In mid-2017, midstream-energy-focused ONEOK (OKE +0.51%) bought its controlled limited partnership, simplifying its business structure. It got through the transition -- which was undertaken in a difficult period for the midstream sector -- without cutting its dividend.

Since completing the merger, ONEOK's stock is up around 25%, while industry-leading names like Enterprise Products Partners (EPD +0.56%) and Magellan Midstream Partners (MMP +0.00%) are flat to lower. Is ONEOK a worthwhile deal today in the midstream space?

1. A good business

ONEOK operates a large natural gas pipeline, storage, and processing business. The vast majority of its revenues are tied to fee-based assets, providing consistency and protection from commodity price volatility. The company's market cap of around $26 billion is smaller than the industry's largest players but still makes it one of the bigger names in the space.

Image source: Getty Images.

Demand for the ONEOK's services remains strong in its core markets, as well, with production growth and notable amounts of natural gas being burned off (called flaring) that could be captured. ONEOK has expansion projects lined up through 2021, with a total capital budget of around $5.6 billion. A few of the larger projects should be completed in late 2019 or early 2020.

Based on its current projections, the midstream company is looking for a 10% increase in net income in 2019 with a 6% boost in adjusted EBITDA. That's solid performance that should please investors.

Although ONEOK hasn't provided 2020 projections and likely won't until the end of 2019 or early 2020, the completion dates of its capital projects suggest that next year will be another good one. Put simply, the core business is strong.

2. A leverage improvement

The company's strength also shows up on its balance sheet. ONEOK's debt-to-EBITDA ratio spiked above six times in 2016, but following the merger with its controlled partnership, management has been working on improving its leverage profile. At this point, debt-to-EBITDA is around 3.6 times.

That's a solid number in the midstream space and roughly on par with industry bellwether Enterprise Products Partners. That said, the company's target is in the area of four times -- still a good number -- so it could rise from here to support growth spending.

OKE Financial Debt to EBITDA (TTM) data by YCharts.

3. Dividend issues

ONEOK, meanwhile, has increased its dividend annually for 17 consecutive years. Enterprise (22 years) and Magellan (19 years) have longer streaks, but it would be hard to suggest that ONEOK hasn't shown a commitment to returning value to shareholders via dividends.

That said, over the past decade, ONEOK has increased its dividend at an annualized rate of just under 17%. Magellan's increases were around 12%, and Enterprise's 5%. Magellan and Enterprise, meanwhile, have slowed their increases more recently.

ONEOK's dividend stagnated a bit during the acquisition of its controlled partnership but has since picked up again. The dividend jumped 10.5% in 2017, 20% in 2018, and has been increased twice so far in 2019. The first quarter saw a 12% year-over-year hike, with the second-quarter bump coming in at 9%. ONEOK covered its dividend by 1.4 times in the first quarter, which is strong coverage. As such, it's highly likely it will increase the dividend again before the year is out, following its recent quarterly-hike trend.

When it comes to dividends, ONEOK easily holds its own with some of the best names in the industry. However, after a huge price advance relative to those peers, the company's 5.4% dividend yield is a little light comparatively. Enterprise's yield is a more compelling 6.3%, with Magellan's chiming in at an even higher 6.5%. Which brings on a bigger question... valuation.

4. Valuation

ONEOK is a good company, but sometimes, good companies aren't good investments. And in this case, ONEOK's stock has materially outperformed some of the industry's most conservative names since its mid-2017 simplification transaction. Add in the relatively low dividend yield, and investors should be asking if there are cheaper options in the midstream space. The answer is yes.

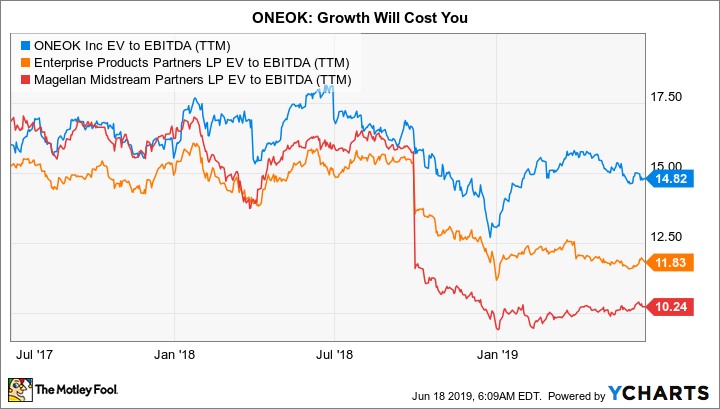

ONEOK's enterprise value (EV)-to-EBITDA ratio is nearly 15 times. Higher-yielding Enterprise's valuation on this metric is roughly 12 times, with Magellan coming in at about 10.5 times.

Investors are clearly affording ONEOK a premium price today. The question is whether or not that premium is worth it, given that ONEOK has been growing its dividend at a more rapid clip than either bellwether Enterprise or highly conservative Magellan.

OKE EV-to-EBITDA (TTM) data by YCharts.

The answer isn't a clean yes or no. From a big-picture perspective, ONEOK, Enterprise, and Magellan would all be solid midstream choices. For conservative investors looking to maximize current income, however, Magellan would likely be the better option. For investors focused on dividend growth, ONEOK has the lead today. However, you'll be paying a notable premium for that growth.

The right balance for you

ONEOK is a great company that's handily managed a big transition without missing a beat. It pays a sizable dividend, but there are higher yields available in the midstream space. That said, dividend growth has been strong and should continue to be so over the next couple of years, as big growth projects come online.

If you're willing to pay up for dividend growth, ONEOK will probably be of interest to you. However, if you're a conservative, income-focused investor, the premium price and lower yield should lead you to hit the pause button. Conservatively managed peers like Enterprise and Magellan might be better options.