets as well) has grown revenue over the last decade:

LECO Revenue (Annual) data by YCharts.

Provided the energy, materials, and heavy-industries end markets keep growing, Lincoln Electric is likely to have good future growth.

Looking ahead

There's no guarantee that energy and heavy-industries capital spending will keep increasing in the future; that's largely a consequence of commodity price movements. But for now, a positive trend is in place.

This means stocks like Caterpillar, Emerson Electric, and Lincoln Electric have the potential to surprise on the upside with their earnings in the next year or so. For now, they all look like attractive stocks.