For a long time, the beverage industry was a relatively boring place to invest, but industry giant Coca-Cola (KO +0.69%) had found the key to long-term success. With the cash cow of its namesake sugary soft drinks, Coca-Cola was able to produce regular sales and earnings growth as it became one of the most recognized brands in the world.

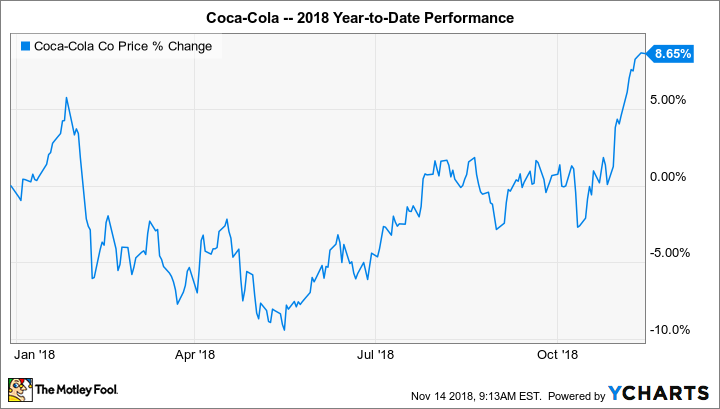

Yet more recently, Coca-Cola has encountered challenges. Shifting consumer tastes have pushed traditional soft drinks out of favor, and an onslaught of alternatives like bottled water, tea, sports drinks, energy drinks, and juices has forced the giants of the industry to pivot their business models. Although Coca-Cola has worked hard to adapt to these changing conditions, the fact that its stock has spent so much of 2018 in the red before its recent climb shows just how difficult those efforts have been.

Dealing with change

Coca-Cola entered 2018 with a chip on its shoulder. The stock had suffered dramatic underperformance for several years, and the bad perception of regular Coke and its sugary carbonated peers was a primary culprit. In some jurisdictions, governments had resorted to taxing soda in order to discourage consumers from drinking it, citing obesity, diabetes, and other health problems as possible consequences. In response, new CEO James Quincey had sought to restore organic revenue and earnings growth through refinements to its product lines. With introductions of new flavors of Diet Coke and Coca-Cola Zero Sugar, the beverage giant hoped to complement offerings of other types of beverages while still maintaining its dominance in sodas.

Another strategic move that Coca-Cola identified was divesting its bottling operations. The company has gone through the cycle of acquiring bottling franchises and later refranchising them as independent entities on several occasions in the past, but the latest iteration promises to make Coca-Cola a more capital-light operation. That has already had huge downward impacts on GAAP revenue, but it's opened up opportunities to promote smaller beverage sizes and packs with fewer containers, thereby improving profit margin.

Stats on Coca-Cola

|

Revenue, Past 12 Months |

$32.31 billion |

|

1-Year Revenue Growth |

(13.4%) |

|

Net Income, Past 12 Months |

$2.81 billion |

|

1-Year Net Income Growth |

(38%) |

Source: Coca-Cola.

Yet results from early in the year didn't inspire much confidence. Even though organic revenue climbed 5% in the first quarter, investors were nervous about the 16% drop in overall revenue, and adjusted earnings growth of just 8% was less than many companies elsewhere in the market were delivering.

Getting a big bump higher

More recently, though, Coca-Cola has started to gain speed with its restructuring efforts. In its most recent quarter, Coca-Cola sported a 6% rise in organic revenue, and even though net sales were down 9% due to refranchising efforts, adjusted earnings jumped 14% on a per-share basis despite the huge 8-percentage-point negative impact of the strong U.S. dollar on its international profit.

Image source: Coca-Cola.

Management is also more enthusiastic about the future. The $5.1 billion acquisition of Costa Coffee points to a new strategic direction for Coca-Cola, and plans to release lines of sports drinks, fruit juices, and kombucha also point to potential growth areas. Marketing efforts to promote no-sugar sodas have resulted in greater case volume, and careful price increases show that Coca-Cola still has pricing power to pass on higher costs to consumers even with the challenges the beverage giant has faced.

What's next for Coca-Cola?

Coca-Cola's recent spike higher in its stock price also likely stems from investor nervousness about the stock market generally. With a correction having occurred over the past couple of months, investors have flooded into defensive areas of the market like consumer staples, and Coca-Cola has been just one of the many beneficiaries of that increased interest. With a dividend yield exceeding 3%, income is also an attractive attribute for Coca-Cola stock over some faster-growing companies in other sectors.

Modest gains in 2018 have reflected the challenges and opportunities that Coca-Cola has. The transformation in the business hasn't been easy, but ongoing efforts are bearing fruit, and investors are generally optimistic that Coca-Cola can remain atop the beverage industry for years to come.