It's hard to find value on Wall Street right now, with indexes near all-time highs. But compared to the froth in a lot of sectors, airlines stocks look cheap.

There's good reason why these stocks haven't rallied along with the broader market, but does that mean investors should continue to avoid the sector?

Here are three things you need to consider before buying in.

1. The pandemic impact will linger for years

Airlines were among the sectors hardest hit by the COVID-19 pandemic, with travel demand evaporating as the virus spread around the globe. U.S. carriers saw revenue fall by more than 60% in 2020, and the industry only survived thanks to nearly $100 billion in government support and private fundraising.

We're in the early stages of a recovery, but it is going to take time for airlines to bounce back. Industry execs have said to expect it to take years for passenger volumes to return to pre-pandemic levels, and some prominent voices have questioned whether business travel will ever rebound. International demand figures to trail domestic as countries recover at different paces.

A lot of the biggest airlines, companies including Delta Air Lines (DAL 1.28%), United Airlines Holdings (UAL 1.59%), and American Airlines Group (AAL 0.39%), rely on business travel for the bulk of their profits and will need to dramatically revamp their operations if it doesn't return.

Even in the best-case scenario where conditions normalize quickly, the airlines are going to need years to pay down ballooning debt balances and repair other scars from the pandemic before they can focus on growth and expansion again.

Image source: Getty Images.

2. It is time to pick winners

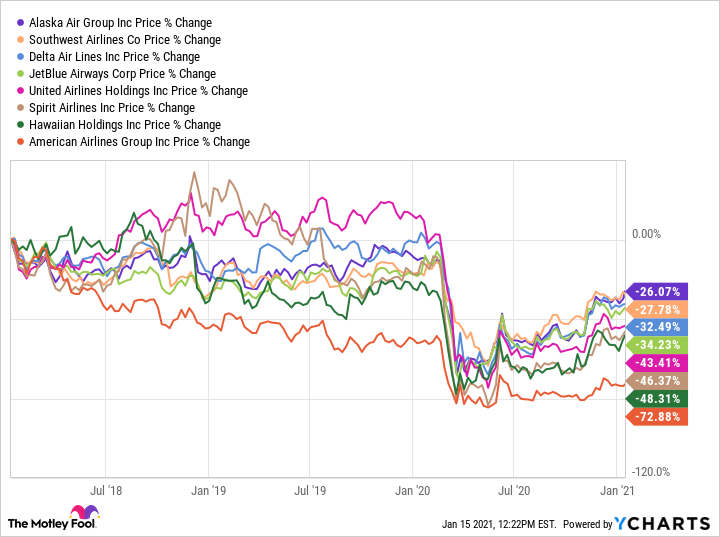

That said, with the introduction of a vaccine we at least now know there is an end to the crisis in sight. Airline stocks mostly traded as a group for most of 2020, which made sense since pandemic-related worries didn't discriminate against any specific airline. The recovery is unlikely to be as even.

As mentioned above, the larger network airlines Delta, United, and American are more reliant on business travelers. They also tend to have higher costs. Delta is the safest bet among these airlines due to its strong position prior to the pandemic and the flexibility provided by its largely non-union workforce, while American came into the crisis with the most debt on its books and could need longer to recover.

United's network has long been the envy of the industry because of its focus on business and international customers, but that route structure will need to be adapted if the airline is to be an early beneficiary of a recovery.

On the other hand, Southwest Airlines (LUV 0.19%) has a long history of gaining market share during industry downturns and is already beginning to go on the offensive post-pandemic. Spirit Airlines (SAVEQ) has an industry-low cost structure and its route network is already optimized for leisure travelers, and is likely to be among the first airlines to fully recover.

3. This remains a long-term growth story

Prior to the pandemic there were a lot of tailwinds pushing growth in the aviation industry. Over time, those forces should return.

A growing global middle class is increasingly looking to travel, and attracting investment, and business travel, to new corners of the globe. A generation of discounters has lowered the cost of travel, opening it to more consumers and establishing air travel as a primary source of transportation for a lot of trips.

COVID-19 has brought those trends to a halt, but it should be temporary. Plane maker Boeing dramatically decreased its 10-year delivery forecast due to the pandemic but kept its 20-year forecast intact, implying it sees a full recovery over time.

The opportunity for growth remains substantial. The International Air Transport Association forecasts total global passenger count will grow from 3.9 billion in 2019 to 8 billion by 2039, and said the number could be as high as 11 billion passengers in its most bullish scenario. Even in its bearish scenario where air travel is reduced post-pandemic and due to carbon taxes and other policy changes, the trade group still expects a near doubling in passenger volumes in 20 years.

The bottom line is, air travel is not going anywhere, and even if you are bullish on Zoom Video Communications and the like replacing some chunk of business travel, there should still be ample demand in the years to come.

Investor takeaway: Be cautious, but not afraid

I'm bullish on airlines, but it is an open question how long it will take for the bullish bet to pay off. For now, I'd expect an uneven recovery, with stocks pulled between optimistic and pessimistic pandemic news and the outlook for the broader economy.

It's highly unlikely we are going straight up from here.

For investors able to stomach turbulence and focus on the long term, it is a great time to start positions in some of the top names in the industry. Spirit looks like a good bet to be a winner over the next 12 months, and Southwest and Delta are the best candidates to buy and hold forever.