It's been a decent year so far for shareholders in 3M Company (MMM +4.11%), with the stock up nearly 12% year-to-date at the time of writing. It's a few points behind the S&P 500, but dividend hunters will be happy with the 2.7% dividend yield and shareholder-friendly management that has helped oversee a company with more than 60 years of consecutive dividend increases. That said, a stock trades on its future prospects rather than its history, so let's take a look and see whether 3M is a buy or not.

Image source: Getty Images.

Valuation

I'll cut to the chase: I think the answer is no, and there are five reasons why.

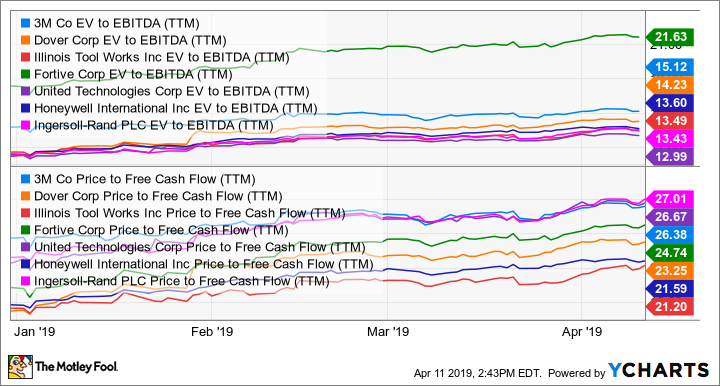

The first focuses on valuation. As you can see in the chart below, 3M continues to command a premium valuation. This is demonstrated whether you use an earnings-based metrics method such as enterprise value (market cap plus net debt) over earnings before interest, tax, depreciation, and amortization (EBITDA), or a free cash flow (FCF) based method.

In the price to FCF chart below, 3M doesn't seem to be trading a premium relative to its peers. there are some things to consider, though. Ingersoll-Rand is set to increase its FCF by nearly 40% in 2019, and United Technologies FCF (excluding separation costs) is set to increase by 42%, aided by the recent Rockwell Collins acquisition.

MMM EV to EBITDA (TTM) data by YCharts

Moreover, based on analyst consensus for EPS of $10.53, 3M's stock trades on a forward PE ratio of 20.2 times earnings -- it's not cheap on a relative (peer group) or absolute basis.

Earnings prospects vs. guidance

The second issue is that the company's recent record of meeting guidance isn't great. Management spent much of 2018 lowering full-year sales, earnings, and FCF expectations. In the end, full-year organic sales growth came in at 3.2%, while the company started the year expecting 3% to 5%. Similarly, full-year FCF came in at $4.9 billion, while management had started the year forecasting $5.6 billion to $6.6 billion.

Fast-forward to 2019 and, after a disappointing fourth-quarter 2018 set of earnings, management lowered its full-year 2019 guidance. The organic sales growth range is now 1% to 4%, compared with a previous estimate of 2% to 4%, and the adjusted EPS range is $10.55 to $11, compared with a previous range of $10.60 to $11.05.

Granted, it's not much of a reduction, but during an investment conference in March CFO Nick Gangestad told investors about weakening trends in China, the automotive sector, and consumer electronics. He also implied that organic revenue growth could be flat in the first quarter.

End-market deterioration

Third, as noted above, some of 3M's key end markets are deteriorating, and given that it's primarily a short-cycle company, there are concerns that its earnings outlook could worsen. In other words, it has limited visibility into orders, and its revenue can turn down quickly with a slowdown in the economy.

Moreover, the two segments that have underperformed the company's medium-term growth expectations in recent years are healthcare and consumer products. This is problematic because they are precisely the segments 3M needs to do well in to counter any potential cyclical weakness from slowing industrial production growth.

Business-model challenges

Fourth, if you break out the composition of 3M's growth in recent years, it's clear that the bulk of it comes from volume increases rather than pricing. This is not a bad thing in itself, but it's a concern when it comes from a company whose business model involves spending around 11% of its revenue on capital expenditures (5%) and research and development (6%) in order to create differentiated products with pricing power.

Data source: 3M Company presentations.

Lack of significant restructuring

Finally, the company's recent "portfolio realignment" really isn't a dramatic change at all. In a nutshell, the number of segments was cut from five to four, with some individual businesses moved around within them.

The changes arguably make it easier to spin off or sell its healthcare segment, but other than that it's not really the kind of significant change to restructure the company for growth that investors might have hoped for.

A stock to buy?

On a more positive note, it's hard to argue with 3M's history of generating returns for investors or its dividend legacy. Moreover, the company's near 50% gross margins are the envy of the industrial sector, and if 3M hits the high end of its 2019 FCF guidance range of $5.8 billion to $6.7 billion, then it will trade on a forward price to FCF multiple of 18.3 times. That would make the stock look to be a good value.

However, the case to buy the stock is based on excellent execution in the face of the headwinds discussed above. On balance, I think 3M is worth avoiding for now under the current circumstances.