What happened

Shares of thermal-imaging infrared camera maker FLIR Systems (FLIR +0.00%) were down by 11.9% at 2:38 p.m. EDT after the company delivered its earnings report earlier Thursday. Surprisingly, though, it didn't miss on earnings. It beat them ... significantly.

The analysts' consensus was that the tech company would report $0.52 per share in profit on $473.1 million in sales. Instead, FLIR Systems earned pro forma profits of $0.64 per share on $482 million in sales.

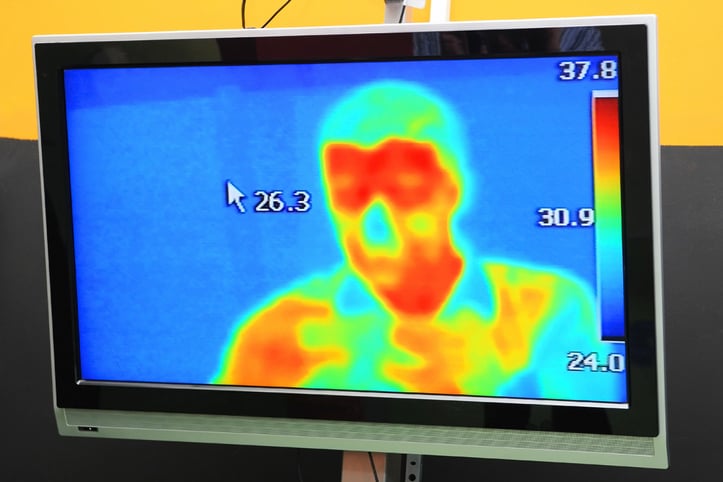

Image source: Getty Images.

So what

What's wrong with those numbers? Honestly, I cannot say.

Although FLIR's sales were roughly flat year over year, at least they didn't decline as analysts had predicted -- and as one might expect they would in the middle of a global pandemic. What's more, it cut its selling, general, and administrative spending significantly in the quarter, which helped to boost profits. In fact, FLIR Systems grew its GAAP earnings to $0.47 per share. That may not have been as big as the pro forma number, but still represented 38% year-over-year growth.

Really, the only bad news I see in the report at all is the fact that free cash flow took a hit in the quarter, down 18% to $48.6 million.

Now what

Of course, investors may have been upset by the fact that FLIR Systems didn't provide hard guidance for how it expects revenues, profits (or free cash flow) to look for the rest of the year. Still, CEO Jim Cannon said he was "extremely pleased with our strong performance and operational execution in the quarter amid unprecedented challenges," and the cost-cutting FLIR Systems got done in the quarter does seem likely to support future profits.

FLIR Systems is carrying a modest debt load, and even has a bit of cash on the balance sheet. With the stock now trading for just 18.2 times trailing free cash flow, it shouldn't take too much growth to get the share price moving higher again.