It's now been a little over two years since Apple (AAPL +2.28%) unleashed its blockbuster legal war against Qualcomm (QCOM +11.09%), which has continued to escalate and spread to courts all around the world. At the heart of that initial foray was $1 billion in rebates that Qualcomm owed Apple that effectively served as royalty relief. Qualcomm had stopped paying those rebates after Apple started cooperating with antitrust regulators in numerous countries that were investigating alleged anticompetitive practices, most notably Qualcomm's controversial "no license, no chips" policy that amplified its market power.

Apple just scored that $1 billion it was asking for.

Image source: Getty Images.

Siding with Apple

Reuters reports that Judge Gonzalo Curiel of the U.S. District Court for the Southern District of California ruled yesterday that Qualcomm owes the $1 billion to Apple, and that Apple's conduct did not violate the Business Cooperation and Patent Agreement (BCPA) that covered the payments. Apple entered into the BCPA with Qualcomm back in 2013, desperate for ways to reduce its excessive royalty burden.

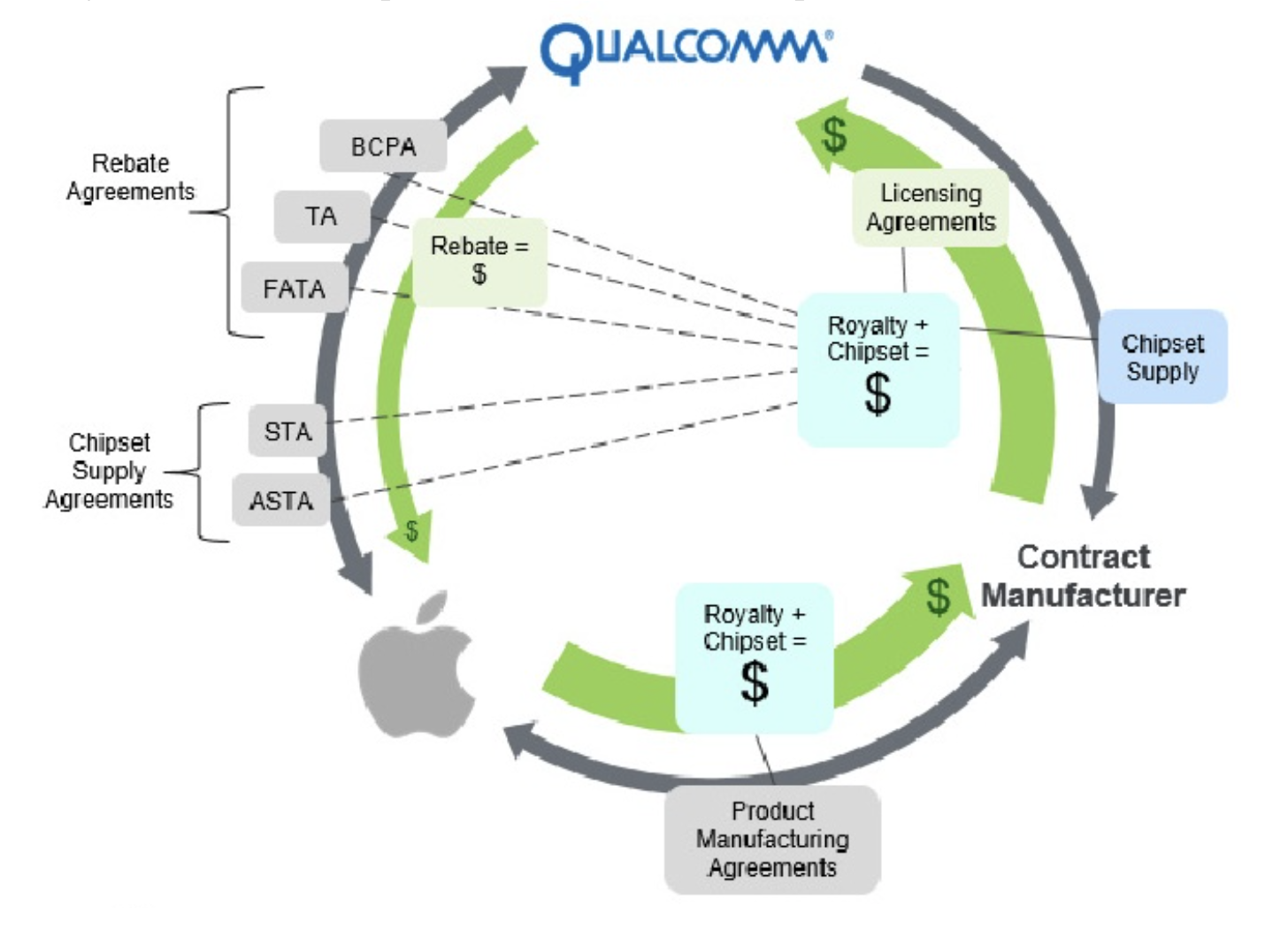

Historically, Apple's contract manufacturers would pay the necessary royalties to Qualcomm and Apple would reimburse its manufacturing partners, but those partners have no incentive to negotiate with Qualcomm and had long paid elevated rates.

Check out the latest earnings call transcript for Apple.

How the money flowed between Apple, Qualcomm, and contract manufacturers. Image source: Court filings.

Qualcomm would then subsequently send Apple rebates as part of the BCPA, which had a key provision that "restricted Apple from initiating or inducing certain legal actions." In other words, Qualcomm did not want Apple to bring its concerns to law enforcement, but the Mac maker did have a responsibility to respond appropriately to agencies requesting information.

Apple has argued that it did not initiate the regulatory investigations, but merely responded to them. More specifically, Qualcomm had argued that Apple had made "false and misleading" statements to the Korea Fair Trade Commission as part of its investigation, while "actively encouraging regulatory attacks" in other countries. Curiel ruled in Apple's favor, saying it did not violate the 2013 BCPA.

There's still more to come

However, the ruling is preliminary in nature, and Apple won't be able to collect the $1 billion quite yet. There are other parts of the sprawling legal dispute that have yet to be settled, and the case is set to go to trial next month. In particular, Apple had instructed its contract manufacturers to stop paying Qualcomm the royalties in early 2017. The disputed amount there also happens to be about $1 billion as well. This is how CEO Tim Cook initially justified that decision:

In terms of why we're withholding royalties, you can't pay something when there's a dispute about the amount. You don't know how much to pay. And so they think we owe some amount. We think we owe a different amount. And there hasn't been a meeting of the minds there, and so at this point, we need the courts to decide that unless we are able to, over time, settle between us on some amount. But right now we're depending upon the courts to do that, and so that is the thinking.

In the years since, there still hasn't been "a meeting of the minds" or settlement of any kind, so it's time to let the courts have their say.