What happened

Shares of thermal camera maker FLIR Systems (FLIR +0.00%) are up 14.4% as of 12:35 p.m. EDT, and if you think this has something to do with the novel coronavirus -- you're right!

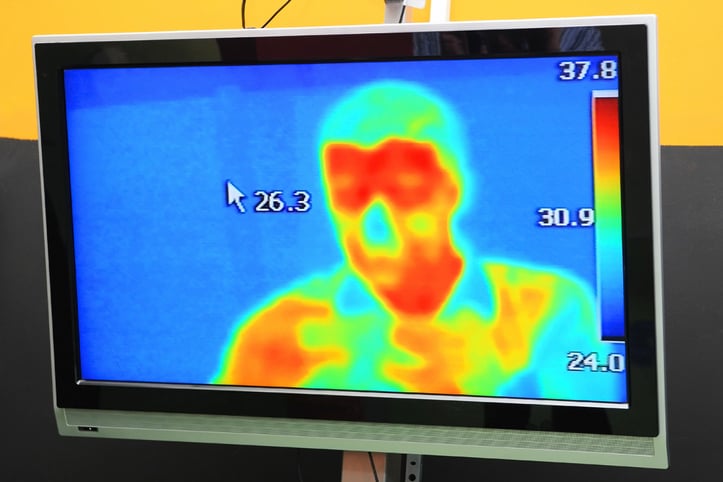

This morning, Reuters reported that Amazon.com has begun deploying thermal cameras at its warehouses to facilitate identification of employees who might have higher-than-normal temperatures (an early indicator of COVID-19 infection).

Image source: Getty Images.

So what

Amazon isn't saying from whom it bought the cameras, but investors are guessing it might be FLIR -- or that other companies might buy from FLIR in imitation of Amazon.

Two investment banks are giving further support for this thesis, with both Raymond James and William Blair putting out notes in support of FLIR stock. In a note covered on TheFly.com today, Raymond James explains that it has a strong buy rating on FLIR because the company could benefit from higher sales of thermal-imaging cameras for detecting elevated skin temperatures. William Blair expressed doubt that Amazon bought its cameras from FLIR but notes that FLIR is nonetheless "the global leader in thermal uncooled cameras" and thus the logical choice to benefit from "what may become a major trend" among employers in general.

Now what

How should investors react to this news? Blair's advice is perhaps the best here, explaining that net-net, COVID-19 could end up being neither good nor bad for FLIR stock, because additional sales of thermal cameras to detect COVID-19 infections could merely offset sales lost to industry as a result of the recession.

That being said, with FLIR stock down more than 30% over the past year, right now, it looks like investors are still focusing only on the sales lost and not on those potentially gained from the FLIR-as-fever-detector angle. The stock's still no great bargain at 27 times earnings, of course -- but at least it's cheaper than it once was, and now, potentially, still just as strong a business as it once was.