Various forms of automation are sweeping through the economy. The thought of machines doing human work and eliminating jobs is a big worry, but it's not all bad. Automation can also be a force for good, and healthcare is an example of that.

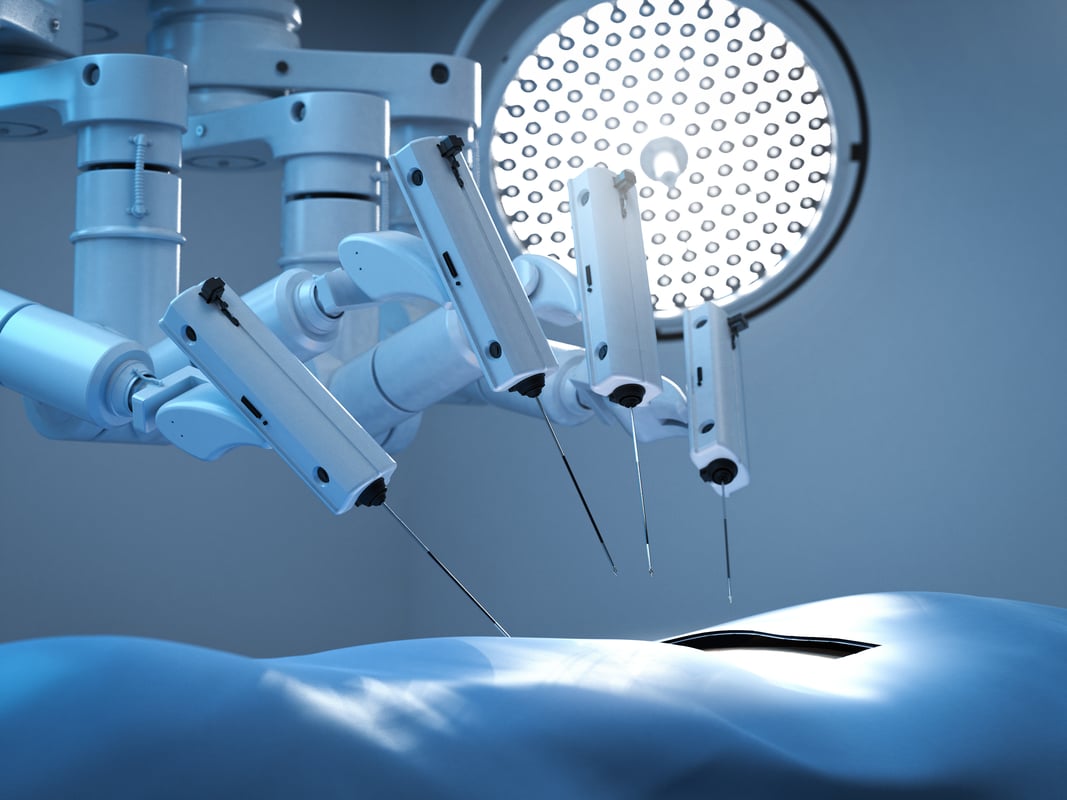

That's where Intuitive Surgical (ISRG 1.46%), the pioneer in robotic surgery, comes in. Its da Vinci Surgical System gained U.S. Food and Drug Administration approval almost 20 years ago in 2000, and the company is now a giant (currently valued at $60 billion) and still leading the charge in the industry by helping surgeons provide better outcomes for patients, not replacing them.

After a big run -- especially in the last decade -- Intuitive's stock has flatlined in the last year or so. Results are still going strong, though, and robotic surgery is likely to continue to steadily gain adoption around the globe. In five years' time, there's a strong chance this healthcare technologist will be much bigger than it is now.

Data by YCharts.

Riding the wave of procedure growth and installed base

Intuitive is a big operation these days, with 2019 total revenue on track to top $4 billion. Sales are broken down into three general categories. From largest to smallest, they are: instruments and accessories, systems, and services.

Through the first half of 2019, the revenue grand total was up 18% year over year to $2.07 billion. Global growth in procedures is the story here. The more procedures surgeons are performing, the more instruments and accessories are sold. The rise in the number of procedures means the da Vinci system gets to keep proving its merits, which leads to more system sales to hospitals and other places where general surgical procedures are performed. That, in turn, boosts services revenue on systems in operation.

|

Segment |

First-Half 2019 Revenue |

YOY Increase |

|---|---|---|

|

Instruments and accessories |

$1.13 billion |

21% |

|

Systems |

$591 million |

15% |

|

Services |

$351 million |

14% |

YOY = year over year. Data source: Intuitive Surgical.

Procedures using da Vinci grew 17% year over year in the second quarter of 2019, and though Intuitive is big business, it still had just 5,270 surgery systems installed around the world at the end of Q2 -- a small fraction of the total opportunity that exists out there. Thus, the runway that lies ahead of it is still a long one. Early success never goes unnoticed, however. Intuitive's pioneering work has led others to enter the fray, albeit to mixed results. But a much larger peer is gearing up to go head-to-head with the da Vinci machine.

Image source: Getty Images.

Big competition and why it's potentially fantastic news

When the world's biggest medical device company decides it's time to make a splash in a promising new business, incumbents should take note. That's likely part of what has been going on with Intuitive's stock since Medtronic (MDT +1.90%) has made it clear for some time it will be entering the robotic general surgery space. It isn't ready yet, nor have all the details been unveiled, but the Hugo -- the first real direct competitor to Intuitive, and from a company more than twice the size at $144 billion -- could give da Vinci some headaches.

But maybe it won't. Medtronic says that its Hugo system will be more affordable than da Vinci, but it also claims that only about 2% of surgeries around the world are performed with the assistance of robotic surgery equipment. This market has barely been touched if that's true, leaving plenty of room for both Intuitive and Medtronic to innovate and grow their respective systems.

In fact, some competition could be good for da Vinci in the long haul. A bigger name devising a system vets the benefits of robotic assistance in the operating room, which could spur adoption of new systems, which then boosts recurring sales from instruments and services, the real moneymaker for Intuitive. Plus, as economics 101 teaches us, higher production generally (but also up to a certain limit) reduces costs. Hugo and da Vinci competing against each other, but ultimately purchasing similar technology, could lower manufacturing expenses and drive innovation. That, too, might foster more system sales.

I think a similar trend will play out for fellow healthcare technologist Teladoc Health now that Amazon.com has decided to enter the telehealth industry. One thing's for sure, though: Automation and other technology are emerging trends in the healthcare industry, and could help stem the tide of rising care costs and provide better outcomes for patients. In five years, Intuitive Surgical has a good shot at playing an even bigger role in the industry overall as a result.