Chinese electric-vehicle maker NIO (NIO 1.36%) said it delivered 3,740 vehicles in June, up 179% from a year ago, a record monthly total that powered a record quarterly total for the company as well.

What NIO said

Here are the key points from NIO's statement.

- NIO delivered 2,476 of its five-passenger ES6 SUVs in June, and 1,264 of its larger ES8 models. A year ago, in the ES6's first month of sales, it delivered 413 ES6s and 927 ES8s.

- For the second quarter, NIO delivered a total of 10,331 vehicles, up 191% from 3,553 in the second quarter of 2019.

- That result was arguably ahead of NIO's guidance. NIO said in May that investors should expect its deliveries to "more than double" in the second quarter from the year-ago period; they nearly tripled.

- Year to date through June, NIO delivered 14,169 vehicles.

Data source: NIO. Chart shows monthly deliveries of NIO's ES8 and ES6 for every month since the ES8's debut in late June of 2018. Chart by author.

CEO William Bin Li credited the strong quarter to the company's loyal owners and its employees.

"In June, we achieved a historical high of monthly deliveries, contributing to our best quarterly performance. We appreciate the continuous support from our growing and loyal user community," Li said in a statement. "We are proud of our team for their strong execution from production to delivery."

NIO's new chief financial officer, Steven Feng, said that the strong second-quarter deliveries result gave him confidence that the company is on track to meet its financial targets.

"Our deliveries in the second quarter of 2020 exceeded the high end of our earlier projection, and we are confident that our goals on gross margin and operational efficiency will be achieved," Feng said.

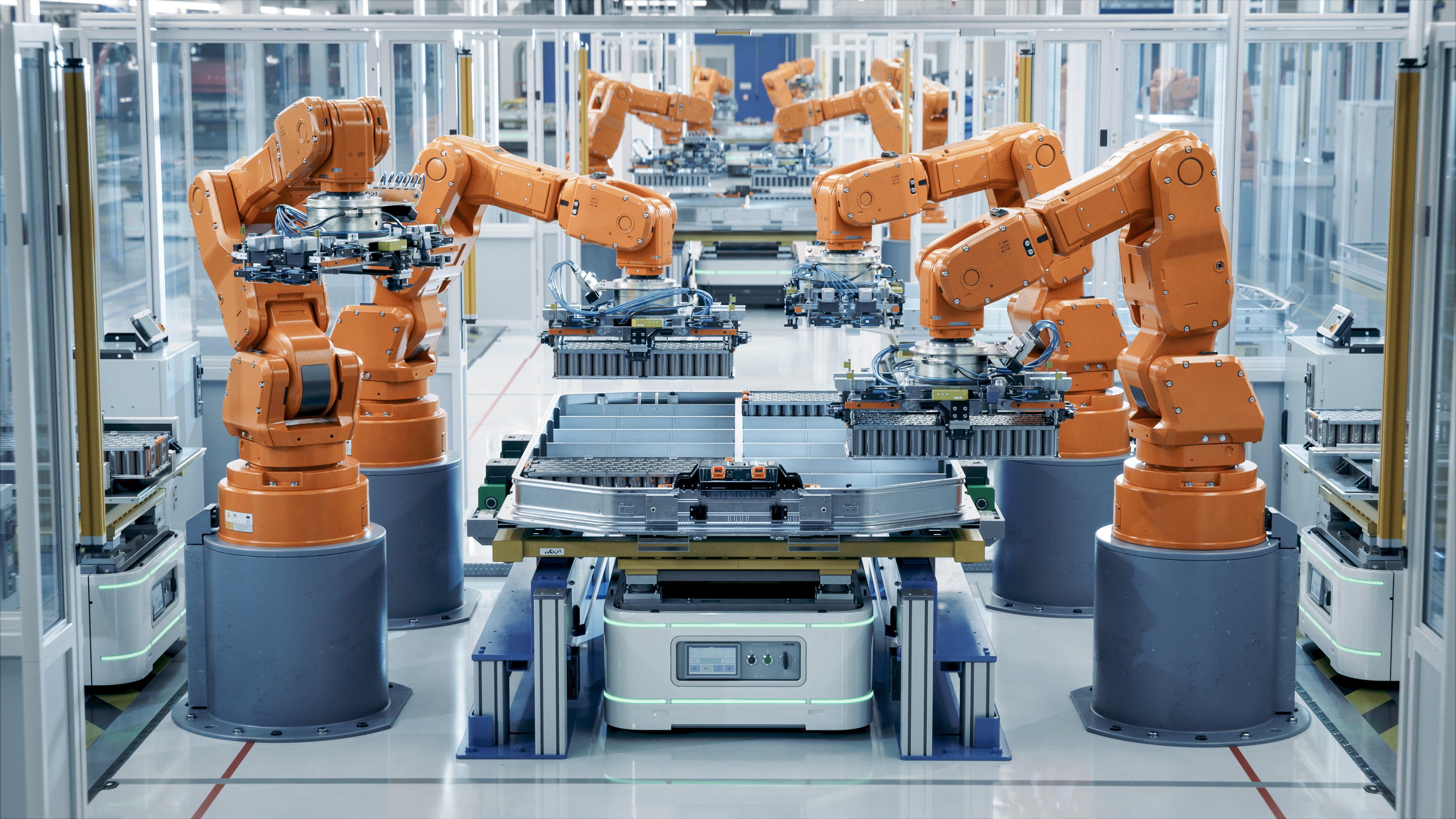

Sales of NIO's ES8, available in six- or seven-passenger versions, have been rising since a revamped version was released earlier this year. Image source: NIO.

What it means

Simply put, these delivery numbers suggest that NIO is executing very well on its near-term plan.

NIO's share price has more than doubled since the beginning of April, as the company's sales have recovered from COVID-19-related shutdowns earlier in the year. The stock's gains accelerated after the company sealed a funding deal with economic development authorities in China in late April, easing auto investors' concerns about its dwindling cash hoard.

That funding deal, with authorities in China's Anhui province and its capital city of Hefei, gave NIO nearly $1 billion in new cash in exchange for a stake in its China-based businesses and an agreement to consolidate its operations in Hefei. NIO's vehicles are currently built by another automaker, Anhui Jianghuai Automobile Group, under contract; the company plans to build its own factory in or near Hefei, as it relocates its other operations to the city.

The deal required NIO to contribute some of its own cash; the company successfully raised $428 million to meet that requirement via a secondary offering of its American depositary shares in June.

What's next for NIO

Investors will have to wait until NIO's second-quarter earnings report to find out exactly how the company is performing and how it expects the next few quarters to unfold. NIO hasn't yet announced a date for that report, but it's likely to happen sometime in August.