What happened

Shares of Chinese electric-vehicle maker NIO (NIO +0.66%) were up sharply on Tuesday afternoon, as investors continued to react positively to an upbeat June sales report.

As of 2 p.m. EDT, NIO's American depositary shares were up about 12.9% from Monday's closing price and up 68.3% since the beginning of July.

So what

Last Thursday, right before the U.S. holiday, NIO released its June sales numbers, and investors were impressed. NIO delivered 3,740 vehicles in June, up 179% from a year ago and its best monthly total ever, and capped off its best quarter ever with 10,331 vehicles sold, up 191% from last year.

Coronavirus? Not an issue last quarter for NIO, which sells all of its vehicles in China. As you can see, NIO's sales did slump early in the year during China's shutdown, but from April onward they have been right back on their prepandemic growth trajectory.

Data source: NIO. Chart shows monthly sales of the NIO ES8 (in blue) and ES6 (in green) since the ES8's launch in late June of 2018. Chart by author.

NIO spent a lot of money (too much, some analysts thought at the time) building out its dealership and distribution network last year. That looks like a great decision now, with sales rising rapidly, but it was a risky bet: By late last year, investors were wondering if NIO was close to running out of cash, and its stock price reflected those grim concerns.

But over the last few months, things have changed for the better. A series of cash infusions from early investor Tencent Holdings and economic-development authorities in China's industrial heartland have addressed auto investors' liquidity concerns convincingly for now.

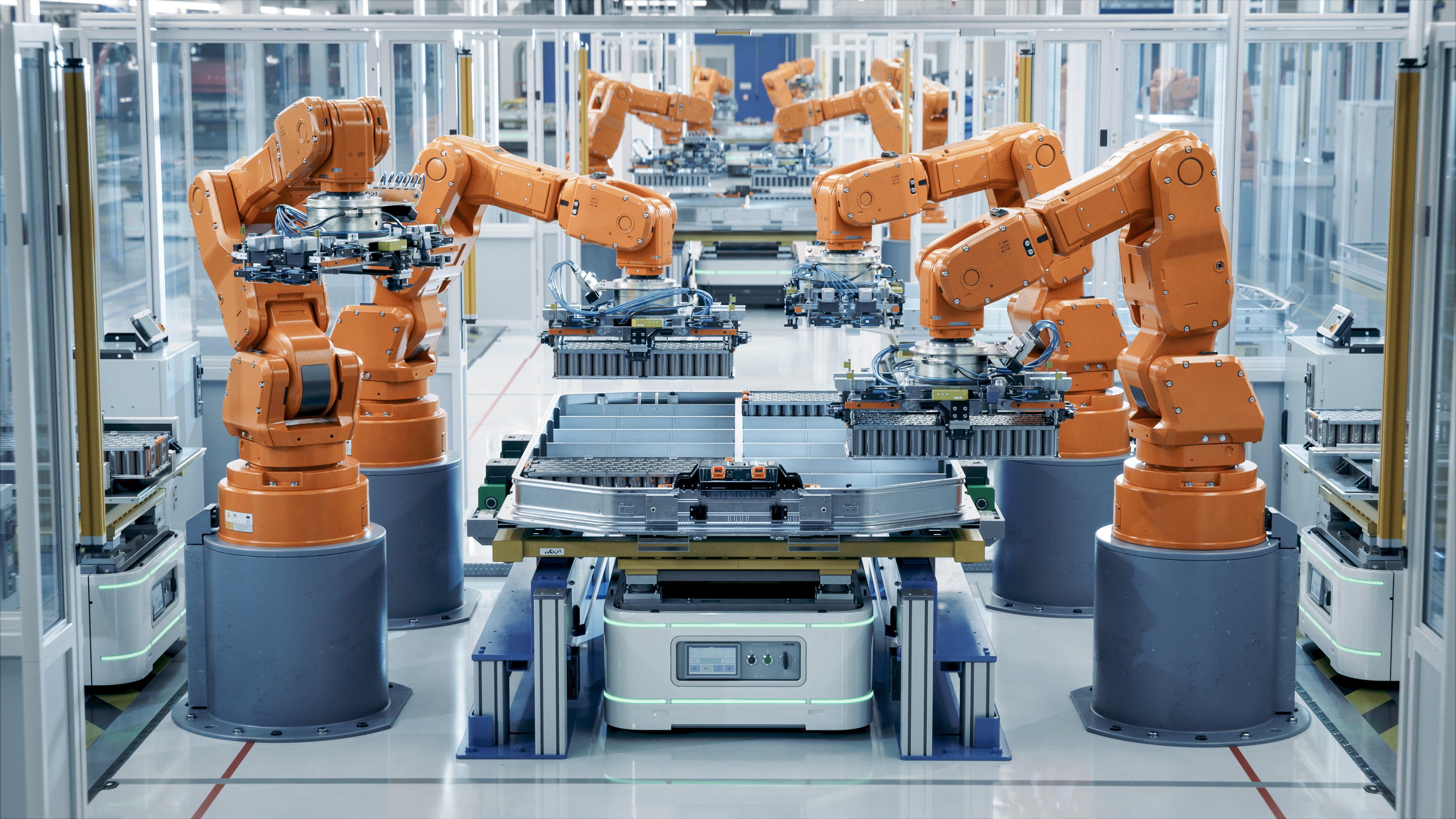

NIO is expected to add a sedan to its lineup later this year. Image source: NIO.

Now what

Investors now are looking forward to NIO's second-quarter earnings report, likely to happen next month. It could be a good one: CFO Steven Feng said last week that NIO's strong second-quarter sales and ongoing cost-control efforts give him confidence that the company will meet or beat its profit-margin and spending targets.