Apple (AAPL -0.05%) just wrapped its "show time" event, which expectedly focused heavily on new services. After three consecutive days of quiet hardware announcements last week, combined with the company's ongoing emphasis on its growing services business, it was clear where Apple's focus would be today. The new offerings were largely in line with expectations and promise to build on the tech titan's services momentum.

Here's what investors need to know.

Image source: Apple.

Apple News+

The first new service that Apple introduced was Apple News+, a $10-per-month subscription that includes access to over 300 magazines, numerous digital subscriptions, and prominent publications like the Los Angeles Times and The Wall Street Journal. The service is clearly built on the foundation of Texture, the magazine subscription service that Apple acquired about a year ago.

Scoring the WSJ had been previously reported and represents a major coup for Apple. A standard WSJ subscription costs $40 per month, and the Journal's subscriber base is known to have a large proportion of professionals and corporate subscriptions. Parent News Corp. may be looking to better appeal to average consumers that are more sensitive to prices than readers whose employer is footing the bill.

Check out the latest earnings call transcript for Apple.

Image source: Apple.

An Apple News+ subscription can be shared within the family at no additional cost and is launching today in the U.S. and Canada.

Apple Card

No, it's not an Apple Car, it's an Apple Card. Apple is making its biggest push into financial services yet with a new credit card intended to address common consumer pain points in the credit card industry. Apple Card is an obvious evolution of Apple Pay, which continues to gain traction in terms of consumer adoption, merchant acceptance, and transactions processed. The company expects to hit 10 billion Apple Pay transactions this year.

Instead of using amorphous points for the reward program, Apple is offering a straight dollar-based cash-back reward system that it calls Daily Cash. Rewards are automatically credited daily to the Apple Pay Cash card stored in the Wallet app. In terms of reward rates, Apple Card will give 1% back on physical card purchases, 2% back on Apple Pay contactless payments, and 3% on Apple purchases.

Image source: Apple.

A flat 1.5% cash-back rate with no annual fee is table stakes in consumer credit cards these days, and the ultimate reward rate that Apple Card users receive will largely be a function of how they process their transactions, which in turn will hinge on merchant acceptance. Assuming that Apple purchases will represent a tiny chunk of an average household's annual spending, the typical reward rate will likely end up between 1% and 2%.

There are no late fees, no annual fees, no international fees, and no over-the-limit fees. Apple is also offering lower interest rates and will not have any type of penalty interest rate, a common practice among traditional credit card issuers. Apple is partnering with Goldman Sachs, which recently entered the consumer lending business in 2016 and has been looking to expand there. The card will use Mastercard's payment network and become available this summer.

Apple Arcade

Following Alphabet subsidiary Google's big announcement last week of its cloud gaming service Stadia, Apple is following up with a gaming service of its own: Apple Arcade. iOS is a massive gaming platform, but most titles are free and monetized with either ads or in-app purchases. That's made it difficult for developers to sell games for an up-front price.

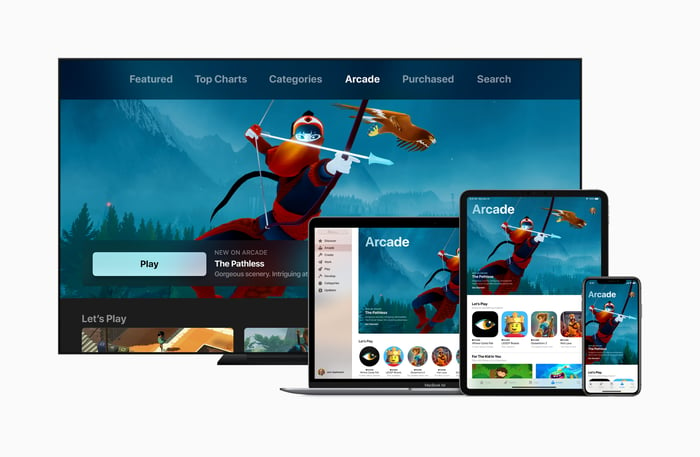

Image source: Apple.

In an effort to help game developers navigate this challenge, Apple Arcade will include access to a large library of high-quality games that are exclusive to the platform. Apple is backing their development and will curate the content available in the service. No titles will include ads or be monetized with in-app purchases. This isn't a cloud gaming service, though -- all games will be played locally and available offline. The company did not disclose pricing or availability yet.

Apple TV+

The feature presentation was Apple TV+. Apple spent considerable time showcasing all of the original content is has been buying up, with a slew of celebrities introducing their projects for the platform. It will be an ad-free subscription service launching this fall, but Apple declined to specify pricing. Those rumors of free original content appear to be squashed.

Image source: Apple.

Apple is also rolling out a revamped storefront for cable channels and other streaming services. The TV app is getting a redesigned interface and will serve as a centralized hub for all content, even more so than it currently does. Apple will sell subscriptions to popular premium channels like AT&T's HBO, CBS' ShowTime, and Lions Gate's Starz, among others. The TV app is getting extensive cross-platform support and is coming to third-party smart TVs, as well as Roku players and Amazon's Fire TV platform.

Apple wants investors to consider it a services company, and it sure is acting like one.