The global oil market is in a state of disarray thanks to multiple factors, most notably the impact of COVID-19. That's sent the energy sector reeling, with bankruptcies, spending cuts, and cost containment efforts all viable avenues for companies looking to get through this historically difficult period. Material dividend cuts are also starting to take shape at companies like Royal Dutch Shell (RDS.B) and Equinor that had long histories of reliably returning cash to investors.

It's only logical to question whether or not peers ExxonMobil (XOM 1.12%) and Chevron (CVX 0.34%) will be forced to do the same. Here are some key things to consider.

1. It's the board's call

The first and most important thing to remember about dividend decisions is that, for the most part, they are entirely up to the board of directors. The management team clearly provides guidance on the matter, but whether or not to pay a dividend and how much to pay is at the discretion of the board.

Image source: Getty Images

This isn't good or bad, it's just a fact. However, there are clear statements that are made via dividend decisions. For example, Exxon has increased its dividend annually for 37 consecutive years. Chevron's annual streak isn't that far behind at 33 years. There have been multiple ups and downs in the historically cyclical energy sector over the last three decades. Clearly, paying a consistent and growing dividend is important to the boards of these to integrated energy giants.

2. Dividends get cut all the time

Don't assume, however, that the boards of Exxon and Chevron won't make the hard call to cut their dividends if need be. The current headwinds (more on this below) are intense, and have led many energy companies to trim their dividends. Shell and Equinor are two direct competitors that have taken this drastic step to ensure they have ample cash to survive.

But an even better example could be energy services company Helmerich & Payne (HP -0.84%). This company had a streak of 47 annual dividend hikes under its belt, but still felt it necessary to cut the dividend in March.

What's interesting about this cut is that Helmerich & Payne has a rock-solid balance sheet. Long-term debt made up just 12% of the company's capital structure at the end of the first quarter. That would be low for any company in any industry. This decision was a hard one, driven by the need to maintain capital spending plans in a capital-intensive business even though revenue was under pressure. That should sound pretty similar to what's going on at Helmerich & Payne's customers, a list that includes names like Exxon and Chevron.

3. The energy market is painful right now

That last point is important here, because the top and bottom lines at Exxon and Chevron are clearly driven by the price of oil. There was excess supply coming into the year thanks to decades worth of expansion in U.S. onshore production. That oversupply situation was exacerbated by a price war between OPEC and Russia, which has since been resolved. But the real hit was the global economic shutdown from COVID-19, which led to a swift decline in demand. With too much oil and too little demand, oil prices have plummeted to historic lows.

Although the world is starting to reopen again, there's a glut of oil sitting in storage that will need to be worked off. And while the supply side is contracting quickly, particularly in the U.S. -- the U.S. Energy Information Administration notes that the rig count is at its lowest point on record -- a material increase in oil prices is likely to take some time to materialize. That's not good news for Exxon or Chevron, since earnings could remain under pressure for a long time.

4. Pay attention to cash flow, not earnings

That said, dividends are paid out of cash flow and not earnings. It's an important difference, because earnings includes items that don't impact cash flow, like depreciation. And companies can generate cash outside of earnings. For example, both Chevron and Exxon have been selling assets in recent years. That results in cash that can be used however the companies want, including investing in the businesses or supporting the dividends. Although selling assets in the current market environment isn't likely to be easy, the key takeaway is that Exxon and Chevron can support their dividends in other ways. In fact, they have to support their dividends in other ways, since neither is earning enough to cover its dividend right now.

5. Keep an eye on the balance sheet

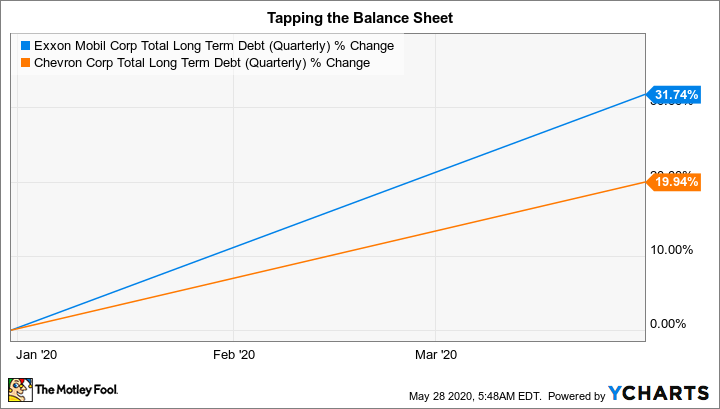

One of the other ways a company can get cash to pay for things is to issue debt. That's exactly what both Chevron and Exxon have done. At the end of the first quarter, Chevron's total long-term debt had increased roughly 20% from the start of the year. Exxon's long-term debt jumped even more, rising by nearly a third. The boards of these two companies are clearly making the call to lean on the balance sheet to maintain capital spending plans (at reduced levels) and dividends (at the same or higher levels) with the expectation that oil prices will recover. This is a cyclical business, so history suggests that prices will, eventually, turn higher again.

XOM Total Long Term Debt (Quarterly) data by YCharts

There is an important distinction here between Exxon and Chevron on the one hand and Shell and Equinor on the other. Shell and Equinor have historically operated with more leverage, offsetting that risk with sizable cash balances. That's typical of European energy companies. Exxon and Chevron have historically done the exact opposite, focusing on low leverage and more modest levels of cash. These are not equivalent options, as the current situation shows. High levels of leverage limit financial flexibility in tough times, because increasing leverage even more in a downturn isn't a desirable move. And in times of stress, burning through cash is equally problematic. Thus, Shell and Equinor chose to preserve cash by cutting their dividends. Starting out with much lower leverage, Exxon and Chevron have more balance sheet flexibility -- which they are using to protect their dividends. In fact, even after the increases in leverage at these two oil giants, they still remain at the low end of the peer group.

6. Between oil prices and dividends, something has to give

While the boards of Exxon and Chevron are clearly making the decision to support their businesses and dividends today by using their balance sheet strength, that can only go on for so long. If oil prices don't recover at some point the dividends here will eventually get cut. However, that would likely mean that there's been a structural change in global energy demand. That isn't something that Exxon or Chevron think is on the horizon right now, with each focusing on long-term supply and demand dynamics that suggest oil and natural gas will remain vital to the world for many years to come.

Still, as an investor, you need to watch the big picture. Exxon and Chevron made it clear during their first-quarter conference calls that they both plan to support their dividends during this dip, and they both have ample capacity to do so. But if the dip turns into something more, they will be forced to change those plans.

What to watch for

There are no guarantees when it comes to investing -- you have to accept a certain amount of uncertainty. When it comes to investing in Exxon and Chevron today, there are legitimate concerns about their abilities to keep paying the dividends supporting their 7.5% and 5.5% yields, respectively. In the near term it looks like both have the financial capacity and the will to support the dividends through what is a historically difficult energy market. That's not likely to change in a quarter or two.

However, dividend investors should be keeping a close eye on what these two integrated energy giants do and say. If either starts suggesting that there has been a fundamental change in the industry, you should probably begin to worry.