If you're interested in dividend-paying stocks, you're in good company. It's been shown that dividend-paying companies outperform their non-dividend-paying peers, and as a result, dividend stocks have been among the stock market's best performers over the past decade.

Income investors looking for a steady stream of income should consider buying Verizon Communications (VZ +2.49%), Foot Locker Inc. (FL +0.00%), and Coca-Cola (KO +2.62%). Here's why.

IMAGE SOURCE: GETTY IMAGES.

The great mobile phone dividend

Travis Hoium (Verizon Communications): I think one of the most underappreciated industries in the market today is wireless communications. Most Americans have a cell phone in their possession right now, yet the companies who provide critical cellular service aren't very loved by the market. But that gives investors the chance to buy an industry giant like Verizon Communications and get a lofty dividend yield of 4.2% along the way.

The company is part of an oligopoly in wireless service, meaning a small number of competitors control most of the market, but it's the premium player in the space. Verizon is able to command higher prices and therefore better margins than competitors, and that pays off with greater profits.

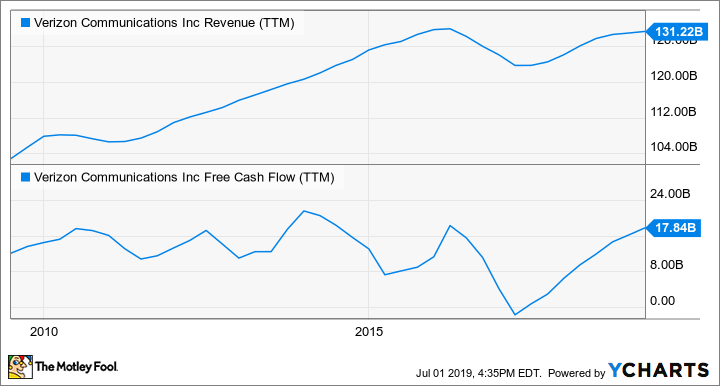

VZ Revenue (TTM) data by YCharts.

Higher profitability will really pay off as 5G services are rolled out across the country. Verizon will be able to bundle higher performance for mobile phones with connections to cars, watches, and even home broadband services. The number of devices we'll have connected to networks like Verizon's will only grow, and that should help its profits long term. The dividend yield is a healthy 4.2% today, but over the next decade I think there's a lot of growth left in that payout.

An unloved footwear retailer

Leo Sun (Foot Locker): Foot Locker's stock tumbled about 30% over the past three months, mostly after its first-quarter numbers missed estimates on both the top and bottom lines in late May. However, that sell-off reduced Foot Locker's forward P/E ratio to 8 and boosted its forward yield to nearly 4%. The retailer spent only 31% of its free cash flow and 29% of its earnings on that dividend over the past 12 months, and it's raised its payout annually for eight straight years.

I believe Foot Locker's sell-off was a major overreaction for three reasons. First, Foot Locker's 4.6% comps growth in the first quarter was solid, and marked its fourth straight quarter of positive growth. It also reaffirmed its full-year guidance for mid-single-digit comps growth.

Second, Foot Locker's gross margin expanded sequentially and annually during the first quarter, and it expects that momentum to continue with a 20 to 40 basis point expansion for the full year. Foot Locker's inventories also held steady, rising a mere 0.1% annually during the quarter.

Lastly, investors seemed to dump Foot Locker because it scaled back its buyback plans for the full year, which reduced its prior forecast for double-digit EPS for the full year to the high single digits. Conservative buybacks aren't necessarily a bad thing, and high single-digit growth matches its forward multiple.

Therefore, Foot Locker probably won't rally anytime soon, but its low valuation, high yield, and promising growth prospects should set a firm floor under the stock.

New energy drinks could give this company a boost

Todd Campbell (Coca-Cola): Coca-Cola benefits from the shift in the calendar to hot weather, but quenching consumers' thirst this summer isn't the only reason to consider buying shares in the beverage giant. An arbitration ruling was recently made in Coca-Cola's favor, allowing it to build a bigger footprint in the highly successful energy drink market.

Last year, Monster Beverage (MNST +1.16%) and Coca-Cola agreed to arbitration over a disagreement in contract language associated with their existing relationship, which includes Coca-Cola's owning a 17% equity stake and distributing Monster beverages. According to Monster, the contract prohibited Coca-Cola from developing its own energy drink competitors to Monster. However, the arbitration panel determined Coca-Cola could indeed launch energy drinks if it did so under its existing brands.

The two companies say they respect the decision and value their existing relationship, so a divorce isn't on the table -- at least not yet. Therefore, the decision means Coca-Cola can expand deeper into the category, boosting sales while also pocketing money from its relationship with Monster.

There's no guarantee Coca-Cola's new drinks will be winners. Nevertheless, the potential for a new revenue driver alongside the natural seasonal sales tailwind could make it a good time to buy shares and pocket Coke's 3.1% dividend yield.